Twitter Advertisers Say Service Needs More Users; Buyers Say Service Should Be More Mainstream Before It Gets More From Mass-Market Clients

October 5, 2013 Leave a comment

October 4, 2013, 7:03 p.m. ET

Twitter Advertisers Say Service Needs More Users

Buyers Say Service Should Be More Mainstream Before It Gets More From Mass-Market Clients

SAN FRANCISCO—For some advertisers, 218 million people isn’t a big enough audience. That’s their message to Twitter Inc., which Thursday detailed plans for an initial public offering. Ad buyers say that the short-message service will need significantly more users, and a bigger sales force, to win more spending from their mass-market clients. “Scale still matters,” says Adam Shlachter, senior vice president of media at DigitasLBi, a digital-ad firm owned by Publicis Groupe PUB.FR +0.38% SA. “How consumers embrace [Twitter] and tap into it or tune in or out is going to be critical.”

Since the first 140-character message was dispatched in March 2006, Twitter has exploded into a game-changing communication tool where news is made and broken by public figures and ordinary citizens.

Here’s the problem: It seems there are more people talking about Twitter than using it.

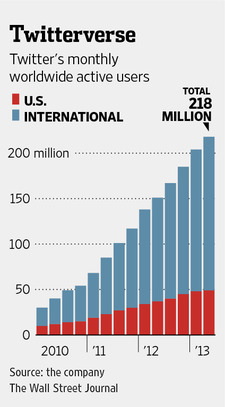

Twitter boasts 218 million monthly active users, according to its Thursday filing with the Securities and Exchange Commission. That’s less than one-fifth as many as rival FacebookInc.’s FB +3.78% 1.15 billion.

Some 22% of U.S. Internet users are on Twitter, according to Forrester Research Inc.FORR +0.19% By comparison, 72% check Facebook at least once a month.

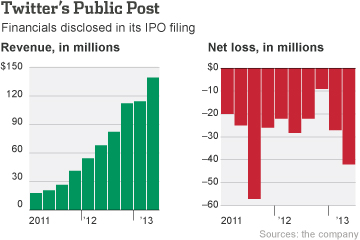

It is a troublesome issue for Twitter, which relies heavily on advertisers to make money, as it looks to raise $1 billion in a public offering. Advertising accounted for about 85% of Twitter’s $317 million in revenue in 2012, according to the filing. Facebook reported $4.3 billion in advertising revenue last year.

What is more, the rate of user growth is slowing. In the second quarter, Twitter’s growth in monthly active users slowed to 7% from three months earlier, compared with 10% to 11% growth in the prior three quarters.

Progressive Corp. PGR +0.63% buys ads featuring tweets from “Flo,” the zany always-cheerful star of its television ads, who has more than 20,000 Twitter followers. But the Mayfield Heights, Ohio, insurer favors Facebook for social-media advertising.

“The 200 million-plus Twitter nation is a powerful and influential force that you have to pay attention to,” says Jeff Charney, Progressive’s chief marketing officer. He says the insurer will consider spending more as Twitter grows. But Facebook has “more heft,” he says. “You just can’t ignore Facebook.”

Twitter itself recognized the risk if it fails to increase its user base and engagement level in its Thursday filing, saying it “could result in the loss of advertisers and revenue.” A Twitter spokesman declined to comment.

Brian Wieser, an analyst at the Pivotal Research Group, says advertisers today are spending far more on Facebook than Twitter. But he is optimistic about Twitter’s future, because he thinks the company is “clued in” to advertisers’ concerns.

Some advertisers say Twitter makes up in quality what it lacks in quantity. The many celebrities and media pundits who use the service can be very influential, they say.

“It is an important audience and I want our brand to be part of the conversation that is happening there,” says Lisa Cochrane, senior vice president of marketing at AllstateCorp. ALL +2.87%

Ms. Cochrane says she isn’t worried about Twitter’s slowing user growth. “People are learning how to use it and it will find its place,” she says.

Part of Twitter’s problem, analysts say, is that the service is hard to use. It can be difficult to identify relevant information amid the torrent of tweets. New users must devote time and energy to acquire “followers” and curate a list of accounts they want to “follow.”

The “focus needs to be on making the service useful and relevant to the masses,” said Vik Kathuria, managing partner at MediaCom, a media-buying firm owned byWPP PLC. WPPGY -0.58% “They need to find ways to connect with the masses to increase engagement so it’s not a small minority who remain the power users,” he added.

