Big Tobacco’s Electronic Shock: Lorillard Makes Another Bet on E-Cigarettes With Skycig, and Industry Risks Suggest Such Deals Could Also Be Worthwhile for Altria and Reynolds American

October 3, 2013 Leave a comment

October 2, 2013, 2:56 p.m. ET

Big Tobacco’s Electronic Shock

Lorillard Makes Another Bet on E-Cigarettes With Skycig, and Industry Risks Suggest Such Deals Could Also Be Worthwhile for Altria and Reynolds American

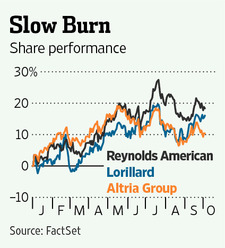

Big Tobacco has largely stayed on familiar turf in recent years. Now, it is expanding its horizons. Lorillard, LO +0.60% the No. 3 U.S. tobacco company by market value after Altria Group MO +0.12% and Reynolds American, RAI -0.16% has agreed to pay up to $100 million for Skycig, a U.K.-based maker of electronic cigarettes. That follows a $135 million deal last year to buy blu eCigs, a big U.S. brand.While the deals may not look huge, they are the two largest acquisitions by any of the Big Three U.S. tobacco companies since Altria Group bought smokeless tobacco firm UST Inc. in 2008.

Lorillard is sticking its neck out. While Altria and Reynolds American have experimented with small e-cigarette brands internally, they are available only in a few U.S. test markets. Electronic cigarettes are nicotine-delivery devices that look like the real thing but contain no tobacco.

The likely reason for Lorillard’s move: pressure on it to diversify. Its main product is Newport, a menthol cigarette that U.S. regulators have recently considered controlling more tightly.

Lorillard shares, which for years traded at a premium to peers, have dropped to a multiple of 13 times forward earnings, compared with 14.3 times for Reynolds and 13.8 times for Altria.

Yet the entire industry could use some insurance. The Food and Drug Administration has signaled a desire to reduce the level of nicotine in cigarettes. That would make them less addictive, creating an incentive for smokers to find a replacement.

Retailers have reason to put more e-cigarettes on their shelves in place of traditional products. Thilo Wrede of Jefferies says the industry has raised traditional cigarette prices in recent quarters, but retailers weren’t able to pass this on to consumers. That has squeezed their margins.

And there are plenty of independent e-cigarette players chasing the opportunity. The likes of NJOY and FIN already have brick-and-mortar distribution in 50 states.

The opportunity cost for big tobacco isn’t that high. As with rivals, Lorillard directs a large percentage of its available cash to dividends and share buybacks. But the cash needed from the latest deal would hardly move the needle for a company with a market value of $17 billion. Altria and Reynolds are even bigger.

It is easy to brush off e-cigarettes, with Morgan Stanley estimating they will take just 0.5 percentage point of market share from traditional tobacco in 2013. But with few other ways to protect traditional tobacco, Lorillard could soon look like the brighter bulb.