On the 30th anniversary of Nintendo’s iconic console, the company is facing an existential crisis

July 17, 2013 Leave a comment

On the 30th anniversary of Nintendo’s iconic console, the company is facing an existential crisis

By Christopher Mims @mims 9 hours ago

On Monday, the original Nintendo game console turned 30, but it’s looking increasingly unlikely that the company that made it will last another 30 years. Nintendo’s issues are many. The company took losses in its last two fiscal years despite maintaining revenue—mostly because of a strong yen, says CEO Satoru Iwata. Meanwhile, stiff competition from Microsoft and Sony and the advent of mobile gaming have eaten into the company’s growth. Nintendo’s recent Q&A with shareholders included a number of pointed questions that highlight the company’s weaknesses:The company’s flagship console, the Wii U, isn’t doing well

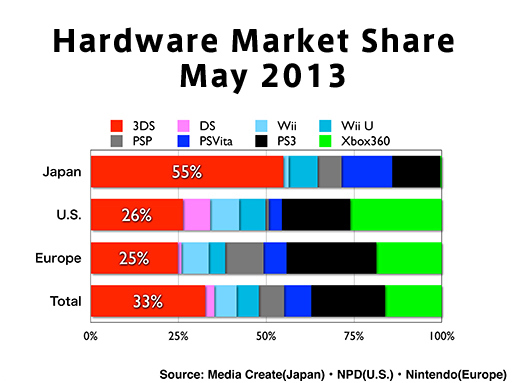

If you look at Nintendo’s overall share of the gaming market, it looks healthy—close to 50% for Japan, Europe and the US.

But there are a number of problems with that metric. First is that, in the months prior, when Nintendo’s newest product, the Wii U, should have been taking off, its market share barely moved. Compare May 2013 (above) to January through March of 2013 (below).

During that period, the share of the global gaming market held by the Wii U appears to have shrunk slightly, although primarily because of advances by Nintendo’s own portable 3DS console.

Nintendo’s cash cow, mobile gaming, is staring down the barrel of the iPhone

The second problem with Nintendo’s own measure of the health of its gaming consoles is that it conveniently ignores all the gaming now happening on tablets and mobile devices, which are eating Nintendo’s lunch. Industry observers are saying that Nintendo is in deep denial about the impact of Android, the iPhone and their respective app stores.

Developers other than Nintendo aren’t offering hit games exclusively on the Wii U

Hits and exclusives are what get gamers to buy consoles in the first place. Nintendo’s shareholders are concerned that the Wii U doesn’t have big name developers producing Wii U-only content. CEO Iwata’s counter is that Nintendo could buy more market share (for example, by lowering the price of the Wii U) but that doing so could make Nintendo’s business “collapse,” presumably because buying market share isn’t sustainable. In the long run, you have to earn it by offering great products.

Nintendo’s failure to go to where the gamers are is a failure of leadership

Another day, another (soon to be banned) Nintendo emulator for the iPhone. Everyone has a smartphone, and everyone loves Super Mario, but according to Nintendo, never the twain shall meet. Separately and together, Nintendo’s CEO Iwata and lead designer Shigeru Miyamoto, who created Mario, are consistent about the company’s message, which is: in order to succeed, Nintendo needs to do more of what it’s always done. Consistent with that message, Miyamoto recently announced that Nintendo needs a new franchise—something iconic like Super Mario—to revive its fortunes.

The problem with this logic is that the gaming landscape is so much more vast than when Miyamoto first started making games. When the original NES was released, nothing else at its price point was fast and responsive enough to create a gaming experience that was as satisfying. Thirty years later, even a $40 Android tablet can run Angry Birds. We are surrounded by high-resolution screens and fast hardware, in our phones, tablets, soon, even our watches, and Nintendo can either figure out how to create compelling experiences on these devices, or it can continue to shrink along with the market for dedicated gaming hardware.

Nintendo’s survival hinges on its leaders giving up on making most hardware. Nintendo is sitting on an enormous pile of compelling intellectual property, and its designers are still some of the best at making games that are uncomplicated and fun—exactly what the sea change toward casual video gaming demands. AS for Nintendo’s shareholders, they could be in for a battering as the company is forced to shrink to a more appropriate size.