Another weakness, advertisers say, is that Twitter has yet to become a daily habit for many people. Usage tends to spike during big events, such as the Super Bowl, or natural disasters.

Advertisers want to know it has a “consistent audience to tap into and it’s not an audience that is just churning in and out,” says Mr. Shlachter of DigitasLBi.

Updated October 3, 2013, 10:56 p.m. ET

Twitter Reveals $1 Billion IPO Plan

First Glimpse of Financials Shows Users Still Growing but No Profit; TWTR Has Yet to Name Exchange

YOREE KOH, TELIS DEMOS and SHIRA OVIDE

Twitter Inc. on Thursday revealed plans to raise up to $1 billion in a public offering, looking to cash in on a messaging service that has transformed public conversation but is still losing money and facing challenges attracting new users and advertisers.

Potential buyers for the first time saw the financials behind one of the most anticipated stock-market debuts of the year, which showed the social network’s revenue more than doubled to $254 million in the first six months of this year.

But its net loss grew by 40% to $69 million as the company’s expenses ballooned. Twitter’s user growth is also slowing, and prices for advertisements, which make up the bulk of the company’s revenue, are falling.

“They certainly have a lot of work ahead of them to get mainstream America to understand” how Twitter works, said Brian Solis, an analyst at the Altimeter Group.

Twitter had previously shielded the figures by filing its initial IPO documents confidentially in July, under a new federal law.

The amount raised in the filing is an estimate that could change when Twitter launches its investor “roadshow,” where it will formally pitch its stock to investors.

The document suggests Twitter recently valued itself at about $9.7 billion, based on the number of shares outstanding, or at about $13 billion when including equity awards.

Twitter chose TWTR as its ticker symbol but hasn’t specified whether it will trade on the New York Stock Exchange NYX +2.48% or Nasdaq Stock Market NDAQ +1.83% .

In seven years, Twitter has grown from a wobbly startup to a social phenomenon where in just 140 characters its 215 million monthly active users tap out more than 500 million messages each day.

The short-message service serves as a global forum in which users break news, organize protests and gripe about what they ate for lunch. As early as 2008, Twitter turned eyewitnesses into “citizen journalists” who reported on a terrorist attack in Mumbai.

Now, once-elusive public figures including the pope, Warren Buffett and Kanye West “tweet” their thoughts and interact with other users. Twitter CEO Dick Costolo uses the service to answer users’ troubleshooting queries. Businesses, stock pickers and politicians alike analyze the sentiments expressed on Twitter as important indicators.

Despite its ubiquity, Twitter remains an immature business. The filing showed Twitter has far fewer users and generates less revenue per user thanFacebook FB +3.78% .

When Facebook filed for a public offering, the company revealed sales of $3.7 billion and a profit of $1 billion for 2011. It also had 845 million monthly active users, a huge bragging point as it pitched itself to investors.

Twitter’s growth is also a question. The majority of Twitter’s revenue, about 75%, is from the U.S., even though three-quarters of monthly users are outside the U.S. Facebook also has a wide gap between its usage and its ad revenue outside the U.S., where advertising businesses typically are less mature.

In the second quarter, Twitter’s growth in monthly active users slowed to 7% from three months earlier, compared with 10% to 11% growth in the prior three quarters.

Like Facebook, Twitter makes money mostly by selling advertising based on users’ posts. As they compete for advertisers, both companies position themselves as the world’s online town square.

Twitter also has as a second business licensing its data companies that analyze user tweets for insights on news events and social trends. That business generated $47.5 million in revenue last year, roughly 15% of the total.

GS -0.19% Goldman Sachs Group Inc.GS -0.19% is spearheading Twitter’s IPO, but its rival Morgan StanleyMS +0.52% won a measure of vindication by landing the second-biggest role in the deal.

Morgan Stanley had led Facebook’s IPO, and was criticized after Facebook shares fell as much as 50% in their first three months of trading, though the stock has since recovered and is well above its initial price.

J.P. Morgan ChaseJPM +1.41% & Co. also is in the lead group of banks, meaning that the same three banks that led Facebook’s IPO will lead Twitter’s. Bank of America Merrill Lynch andDeutsche Bank AGDBK.XE +0.62% are also serving as underwriters.

