Number of chaebol’s affiliates soar 50% in five years, raising chances of liquidity problems; Many are acquisitions, but analysts warn of over-reliance on debt

October 7, 2013 Leave a comment

2013-10-06 16:49

Number of chaebol’s affiliates soar 50% in five years

By Choi Kyong-ae

Conglomerates are expanding their business territories fast here by setting up new affiliates and acquiring smaller firms, raising chances of liquidity problems, economists said Sunday. The response comes after Chaebul.com, a local chaebol research company, said Korea’s top 30 companies increased the number of their affiliates by 48 percent over the past five years through 2012 to 1,246 from 843 at the end of 2007. At the end of September, the corresponding figure fell slightly to 1,237 as some companies such as Kumho Asiana Group and STX Group have undergone or are undergoing restructuring in the wake of heavy borrowings amid a prolonged slump in their businesses.

“The former Lee Myung-bak government (which ended in February this year) introduced policies in favor of big companies, giving them more room to acquire small companies to diversify their portfolios and have a bigger say and control in their businesses,” Lee Phil-sang, an invited professor of the economics department at the Seoul National University, said by telephone.

As a result, he said Korea’s top 3 companies by assets ㅡ Samsung Group, Hyundai Motor Group and LG Group ㅡ have become the biggest contributors to the nation’s economy but at the same time the economy has become more reliant on their performance which experts say is “riskier than ever.”

“Lack of a balanced contribution and growth between large conglomerates and small-and medium-sized companies will be a headache for the economy,” Lee said.

In addition, reckless expansion through heavy borrowings has put some companies such as Kumho Asiana Group, an airline-to-chemical conglomerate, Taihan Electric Wire, and STX Group, a shipping-to-shipbuilding conglomerate, to undergo massive restructuring to avoid serious impact on the economy from their possible liquidation.

With the economic slowdown expected to drag on for some time, Hansung University economics professor Kim Sang-jo said companies such as Dongbu Group and Hanjin Group “may have to go through restructuring” following years of diversification efforts and snowballed debts.

Dongbu and Hanjin could not be reached for comment.

“Most urgently, the system that governs corporate restructuring for debt-ridden companies before things take a turn for the worse should be established and the streamlining efforts should be made in a timely and transparent manner to seek a balanced growth between large and small companies,” Kim said.

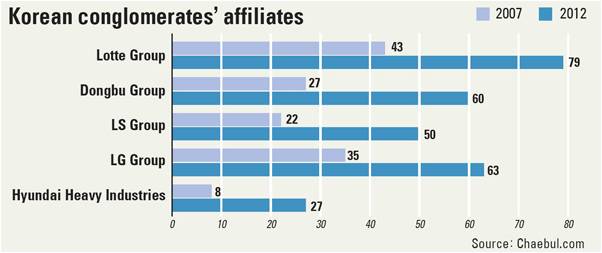

During the previous administration, Lotte Group’s affiliates jumped by 36 to 79 at the end of 2012, followed by Dongbu Group with an increase of 33, LG Group with a rise of 28. When it comes to growth rate, Hyundai Heavy Industries posted the biggest jump in the number of affiliates to 27 from 8 during the five-year period, according to the site.

Outstanding debts held by the 30 biggest firms soared to 574.9 trillion won ($532 billion) at the end of 2012 from 313.8 trillion won at the end-2007, it said.

Chaebol add many subsidiaries

Many are acquisitions, but analysts warn of over-reliance on debt

Oct 07,2013

As the financial meltdown of the Tongyang Group brings new attention to how family-oriented Korean conglomerates manage their affiliates, many of the top 30 chaebol companies have expanded their businesses aggressively over the past five years.

According to Chaebul.com, a Web site dedicated to providing information about the families that run Korea’s chaebol companies, the number of affiliates of the nation’s top 30 family-owned conglomerates have surged nearly 50 percent since 2007, with some expanding 80 percent.

Chaebul.com said the total number of affiliates owned by the top 30 chaebol was 1,246 at the end of last year, up 843, or 47.8 percent, from the end of 2007.

This month, three affiliates of Tongyang Group filed for court receivership after they failed to secure funds to keep themselves afloat. They had relied on another company in the group for financing previously.

Before Tongyang, STX and Woongjin Group had similar problems and some analysts blame the liquidity crises on restless expansion.

Over the past five years, local retail giant Lotte Group posted the largest increase in the number of affiliates from 43 at the end of 2007 to 79 at the end of last year.

The steel and construction conglomerate Dongbu Group added 27 affiliates from 2007 to last year, and smart grid and solutions chaebol companies LS Group and LG Group each added 28.

Hyundai Heavy Industries increased the number of its affiliates from 8 at the end of 2007 to 27 as of the end of last year, while Hyundai Group increased from 9 to 21 in the same period.

The only company that reduced the number of affiliates over the past five years is Kumho Asiana. The number of affiliates of Kumho Asiana Group fell from 35 at the end of 2007 to 20 last year.

The main cause for the surge in affiliates is mergers and acquisitions. A large number of insolvent companies have been acquired by conglomerates after they completed restructuring.

Chaebul.com said there are growing concerns that the excessive expansion could bring about a “winner’s curse” by increasing financial and management strains on the conglomerates.

While M&As are a time-honored way for big companies to grow, it can also put on pressure if they borrow too much to acquire the companies.

“Some conglomerates face insolvency after forcibly acquiring other companies to expand,” said a spokesperson for Chaebul.com. “To prevent such crises, companies should establish an effective and transparent restructuring system for insolvent companies, and receive an approval from the general meeting of shareholders when signing a large-scale M&A.”

In the cases of Woongjin, STX and Tongyang, analysts blame excessive expansion in the number of subsidiaries for the liquidity crises.

The total liabilities of the 30 chaebol companies last year was 574.9 trillion won ($535.2 billion), up 83.2 percent from 313.8 trillion won at the end of 2007.

BY KIM JUNG-YOON [kjy@joongang.co.kr]