Chart Of The Day: The Fed’s “Renormalization” Shock (All 600 bps Of It)

September 22, 2013 Leave a comment

Chart Of The Day: The Fed’s “Renormalization” Shock (All 600 bps Of It)

Tyler Durden on 09/21/2013 15:21 -0400

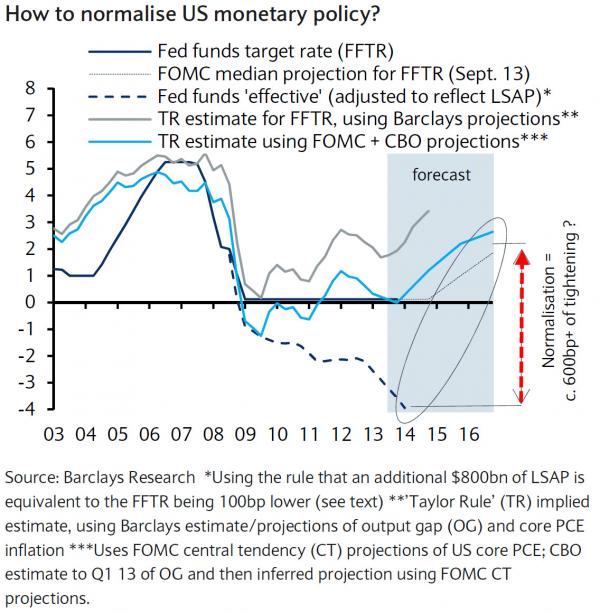

As we noted earlier, Bernanke’s actions this week make it very clear that between “financial conditions” and the fragility of growth, the US is incapable of surviving without ZIRP and QE (for now). As Barclays notes, ultimately, normalisation should proceed according to a timeline that does not threaten recovery, yet will result in a neutral monetary policy by the time the economy reaches full capacity and the desired inflation rate. However, there are many uncertainties along this path.Chairman Bernanke has said it might take “two or three years after 2016” to reach a 4% fed funds rate (the FOMC’s ‘longer-run’ expectation), but, as the disturbing chart below highlights, even an adjustment to 2.0% (the median FOMC expectation for December 2016) entails formidable adjustment of monetary policy once allowance is made for the tapering of QE. Given we now know that ‘tapering is tightening’, the implicit rate hike from a reduction in QE will mean a 600bps tightening in financial conditions. Do you believe in miracles?

There is a wide variation of econometric estimates of the impact of LSAP, but one rule of thumb is that net purchases of $800bn have, very approximately, a similar impact on US GDP to a 100bp reduction in the fed funds rate.

This implies that the Fed’s cumulative LSAP (set to approach $3.0trn by Q1 2014) might be considered equivalent to lowering the fed funds target rate by 370bp. We have tried to represent this in terms of a negative equivalent fed funds rate in the chart above, which illustrates that a return to ‘normality’ in terms of the Fed’s balance sheet and reaching even a 2-2.5% fed funds rate would represent a formidable tightening of US monetary conditions.

Simply put – how do you think our easy-money, share-buying-back, leverage at all-time highs corporations will cope with a 600bps rise in the cost of capital over the next three years?