The largest Twitter shareholder specified in the filing is co-founder Evan Williams, who owns 12% before the offering. He became Twitter’s CEO in 2008 before being replaced by Mr. Costolo in 2010. At Twitter’s most-recent internal valuation, Mr. Williams’ stake would be valued at nearly $1.2 billion.

Other major shareholders listed in the filing include venture-capital firm Benchmark Capital, which owns 6.7% and invested in Twitter early on; co-founder Jack Dorsey, with 4.9%; and Mr. Costolo, who holds 1.6%. Based on the internal valuation, Benchmark’s stake would be valued at about $651 million; Mr. Dorsey’s stake would be worth roughly $483 million; and Mr. Costolo’s shares would be valued at about $155 million.

Four other venture-capital firms, Rizvi Traverse, Spark Capital, Union Square Ventures and DST Global, are listed as owning at least 5% of the shares, but specific share counts aren’t listed.

The clock is now ticking on when Twitter can begin its roadshow. The IPO filing must be public for at least 21 days before the company can set a price range and say how many shares it is selling.

Companies typically take at least a week to travel to different cities and meet investors on the roadshow. That means if the process moves at full speed, Twitter could begin trading around the end of the month or the first week of November.

As for the federal government shutdown, a person familiar with the deal said there isn’t a big worry right now. But a shutdown extending three weeks or longer could possibly slow the offering if the Securities and Exchange Commission isn’t operating at all when Twitter begins the roadshow, this person said.

The deal will be watched by other technology companies looking to go public, such as Box Inc., an online storage company, and Square Inc., the mobile-payments company created by Mr. Dorsey.

Several of those companies delayed potential public offerings after shares of Internet companies such as Facebook, Groupon Inc. GRPN +1.33% and Zynga Inc.ZNGA +2.45% sagged after their debuts. But shares in Internet companies have surged this year, amid a broader rally in the U.S. stock market.

Oct 3, 2013

How Twitter’s Hashtag Came to Be

Hashtags are so ubiquitous now that evenJimmy Fallon and Justin Timberlake are mocking them. Following in Twitter’s footsteps,Facebook incFB +3.78%orporated the hashtag this year. And a March 2013 survey by RadiumOne found that more than half of mobile-device owners regularly use hashtags.

So it’s hard to believe that at one time, hashtags weren’t a part of the Twitter lexicon. Not only that, but Twitter initially rejected the idea of hashtags.

The invention of the hashtag is credited to Chris Messina. The 32-year-old has worked as a developer and UX designer at GoogleGOOG -0.43% but left in August to join the San Francisco based startup NeonMob. In his Twitter bio, Messina refers to himself as the hashtag godfather.

On Aug. 23, 2007, Messina sent out the following tweet: “how do you feel about using # (pound) for groups. As in #barcamp [msg]?” And with that, the hashtag was born.

The hashtag was based on the idea of channels used in Internet Relay Chat and in Jaiku, a Twitter competitor that was later bought by Google. But the real inspiration, according to a blog post Messina wrote in 2007, was that he wanted to have a “better eavesdropping experience on Twitter.”

In the blog post, Messina elaborated what he wanted these “channel tags” to do:

“What’s really interesting, however, i[s] how these channels can be used as tags within Twitter to open up entirely new possibilities.

Every time someone uses a channel tag to mark a status, not only do we know something specific about that status, but others can eavesdrop on the context of it and then join in the channel and contribute as well. Rather than trying to ping-pong discussion between one or more individuals with daisy-chained @replies, using a simple #reply means that people not in the @reply queue will be able to follow along, as people do with Flickr or Delicious tags. Furthermore, topics that enter into existing channels will become visible to those who have previously joined in the discussion.”

In the post, Messina evenmocked up some pagesdepicting what “tag channels” would look like. Yet when he initially mentioned the idea to Twitter, he was turned down.

“[Twitter] told me flat out, ‘These things are for nerds. They’re never going to catch on,’” Messina said in a phone interview.

The use of hashtags became mainstream after October 2007, when citizen journalists used them to give updates about a series of forest fires in San Diego. Messina said he sent a private message to one of the men covering the fire, Nate Ritter, asking him to use the hashtag #sandiegofire.

“That was one of the really great examples of citizen journalism aided by the use of the hashtag,” Messina said.

In 2008, conservative politicians in the U.S. started using the hashtag #dontgo to keep Congress in session to vote on an energy bill.

