Germans Think Small in China; Audi, BMW and Mercedes Are Speeding Up Plans to Offer Small Cars to Expand Sales

October 1, 2013 Leave a comment

September 30, 2013, 4:17 p.m. ET

Germans Think Small in China

Audi, BMW and Mercedes Are Speeding Up Plans to Offer Small Cars to Expand Sales

COLUM MURPHY

SHANGHAI—German luxury auto makers are speeding up plans to offer a wider selection of small cars and sport-utility vehicles in China, hoping to lure Chinese consumers unable to afford a larger luxury car, or affluent buyers who want a less-expensive second car. Small luxury cars are still an oxymoron to many wealthy Chinese, but industry executives say the risks—including lower profit margins—are worth it because of the growth expected in compact, premium-brand vehicles.Producing smaller made-in-China luxury cars in China means Audi AG,NSU.XE -0.29% BMW AG BMW.XE -0.79% and Daimler AG DAI.XE -0.66% can avoid import duties of 25%, allowing them to sell the cars more cheaply. Almost all imported cars also are subject to a value added tax of 17%. Local production also fits with China’s policy goals of promoting the country’s auto industry.

Audi has moved fast to get small in China. It plans to start production of its compact A3 sedan later this year in the southern city of Foshan. In April, Audi launched the Q3, a China-made compact SUV, that the company said has boosted its first half sales.

Its push to get small “is based on our analysis that this will be one leading growth segment in the luxury market in China in the future,” said Dietmar Voggenreiter, Audi China’s president.

Audi estimates sales of luxury compact vehicles in China rose by 29% during the first half of this year, significantly higher than the 11% overall growth for the luxury car market. Audi sales in China during the same period grew 18%.

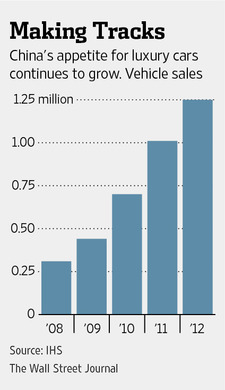

In 2012, compact luxury car sales in China totaled 136,000. By 2015, that number could reach 400,000 cars, or about 20% of the total Chinese luxury market, said Lin Huaibin manager, China vehicle sales forecasts at researcher IHS Inc. IHS -0.70%

Keeping pace with Chinese growth is critical for the German auto makers, particularly as demand in Europe is expected to remain depressed for several more years. China accounts for more than 50% of their earnings, Sanford C. Bernstein analyst Max Warburton estimated in a recent report.

“German brands have established a dominant presence in the market and in consumers’ minds,” said Chris Bonsi, chief executive of Greater China for TNS, a marketing-research and consulting company. “But it is harder to get incremental growth.”

The German premium car makers have around 80% of the market for luxury cars in China. BMW and Daimler are chasing Audi with plans to expand Chinese production of small vehicles. BMW now builds its compact X1 sport utility in China and analysts predict BMW will produce its 1-series sedan in China from 2017. The auto maker declined to comment.

Daimler is launching globally a new generation of small A-Class vehicles, including a CLA sedan and a GLA sport utility. Production of the GLA compact sport-utility vehicle is to start in about 18 months.

Smaller vehicles with smaller displacement engines are “very desirable” products in China, said Hubertus Troska, the member of Daimler’s Board of Management responsible for China. “We will address this.”

However, moving down market comes with risks. Affluent Chinese car buyers have tended to equate bigger with better.

“If BMW and the likes roll out cheaper lineups that look like its expensive ones, I will stop buying the brand,” said BMW owner Harry Tu. “I don’t want people to think that I spent 200,000 yuan ($32,680) to buy the car when actually I spent two million yuan.”

Smaller cars also mean lower prices and tighter margins. Audi’s Q3 retails from around 285,000 yuan, or roughly 20% less than a China-made model of the larger Q5. Prices for BMW’s X1 start around 242,000 yuan, significantly lower than the BMW X3, which start around 523,000 yuan.

Karsten Engel, president and chief executive of BMW’s China region, estimated profit margins could erode by between 1% and 2% annually as the trend toward smaller premium cars takes hold.

Audi’s Mr. Voggenreiter said his brand’s move into lower price segments wouldn’t hurt the brand’s exclusivity, and would pull new buyers out of mass-market rivals. “From market research we know that there are many prospective customers in the huge general compact car market, who think about upgrading to premium,” he said.

Some of the contenders in the crowded second tier of China’s luxury market also see an opportunity in smaller vehicles.

“In China people are becoming more and more aware of the pollution and congestion challenges,” said Lex Kerssemakers, senior vice president for product strategy at Volvo Car Corp., which is owned by China’s Zhejiang Geely Holding Group Co. “That’s why premium smaller cars will play an increasing role as customers are not prepared to compromise on brand image, features and comfort.”

U.S. auto giants General Motors Co. GM -1.10% and Ford Motor Co. F -1.06% so far have tried to gain a foothold in China’s luxury market with larger models from their respective Cadillac and Lincoln lines. Cadillac builds its large XTS sedan in China.

However, in the future, executives at both brands say they plan to offer a full range of models, including smaller cars.

“We believe growth of small premium vehicles in China will significantly outpace that of the overall premium segment between now and 2020,” said John Lawler, chairman and chief executive of Ford Motor (China) Ltd.