Asia Goes Slow on High-Speed Trading

October 8, 2013 Leave a comment

Oct 7, 2013

Asia Goes Slow on High-Speed Trading

By Michelle Price

High-speed trading firms revolutionized stock trading in the U.S., but many have faced challenges in Asian markets. Most regulators in the Asian-Pacific region, eager to protect individual investors and the dominant exchanges, have declined to implement the changes that would open many stock markets to profitable high-speed trading. And a number of trading glitches in the U.S.—most notably the May 2010 “flash crash,” in which the Dow Jones Industrial Average lost about 1,000 points in minutes before recovering—has made them more reluctant.

“We are quite concerned about [high-frequency trading] as it can affect market stability in a negative way, and retail investors feel they are at a disadvantage because of the big [high-frequency-trading] firms,” Chang-geun Yun, business development manager at Korea Exchange’s derivatives market, said in an email.

Still, derivatives markets, often seen more as the domain of professional traders, are providing opportunities. “The focus and attraction is the derivatives markets, where there are fewer restrictions,” said John Fildes, chief executive of alternative trading platform Chi-X Australia.

Using their own money, high-frequency-trading firms deploy computer algorithms to detect opportunities and execute trades, often in stocks or derivatives listed on different exchanges, firing thousands of buy and sell orders in fractions of a second.

The explosive growth in this type of trading was made possible by the liberalization of the U.S. financial markets in 1995 and European markets in 2007. In both cases, new rules gave birth to competing exchanges, pushing down transaction fees and giving rise to high-speed-trading strategies.

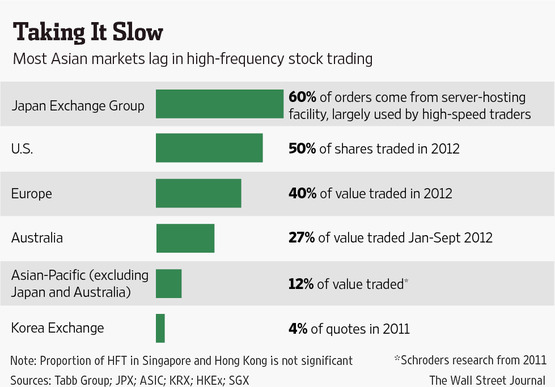

In Asia, though, high-speed trading accounts for only 12% of total trading by value in stocks on Asian-Pacific exchanges, excluding Japan and Australia, according to 2011 research by Schroders, the most recent available. In Singapore and Hong Kong, it is “not significant” and “low,” respectively, the main stock exchanges there said. That is compared with 50% in the U.S. and 40% in Europe, according to consultant Tabb Group.

In the region, only Japan and Australia have embraced high-speed trading.

Japan Exchange Group, created through the January merger of the Tokyo Stock Exchange and Osaka Securities Exchange, said that about 60% of orders on its stock-trading platform come from its server-hosting facility, which is typically used by high-frequency trading firms. The exchange added that not all users of those facilities are high-speed traders.

In Australia, high-frequency trading accounted for 27% of turnover from January through September last year, according to the Australian Securities and Investment Commission.

Some companies that have come to Asia in search of new opportunities have faced setbacks. Chicago-based Getco LLC, which merged this year with Knight Capital Group Inc. to create KCG Holdings, decided to close its Hong Kong office in March after two years. Dutch market-maker IMC also scaled back its Hong Kong operations in 2012, relocating staff to its existing Australian office.

“We have seen a lot of firms build infrastructure there [in Asia] and have found it a lot more difficult than they originally thought,” said Chris Malo, chief financial officer of Chicago-based trading firm Sun Trading, which trades Asian stocks from the U.S.

Elsewhere, taxes on purchases and sales of stocks, including in Hong Kong and South Korea, and a lack of competing exchanges have kept the cost of trading stocks high compared with the U.S. and Europe. This adds up quickly when a firm is selling hundreds of thousands of shares a second.

In Hong Kong, the percentage of high-frequency trading in stocks remains low because of a 0.1% stamp duty on the purchase and sale of stocks, a spokesman for Hong Kong Exchanges & Clearing Ltd. said in an email. Similarly, in South Korea a 0.3% levy on the sale of listed stocks has limited high-frequency trading there to about 4% of quotes, or bids and offers, in the cash equities market, the business development manager at the Korea Exchange said in an email, citing research from 2011.

Traders point to derivatives, which are less regulated than stocks and face lower levies, as providing opportunities in some places where equities trading doesn’t. For example, Nikkei futures and options listed in both Japan and Singapore are popular among high-frequency-trading firms.

Korea Exchange said that some 78% of quotes in its Kospi 200 Options market are from high-frequency traders, while Singapore Exchange Ltd. said roughly 30% of trading in its derivatives market, including Nikkei futures, was by these firms.