Asia’s Chocolate Craving Paces Global Demand: Chart of the Day

October 8, 2013 Leave a comment

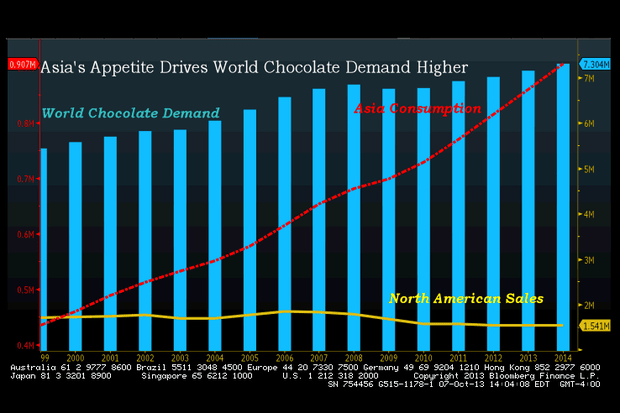

Asia’s Chocolate Craving Paces Global Demand: Chart of the Day

Asia’s craving for chocolate will pace the 2.1 percent increase in global demand in 2014 amid a rally in cocoa prices to the highest in almost two years. The CHART OF THE DAY shows chocolate-confectionary sales in the Asia Pacific will climb 5.4 percent next year from 2013, more than doubling since 1999, according to data from Euromonitor International Ltd. Sales in North America were forecast to drop 0.1 percent in 2014, capping a 9.9 percent decline in 15 years.The International Cocoa Organization said on Sept. 27 that processing of the main ingredient for chocolate will outpace the global bean harvest by as much as 70,000 metric tons in the year that began Oct. 1. Jean-Marc Anga, an executive director of the London-based group, cited prospects for a jump in demand from China’s middle class. Consumption is expanding in Asia as incomes rise.

“There’s a long-term trend at work,” said Paul Christopher, the St. Louis-based chief international strategist at Wells Fargo Advisors LLC, which manages $1.3 trillion. “It’s one of the areas where you can see food demand steadily increasing, especially in sectors that previously didn’t have much foothold in Asia.”

This year, cocoa futures have climbed 21 percent, the biggest gain among 24 raw materials in the Standard & Poor’s GSCI Spot Index. Drier-than-normal weather hurt crops in West Africa, which produces 70 percent of the global harvest. Yesterday, the price for December delivery reached $2,710 a ton on ICE Futures U.S. in New York, the highest for a most-active contract since Nov. 8, 2011.

Cocoa costs may continue to climb until farmers increase planting next season, Christopher said. Indonesia, the world’s third-largest grower, may become a net buyer next year as domestic companies process more beans to make chocolate, a local industry group said.

To contact the reporter on this story: Luzi Ann Javier in New York at ljavier@bloomberg.net