Dow’s Exiles Often Have Last Laugh?

October 7, 2013 Leave a comment

October 6, 2013, 5:30 p.m. ET

Dow’s Exiles Often Have Last Laugh

Recently Dropped From Dow, Alcoa Could Be Set to Outperform, If Past Holds True

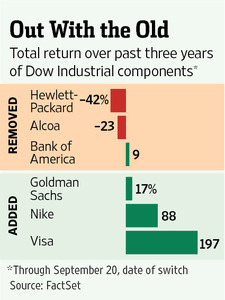

“How’d the market do today?” If your answer takes the form of a number, then it had better be in Dow points. Citing some index other than the Dow Jones Industrial Average to an American is akin to complaining about the temperature in Celsius or your weight in kilograms. But investment professionals roll their eyes at the attention the 117-year-old index receives. Far more products are linked to the S&P 500-stock index with its broader footprint and more sophisticated design. That the two indexes have performed almost identically in the long run is viewed as a curiosity. (The Dow is overseen by S&P Dow Jones Indices LLC, in which Dow Jones & Co., publisher of The Wall Street Journal, owns a stake.)Corporate bosses are honored to be among the 30 Dow components but feign indifference when tossed out.Alcoa Inc., AA +1.27% which was removed on Sept. 20 along with Bank of America Corp. BAC +0.36% and Hewlett-Packard Co., said the move “has no impact on Alcoa’s ability to successfully execute our strategy.”

The company’s results out Tuesday, unofficially kicking off earnings season, will focus attention on the effects of a glutted aluminum market. Alcoa’s stock has lagged behind the Dow by 94 percentage points over five years.

If past trends hold true, though, this may be a good time to buy Alcoa and fellow Dow refugees. A study by three researchers in Pomona College’s economics department shows deleted stocks sharply outperform those added. Over five years following an index change, they collectively gained 173% on average compared with 65% for new entrants.

That bodes poorly for new components Goldman Sachs Group Inc., Nike Inc. and Visa Inc. New entrants have typically performed well enough to gain inclusion and may not live up to the hype. Exiles, seen as washed up, could experience the opposite.

The study, which goes from 1929 through 2005, might be less convincing if it included the financial crisis. American International Group Inc. still hasn’t recovered from its postcrisis losses after being ejected in September 2008.

Even so, the Dow often eschews the flavor of the month. When UnitedHealth Group Inc. was added in September 2012, the exclusion of red-hot Apple Inc. raised eyebrows. Yet the insurer has outperformed Apple AAPL -0.08% by 65 percentage points.

Sometimes membership has its privileges.