Shadow Loans Sound New Alarm; Regulators Cite Growing Role of Individual Investors

October 7, 2013 Leave a comment

October 6, 2013, 7:46 p.m. ET

Shadow Loans Sound New Alarm

Regulators Cite Growing Role of Individual Investors

IANTHE JEANNE DUGAN

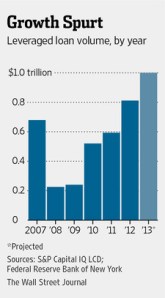

Debt-laden companies are on track to borrow a record $1 trillion this year in the nonbank “shadow lending” system, and regulators are sounding alarms about one of its fast-growing funders: individual investors. The burgeoning role of individuals in lending is highlighted as a top concern in a report released last week by the Federal Reserve Bank of New York as part of a continuing effort to overhaul shadow bankers—the web of largely unregulated financial firms unable to borrow in an emergency from the central bank and without traditional depositors that are insured.“The lack of such access to sources of government liquidity and credit backstops makes shadow banks inherently fragile,” says the staff report, which explores how to monitor the risks of the system.

Regulators estimate that shadow bankers control about $15 trillion, down from about $22 trillion before the crisis. But pockets of shadow activity are burgeoning, and one of the most robust is borrowing by companies and individuals as banks cut back on certain loans following the financial crisis.

Among the hottest areas are loans made by groups of lenders to companies that have low credit ratings, partly because they already are laden with debt.

These leveraged loans soared to about $680 billion in 2007, then began falling out of favor. Now they are red-hot, with some $1 trillion expected to be plowed into the financing this year.

Much of this money is being lent under loose conditions, the New York Fed says.

“The deterioration in loan underwriting has come hand-in-hand with an increased presence of retail investors in the leveraged loan market…as relatively sophisticated investors, like banks and hedge funds, are exiting the asset class,” the report says.

These small investors mainly access the market through mutual funds that invest in leveraged loans. At the end of August, these funds held $145.7 billion in assets, double that of two years ago and up 50% already this year, according to research firm S&P Capital IQ LCD.

Individual investors represent roughly one-third of the money behind leveraged loans issued in 2013, about double the share they held a year ago. They are drawn to these loans in search of higher returns as interest rates remain low. On loans issued in 2013, investors have gotten a yield of about 5.3%, while default rates have been historically low.

These loans tend to carry higher interest rates than standard loans, the New York Fed report notes, generally receiving floating rates pegged to a benchmark such as Libor. So if interest rates climb, the rates on the loans would rise.

Still, hedge funds and other sophisticated investors are paring back on this area. In one category that Capital IQ LCD calls “relative value,” for instance, they held nearly a quarter of the loans last year and just 8% now.

Meantime, there are risks for individual investors, says Steve Miller, managing director at Capital IQ LCD. “If default rates go up, investors will lose.”