Now, Twitter has a whole guide on how to use hashtags. The company doesn’t mention Messina but says the hashtag “was created organically by Twitter users as a way to categorize messages.” Twitter wouldn’t formally comment on hashtags.

“Maybe 20 years from now hashtags will seem quaint, but they’re solving an important problem today,” Messina said, “allowing people to express more about the content they share in order to connect with more people.”

Hashtags are now used to chronicle events from Syria to the Emmys, to the SuperBowl to the government shutdown. When Kate Middleton went into the hospital to deliver the #royalbaby, the hashtag was used more than 900,000 times, according to Twitter.

They have also spread to other social networks, like Google+ and Facebook, something Messina said he is happy to see.

“I’m happy to see the Facebooks of the world … build on the hashtag, like URLs before, but in a way that really makes the conversation that much richer and that much more diverse,” he said.

Twitter Sends Different Message Than Facebook in Filing

Twitter Inc. proved once again it’s not about to have another Facebook Inc. (FB) initial public offering.

The San Francisco-based company yesterday made its prospectus public, in a document that contrasted with Facebook’s S-1 last year. In its filing, Twitter showed more risk factors than its rival, published a much shorter letter to prospective shareholders, and dodged some of the issues that hampered Facebook — such as a lack of mobile advertising — when it went public.

“The thing that stands out is that nothing stands out; it’s sort of stunningly boring,” Paul Kedrosky, a contributor to Bloomberg News, said on Bloomberg West of Twitter’s S-1. “This is a really straightforward IPO document, which is maybe exactly what the market needs right now.”

Twitter had already been taking a different approach to its IPO than Facebook, by confidentially filing for an initial share sale in July, a person with knowledge of the matter has said. That kept the company’s financials under wraps until yesterday, shortly before a roadshow to market to investors.

Facebook, by contrast, underwent months of hype after it filed its S-1 last year. After its stock market debut, the shares quickly plunged below the $38 offering price, and have only recently climbed back above that price.

IPO Letters

The dissimilarities are stark within the letters that the two companies included in their IPO documents. When Menlo Park, California-based Facebook filed to go public in early 2012, Chief Executive Officer Mark Zuckerberg printed more than 2,000 words in a letter giving his philosophical take on social networking. It included a discussion on the “Hacker Way,” which Zuckerberg said is an “approach to building that involves continuous improvement and iteration” at the company.

Twitter, by comparison, didn’t include a letter from co-founders Evan Williams, Jack Dorsey and Biz Stone. Instead, the company had a missive that was less than 140 words long, signed by @twitter, which touted the service’s ability to help people create and share ideas.

“Twitter represents a service shaped by the people, for the people,” the letter said. “Thank you for supporting us through your Tweets, your business, and now, your potential ownership of this service we continue to build with you.”

Tucker Bounds, a spokesman for Facebook, declined to comment. Jim Prosser, a spokesman for Twitter, didn’t respond to a request for comment.

Stock Structure

Twitter’s filing also revealed that its founders don’t have the same level of influence over the company as Zuckerberg does at Facebook. Zuckerberg used a dual-class stock structure to boost his control, similar to arrangements at other technology companies such as Google Inc. (GOOG) Twitter has one class of stock, giving other shareholders more say on what happens at the company.

“It doesn’t appear Twitter is going to be one of those founder-controlled entities,” said Charley Moore, executive chairman of Rocket Lawyer Inc., which sells services to Twitter. “Here you have a company that is probably going to be more democratic than some of those other businesses may be.”

Twitter’s risk factors also covered 32 pages of its prospectus, while Facebook’s were contained in 22 pages. Twitter disclosed potential threats that included potential sagging user growth and worries about competition — including from Facebook. One similarity among the risk factors: Both companies listed earthquakes as a potential danger to their business.

The differences extend to how the leaders of both companies reacted to their public S-1s. On the day Facebook filed its IPO last year, Zuckerberg alluded to the event by posting a photo that showed a desk with a poster that read “stay focused & keep shipping.”

Twitter CEO Dick Costolo, in contrast, posted messages about Vine, the company’s mobile video service, in response to a clip that included a Sesame Street character.

“Vine constitutes an offer for smiles!” he wrote, without any mention of the prospectus.

To contact the reporter on this story: Brian Womack in San Francisco at bwomack1@bloomberg.net