Yahoo’s Rally: Made in China by Alibaba

July 19, 2013 Leave a comment

July 17, 2013, 1:00 p.m. ET

Yahoo’s Rally: Made in China

In CEO Marissa Mayer’s Efforts to Turn Around the Company, Alibaba Is Buying Her Time

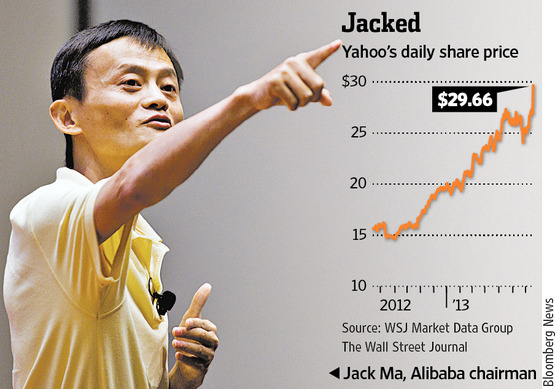

The typical honeymoon doesn’t last too long before the hard work of marriage begins. And so it normally is with new corporate chief executives and their shareholders. Lucky for Marissa Mayer, as well as Yahoo YHOO 0.00% shareholders, growth at Alibaba Group is extending the vacation. Yahoo’s second-quarter results, released late Tuesday, were unimpressive at best. Sales shrank 1% year over year, and the company forecasts no improvement in the third quarter. Ms. Mayer has little to show for her efforts a year after becoming CEO. Still, Yahoo shareholders didn’t seem to mind: The stock jumped 7% on Wednesday and now trades at a five-year high.For that, credit is due to Yahoo co-founder Jerry Yang. He is no longer with the company, but he spearheaded Yahoo’s investment in Alibaba. Yahoo, which owns a 24% stake in Alibaba, shared financial results for the Chinese e-commerce giant on Tuesday. Its first-quarter sales jumped 71% year over year to nearly $1.4 billion. Meanwhile, thanks to high and rising margins, operating profit more than tripled to $700 million. To put that in context, Evercore Partners EVR +1.18% projects that in 2014, Alibaba’s operating profit will be nearly as high as Facebook‘s FB -1.76%revenue.

So investors keep buying Yahoo stock as a proxy for as-yet unlisted Alibaba. An initial public offering is expected soon, and Alibaba could be valued at as much as $120 billion, says Evercore.

Assume a more conservative valuation of $90 billion, and the after-tax value of Yahoo’s stake would still be worth $15 billion, or about $14 a share. Add in Yahoo’s stake in Yahoo Japan,4689.TO +0.73% worth around $5 a share, as well as $4 a share of cash and Yahoo’s core business is today valued at less than $6 a share.

Alibaba’s expected valuation provides a good foundation for Yahoo’s stock, while Ms. Mayer battles to turn around the aging Internet giant. She has started with multiple “acqui-hires”: buying small companies for their people, not their products. The hope is that the pricey talent can hit product home-runs at Yahoo. Meanwhile, the recent $1.1 billion deal to buy blogging service Tumblr gives Yahoo a better foothold in social media, though it will take time to get its users comfortable with seeing ads.

But these things don’t happen overnight. Alibaba is buying Ms. Mayer some crucial time.