Buffett’s Washington Post is buying Forney Corp., a supplier of products for industrial boilers, an usual acquisition for a media and education company

July 19, 2013 Leave a comment

Updated July 18, 2013, 7:35 p.m. ET

Washington Post Diversifies… Into Boilers

Publishing Company Buys Industrial Unit from United Technologies

It’s not uncommon for an industrial company to seek some glitz by buying into media and entertainment. Washington Post Co. WPO -0.11% may be the only media company going in the other direction—adding soot and grease. The company on Thursday said it is buying a maker of parts for industrial furnaces from United TechnologiesCorp. UTX +0.48%. The decidedly un-glitzy deal is in keeping with a strategy of investing in companies that have strong earnings potential, said Post Chairman Donald Graham.Washington Post didn’t disclose the price it is paying for Forney Corp., an 86-year-old supplier of parts and systems for industrial utilities like power plants. But Mr. Graham, in an interview, described Forney as a “small acquisition.”

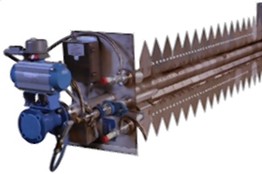

Forney’s specialties include making igniters and flame detectors for industrial-grade fuel burners, a far cry from the newspapers, television and education businesses that account for the bulk of the Post’s businesses. Then again, some of those businesses have seen sharp declines in recent years: Post Co.’s cash cow, the Kaplan higher education unit, and its namesake newspaper each booked operating losses last year.

Last year, the company made a similar tiny diversification with the acquisition of a majority stake in Celtic Healthcare Inc., a provider of hospice and home health-care services. Mr. Graham later told investors Post Co. doesn’t “plan to become a giant in the health-care field. We plan to acquire every time we can [find] well-run businesses that … can contribute some profit meaningfully to the Washington Post Company.”

In the same vein, General Electric Co. GE +0.38% doesn’t need to worry about competition from Washington Post Co. anytime soon. Forney “doesn’t represent a new path” for Post Co., Mr. Graham said.

On Thursday he described Forney as a company with “a long record of profitability, excellent management and a good reputation.”

Owning a range of businesses is a philosophy that bears more than a passing resemblance to that of Warren Buffett, whose Berkshire Hathaway BRKB +0.79% is a big shareholder in Post Co. and who was a longtime board member and remains close to the Graham family.

Mr. Graham played down any similarity but acknowledged that Mr. Buffett’s investing philosophy might have “rubbed off” on everyone who worked with him.

Some investors, at least, appeared unimpressed. Brad Sanfalow, founder of research firm PAA Research LLC, described the deal by Post Co. as an “indictment of their current asset base” and a move “well outside of their core competencies.”

Post Co. shares finished Thursday at $515.50, down 56 cents.