Yum Brands: Asian Flu Is Sapping the Appetite; Slowing Economy, Food-Safety Scare Drag on Yum in China

October 8, 2013 Leave a comment

Updated October 7, 2013, 4:19 p.m. ET

Yum Brands: Asian Flu Is Sapping the Appetite

Slowing Economy, Food-Safety Scare Drag on Yum in China

The world looked different the last time Yum Brands Inc. suffered a decline in full-year earnings per share. In 1997, Asia’s borrowings inspired scary headlines, not America’s. Then called Tricon, the business was loss-making, and management spent most of its time discussing the U.S. fast-food jungle. Its Chinese operations weren’t broken out separately, and total sales in the Asian-Pacific region were less than half of international revenue.China has been a bonanza for Yum’s KFC chain in the intervening years. But stumbles there can be blamed for a slump in profit lately. Earnings per share for the fiscal third quarter that ended in mid-September, due Tuesday, are seen at 92 cents, compared with $1 a year earlier.

A slowing economy and a food-safety scare in China dented sales starting late in 2012. Improvement has been slower than expected, with same-store sales in August down a sharp 10%. Unless that begins to improve soon, Yum’s goal of returning to same-store sales growth in China in the current quarter looks iffy.

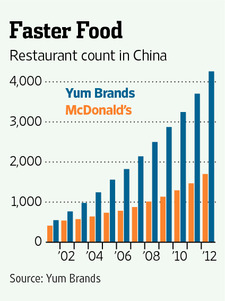

Even after years of expansion, China has just a third as many Yum restaurants as the U.S. But over the past five years, Yum’s compound annual growth rate of new restaurants there has been 17% compared with zero at home. And the financial impact of each restaurant in China, where they are company owned, is greater. About nine in ten U.S. outlets are franchised.

Add it up and China contributes more to the bottom line than the U.S.—or it did until recently. For the first half of 2013, operating profit from China was $222 million, down by half from a year earlier. U.S. operating profit was $338 million, up by 4%.

China is also the reason for Yum’s premium valuation over rival McDonald’s Corp.—its multiple based on estimated earnings for the next 12 months is a third higher. Though no slouch internationally, the latter has been expanding there at about half Yum’s pace the past decade.

Yum’s recent stumbles highlight the risk that comes with China’s reward, but its valuation premium has expanded compared with that of McDonald’s. Investors are treating the episode as a blip before it is fully resolved.

Without firm evidence of a recovery in China, Happy Meals may bring fewer nasty surprises and better value.