Apple’s Passbook Ecosystem: How Retailers, Sports Teams, And Brands Have Made It Work For Them

October 2, 2013 Leave a comment

Apple’s Passbook Ecosystem: How Retailers, Sports Teams, And Brands Have Made It Work For Them

MARK HOELZEL AND MARCELO BALLVE OCT. 1, 2013, 5:40 PM 2,305

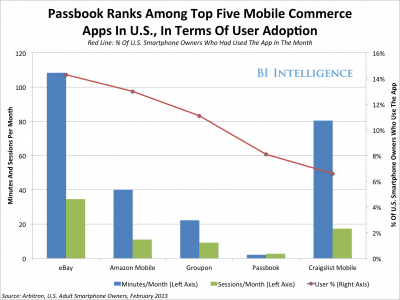

Apple’s Passbook is already the fourth-most popular mobile commerce app among U.S. consumers. It ranks just behind giants like eBay, Amazon, and Groupon in terms of user adoption. One-fifth of iPhone owners already use Passbook to download “passes”— coupons, gift and loyalty cards, airline boarding passes, and movie and event tickets. It’s Apple’s attempt at a virtual wallet. Large retailers — from Sephora to Target — and restaurant chains and Major League Baseball are already using it as a channel for acquiring and retaining customers. So why don’t we hear more about Passbook? In a new report from BI Intelligence, Business Insider’s paid subscription service, we look at the trends and numbers behind the Passbook ecosystem.

What brands and retailers are present?

How effective have Passbook campaigns been in driving consumer activity and raising brand awareness?

The report includes over a half-dozen charts and datasets — and an ecosystem graphic — examining the intricacies of the Passbook ecosystem. Subscribers receive full access to the BI Intelligence library of over 100 in-depth reports on the mobile industry, and hundreds of datasets you can put to use.

In our report on Passbook, we also look at some misconceptions and underrated opportunities:

The Passbook ecosystem is a valuable back-door for developers who would like to market their apps more aggressively, grab more visibility and achieve higher download numbers.

Passbook passes can be generated by websites and/or with the help of third-party vendors, they don’t necessarily need to be created by custom Passbook-integrated apps.

Passbook is well-positioned to seize on recent retailer and consumer enthusiasm for location-based services, mobile coupons, and mobile-powered loyalty programs.

We include a handful of mini-case studies, and examine data that reveals how successful certain brands and retailers have been with Passbook.

We also discuss Passbook’s relationship with the burgeoning and competitive mobile payments space, and the uncertainty surrounding its future as a payments platform.

Will Apple add a payment-processing capability, so that users can make “walletless” credit card payments with Passbook? Will it be joined with fingerprint-reading technology, the rumored authentication feature to be included in iPhone 5S?

Apple has over 500 million credit cards on file. We review what brands and retailers are doing to hook into the ecosystem and prepare for the possibility that Apple will one day leverage these credit card relationships and turn Passbook into a real transactions platform.

It also includes an examination of the top barriers to widespread Passbook adoption: namely, the chicken-and-egg problem that ties relatively low app publisher adoption to a lack of wider consumer awareness.