Stock Investors See Slimmer Pickings; Stocks at Loftiest Levels in Years Compared With Profits

October 1, 2013 Leave a comment

September 30, 2013, 7:38 p.m. ET

Stock Investors See Slimmer Pickings

Stocks at Loftiest Levels in Years Compared With Profits

TOM LAURICELLA

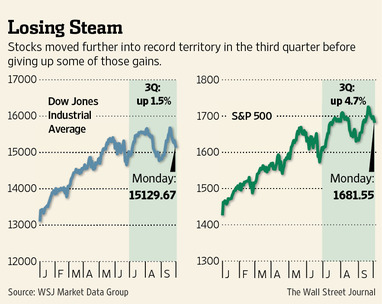

Some investors warn that the air is getting thinner for U.S. stocks, which head into the fourth quarter up 18% for the year and at their loftiest levels in years compared with corporate profits. The Dow Jones Industrial Average advanced 1.5% during the third quarter even as economic growth remained uneven. The resiliency of the stock market’s rally prompted several Wall Street strategists to throw in the towel on negative forecasts.With Federal Reserve officials pledging anew to keep interest rates low as far as the eye can see, money seems poised to keep flowing out of low-yielding, safe investments such as government bonds and bank accounts and into riskier fare such as stocks.

But the bull market’s momentum has slowed lately, as rising valuations have prompted more investors to start taking some chips off the table. In recent weeks, both Warren Buffett and Carl Icahn warned stocks aren’t cheap. Others are urging investors to move cautiously.

“The opportunity sets aren’t as robust and the margins of safety are smaller,” said David Perkins, who oversees the $1 billion Weitz Value fund at Weitz Investment Management, an Omaha, Neb., value-oriented fund manager that oversees $5 billion.

Mr. Perkins says the firm’s internal readings on the stocks they follow are at their most expensive levels since 2006. He is holding more cash as a result.

In the third quarter, major stock-market indexes continued their move into record territory, rebounding from an August swoon sparked in part by worries about the outlook for Fed policy. The S&P 500-stock index gained 4.7%. Despite wobbling in the final days of September amid political brinkmanship in Washington over the federal debt ceiling, the S&P 500 finished just 2% below its all-time high set Sept. 18.

The S&P 500 is up only 0.7% from where it stood on May 21, the day before Fed Chairman Ben Bernanke warned that the central bank could start cutting the $85 billion a month in bonds it purchases in a bid to boost the economy.

After a rough start to the third quarter for the bond market, the decision by the Fed to keep its foot on the gas gave fixed-income investors a reprieve. The yield on the U.S. Treasury 10-year note finished the quarter at 2.6%, up a notch from 2.5% at the end of June but down from a high yield just shy of 3% hit Sept. 5.

In the first two quarters of 2013, the U.S. economy rose just 1.1% and 2.5%, respectively. Meanwhile, payroll growth has plateaued and the jobless rate has been stuck above 7%.

Against this domestic backdrop, corporate-revenue growth has slowed, and with margins already stretched thin, companies have struggled to build profits. According to FactSet, profits at S&P 500 companies increased 3.6% in the first quarter and 2.1% in the second quarter, and are expected to show a rise of 3.1% for the third quarter—all soft readings by historical standards.

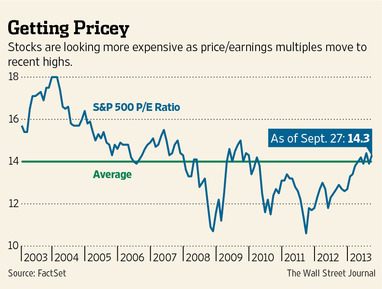

By the most widely used measure of valuations, stocks in recent months have moved to the pricier side of the ledger compared with recent history. The S&P 500 is trading at 14.3 times the next 12 months’ worth of earnings, above the average of 12.9 for the past five years and 14.0 for the past 10 years, according to FactSet. A year ago, the S&P’s P/E was 12.9.

In this environment, Mr. Perkins says, it pays for investors to be paring back on winners and conserving cash. Weitz Value is holding 27% of its portfolio in cash, up from 21% at the start of the year, and well above the 10% to 15% that Mr. Perkins says is “normal.”

Michael O’Rourke, strategist at brokerage firm Jones Trading, points to another metric that he says shows more stocks are overvalued than is generally thought.

He estimates that the median P/E among S&P 500 stocks is 18.7, up from 15.7 at the end of 2012 and 14.8 at the end of 2011.

Meanwhile, Mr. O’Rourke says that even the slow pace of corporate earnings growth has been inflated by stock buybacks—paid for in many cases by borrowed money—which has the effect of lifting earnings-per-share readings even when underlying sales growth remains soft.

“If you are putting new money into stocks now, you are betting on bubble valuations coming down the road,” Mr. O’Rourke says.

To be sure, not everyone sees stocks as moving into dangerous territory. Rebecca Patterson, chief investment officer at Bessemer Trust, which oversees $60 billion, predicts corporate profits will pick up along with economic growth in 2014.

At Bessemer, the firm has increased the share of clients’ investments in stocks, particularly toward the U.S. and other developed-market economies.

“Either the economy catches up with stock prices or stock prices catch up with the economy,” Ms. Patterson says. “At some point those lines must converge.”