Emerging Markets Hit by IMF Forecast; Lower Growth Prospects Further Rattle Developing Nations

July 10, 2013 Leave a comment

Updated July 9, 2013, 9:00 p.m. ET

Emerging Markets Hit by IMF Forecast

Lower Growth Prospects Further Rattle Developing Nations

ERIN MCCARTHY, CHARLES FORELLE and IAN TALLEY

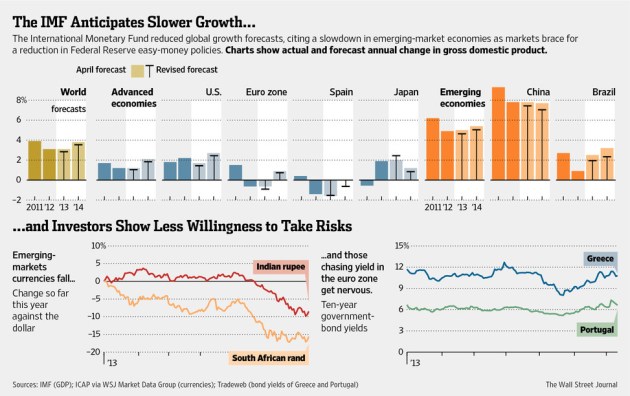

Investor fears that the end of easy money is at hand are ricocheting around the globe, slamming financial markets and squeezing economic growth prospects from Brazil to Turkey. In the latest fallout, the International Monetary Fund on Tuesday trimmed its global-growth forecast, reducing its projections for emerging markets such as China and Russia. The report highlights the difficulties facing nations that recently were flooded with investor cash amid a global search for yield, but now face outflows as interest rates rise in the U.S. The IMF’s move underscores the ripple effects as markets brace for the withdrawal of central-bank stimulus policies. Scores of riskier markets have been whipsawed since Federal Reserve Chairman Ben Bernanke signaled this spring that the central bank’s monthly bond purchases, currently $85 billion, eventually will be curtailed. Many investors expect the sharp moves to continue as participants grapple with Fed policy and economic uncertainty.“We will go through a period of pretty intense volatility,” said Derrick Irwin, a portfolio manager at Wells Fargo WFC -0.30% Advantage Funds, which manages $230.8 billion.

Over the past six weeks, investors have pulled $13.5 billion from emerging-market bond funds and $22 billion from funds dedicated to emerging-market equities, according to data provider EPFR Global.

Emerging-market government debt denominated in local currencies is down 8.3% year to date, according to a J.P. Morgan JPM +0.35% index. Emerging-market equities have declined more than 10% just since June, according to index providerMSCI Inc. MSCI -0.84%

The fallout hasn’t been limited to emerging markets. In Portugal, a member of the euro zone, the threat of a Fed pullback, together with political unrest, has partially reversed a yearlong decline in bond yields.

Portuguese 10-year bond yields tumbled from above 10% last summer to below 6% this spring, reflecting growing demand for its debt amid expansive financing and backstop programs. Bond yields fall when their prices rise.

Portugal’s 10-year yield touched as low as 5.20% on May 22, the day Mr. Bernanke suggested quantitative easing would begin to slow this year. It jumped the next day and rose steadily over the next month. The yield stood at 6.32% last week, when a key government minister resigned. It shot up more than a percentage point amid more turmoil but has since come down, closing Tuesday at 6.62%.

In a sign of how deeply central-bank stimulus had worked its way into these markets, the selloff has forced governments in emerging markets to abruptly reverse their approach to managing their economies.

Many developing countries had spent much of the past year or so enacting taxes on foreign investment and cutting interest rates in order to stem the torrent of hot money unleashed by the Fed into their currencies, stocks and bonds. In the span of a few weeks, many of these policies have been undone, and increasingly desperate measures taken to keep foreign investors from leaving.

The Turkish lira hit a new low versus the dollar Monday, while currencies such as the Brazilian real and South African rand slid to multiyear lows in recent weeks.

The Reserve Bank of India took measures Tuesday to reduce volatility in the foreign-exchange market and halt the rupee’s slide, after the currency hit a fresh low versus the dollar the previous session.

The potential end of unlimited Fed support isn’t the only reason for asset-price declines in these markets. Many poorer economies face softening demand for their goods as growth slows in China, which has been a major importer. Others, such as Brazil, face hefty inflation—an ill that typically is treated with higher interest rates, which tend to choke off economic growth.

Still, the selloff has wrongfooted many investors. Tim Dingemans, portfolio manager at hedge fund Adelante Asset Management who manages the $82 million emerging-market debt fund, bought the Indian rupee in mid-June, hoping its declines were capped. But the currency continued to fall and he sold at the end of the month.

The IMF, a group of 188 countries that tracks the global economy and recommends policy to member nations, cut its gross-domestic-product growth forecast to 3.1% from 3.3% in April. Emerging-market economies will expand 5% this year, the IMF said, down from a 5.3% forecast in April. With potentially overinflated markets now and weaker growth prospects in the future, emerging markets also face the threat of financial instability, the IMF warned.

Many economists say China’s real-estate market could crash after years of hyper-investment. Beijing faces a difficult choice: allow investment to remain high at the risk of credit bubbles, or tighten credit and slow investment, risking slower growth.

Portugal had been laboring to get back into the capital markets. Last October, it exchanged some existing bonds for longer-dated ones. In January, it sold €2.5 billion worth of extra bonds from a series that matures in 2017. In early May, it sold €3 billion of a new bond maturing in 2024. For now, Portugal’s progress has been halted.

The Fed’s shift “means they are swimming against the tide instead of with it,” says Neville Hill, head of European economics at Credit Suisse CSGN.VX +0.57% in London.

Still, some say that while these economies will gain at slower speeds, they still will outpace most rich economies—which they say should mean for better investments.

Richard Titherington, chief investment officer of emerging-market equities at J.P. Morgan Asset Management, said his team has selectively added Indian and Chinese stocks in the first half of the year. The firm has $1.5 trillion under management globally.

“Clearly when the dust settles people are going to return to the asset class,” Mr. Titherington said.