As smoking fades, growers shift to sweetener ingredient stevia; Stevia is forecast to eventually account for a third of the $58 billion in annual global sweetener sales

October 4, 2013 Leave a comment

Some Tobacco Farmers Have a Sweet Tooth

By Duane Stanford October 03, 2013

The once-idled leaf-processing machines at a former tobacco trading house in Alma, Ga., are coming back to life. Except now the warehouse, which still smells of tobacco leaves and cigarette smoke, is becoming a hub for a sweeter crop: stevia. Approved for commercial use in the U.S. five years ago, stevia extracts are fast becoming the sugar substitute of choice for a population trying to slim down and avoid artificial options. The no-calorie, natural sweetener, derived from plants grown mostly in China and South America, is creating an opportunity for U.S. farmers and processors looking to make up for dwindling tobacco demand and sell to the likes of Cargill and Coca-Cola (KO).Stevia may one day command about a third of the $58 billion global sweetener market, according to Stevia First, a grower in Yuba City, Calif. U.S. tobacco output, meanwhile, has slid by half over the past 20 years. Since the two leaves can be handled using the same planting equipment, harvesters, drying barns, and loaders, processors are urging farmers to switch to stevia. “I can remember 25 years ago when there were 300 tobacco farmers here,” says Julian Rigby, 62, a farmer who’s traded his tobacco fields near the Alma facility for stevia plots. “Today there’s one.”

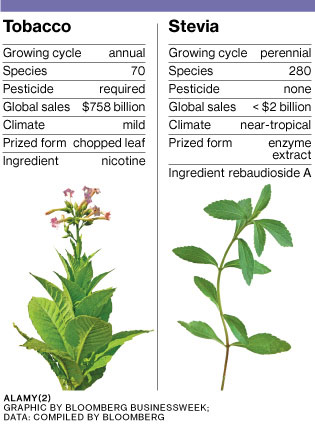

Stevia, named after the 16th century botanist Petrus Jacobus Stevus, and tobacco have a lot in common. They can grow in similar soil and climates. Both leaves are picked, separated from their stems, and dried. But unlike cigarettes and other tobacco products, extracts from the stevia herb are “generally recognized as safe,” says the U.S. Food and Drug Administration.

That’s been a godsend for food manufacturers who have fought a backlash against sugar, fat, and salt as obesity rates ballooned in recent decades. They’ve turned to stevia to sweeten Smucker’s (SJM) jams, Crystal Light drink mixes, ice cream, and even Malibu Island Spiced Rum. Food makers often mix the sweetener with sugar to reduce calories while masking the bitter aftertaste from using only stevia. Coca-Cola uses stevia in more than two dozen products globally, including Sprite and Fanta sodas in parts of Europe, to cut calories by 30 percent. PepsiCo (PEP) uses the sweetener in its Next cola in Australia, some Tropicana orange juices, and SoBe Lifewater.

One of stevia’s biggest markets is the U.S., says Mark Brooks, global business director for Truvia, the stevia brand owned by Cargill. About 55 million American households purchased a stevia product in the past year, Brooks says, citing Nielsen (NLSN) data. Truvia, with a 13 percent share, is the second-best-selling sugar substitute in the U.S. after sucralose-based Splenda, with 34 percent.

The vast majority of the world’s stevia, a green leafy plant, is processed in China and South America. The leaves are picked and separated from the stem mostly by hand and processed in special factories to extract rebaudioside A, a compound hundreds of times sweeter than sugar. Truvia’s Brooks says he’d welcome more U.S. production. “It’s great to know some of that can be homegrown—it would resonate with consumers,” he says, noting that he’d like to diversify Truvia’s supply.

Farmers have experimented with stevia in warm states such as California, Georgia, and North Carolina. Most U.S.-grown stevia is now sent to China for extraction of the sweet enzymes from the leaf and then returned, says Hal Teegarden, vice president for agriculture operations at stevia producer Sweet Green Fields in Bellingham, Wash. The leaves’ light weight makes such transport economical. The company is sharing cultivation and harvesting techniques with Rigby and other Georgia farmers in hopes of generating enough domestic production to justify a multimillion-dollar processing plant in the U.S. “in the near future,” Teegarden says.

The bottom line: Stevia is forecast to eventually account for a third of the $58 billion in annual global sweetener sales.