China, whose airline market is dominated by state-owned carriers noted for inefficiency and poor service, will study policies to encourage the budget-carrier model that is sweeping Asia

July 30, 2013 Leave a comment

Updated July 29, 2013, 8:30 a.m. ET

China’s Air Regulator Will Consider Ways to Boost Budget-Carrier Market

Having Lifted Ban on New Independent Airlines, Government Pushes Low-Cost Model

JOANNE CHIU

SHANGHAI—China is taking steps to jump-start the budget-airline business, say people familiar with the situation, a sign of further liberalization in one of the nation’s most tightly regulated sectors. Li Jiaxiang, head of the Civil Aviation Administration of China, told a semiannual CAAC working meeting this month that the regulator plans to study new policies to promote low-cost carriers in the second half of the year, according to people there, who included airline executives. Mr. Li also urged the nation’s smaller airlines to look into the budget model, and established airlines to learn from successful low-cost airlines to improve management standards and operating efficiency, the people said.Introducing policies to support budget-airline travel would reflect “a paradigm shift that could fundamentally alter the long-term industry landscape,” said Davin Wu, an analyst at Credit Suisse. The CAAC didn’t respond to several requests for comment.

In May, China signaled a loosening of its grip on civil aviation by lifting a six-year ban on setting up new independent airlines.

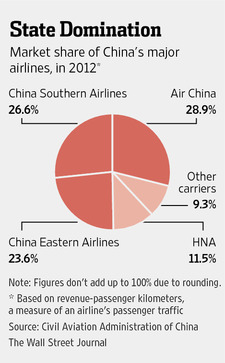

For years, the regulator’s priority was boosting state-owned airlines that dominate the domestic market but have been criticized for their inefficiency and poor service. To protect them, the government in 2007 stopped accepting applications for new airlines after briefly experimenting with liberalization in the middle of the last decade.

Industry executives say measures to help budget airlines could include creating terminals for them with lower landing and takeoff fees and tax incentives.

Mr. Wu at Credit Suisse said he expects a slow growth in the number of budget airlines, though, with policies rolled out gradually.

“An influx of new [low-cost carriers] competing aggressively with the existing state-owned carriers is unlikely to be the government’s vision,” he said. Demand for air travel in China has grown sharply as the nation’s middle class has expanded sharply, with the passenger count reaching 319 million last year, up 65% since 2008.

The low-cost travel boom has altered the industry landscape in Asia, with budget carriers such as Malaysia’s AirAsia Bhd. 5099.KU 0.00% —the region’s biggest—proliferating and growing much faster than full-service operators. Full-service carriers including Singapore Airlines Ltd., C6L.SG -1.17% Japan’s ANA Holdings Inc.9202.TO +1.45% and Qantas Airways Ltd. QAN.AU -0.39% have set up their own discount offshoots.

China’s aviation regulator has recently visited some of the world’s most-successful budget carriers, said a person familiar with the situation. A spokesman for Spring Airlines Co., China’s biggest low-cost carrier, said officials at CAAC’s planning and financial departments visited in May and June to learn more about its budget model.

The nation’s pioneer budget carrier, Spring Air sells a large proportion of its tickets via the Internet, bypassing the third-party reservations agents widely used by established state-owned carriers.

Other Chinese privately-owned airlines are seeking to tap the booming budget-carrier market. Chongqing-based West Air Co., sister company of Hainan Airlines Co.,600221.SH -0.51% is in the process of transforming itself into a budget carrier.

The nation’s state-owned carriers are also seriously studying the low-cost carrier model, say executives. “Growth of budget services could be explosive in China because of the nation’s low penetration rate but rapidly rising air-travel demand,” said an executive at a state-run airline who declined to be named.

The executive added, though, that there remain many challenges: “The lack of budget terminals, congested airspace leading to flight delays, as well as rising labor costs are all unfavorable factors to a model that operates on low costs and quick flight turnaround times.”

Chinese flag carrier Air China Ltd. 601111.SH 0.00% said it is aware of the CAAC’s directives on low-cost carriers, according to company secretary Rao Xinyu.

“We’re monitoring the development of low-cost carriers, but the carrier has no current plans to set up one,” said Ms. Rao.