Decaying Bridges, Highways Raise Costs for Truckers, Manufacturers; America’s road to recovery may face a costly detour due to a fraying transportation network

October 14, 2013 Leave a comment

A Slowdown on the Road to Recovery

Decaying Bridges, Highways Raise Costs for Truckers, Manufacturers

BOB TITA

Oct. 13, 2013 4:42 p.m. ET

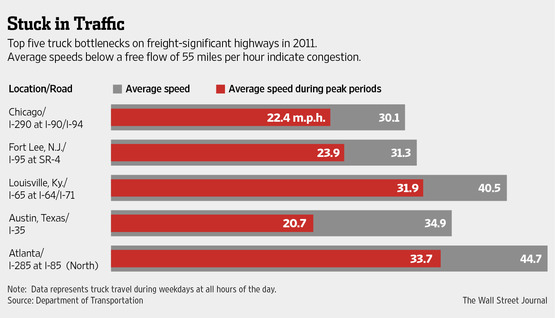

America’s road to recovery may face a costly detour due to a fraying transportation network. One in nine of the country’s 607,380 bridges are structurally deficient and 42% of the country’s major urban highways are congested, according to an American Society of Civil Engineers estimate, the result of years of inadequate funding and deferred maintenance. Trucks ship the bulk of the country’s goods. But trucking companies and their customers complain those shipments are being rerouted—sometimes by hundreds of miles—or traveling at lower speeds over deteriorating or traffic-clogged highways. That causes higher costs for fuel, maintenance and other expenses, including drivers.In some cases, the higher transportation costs end up on consumers. “We try to price our products to what our costs are,” said Donald Maier , senior vice president of global operations for Lancaster, Pa.-basedArmstrong World Industries Inc., AWI +1.36% which makes floor and ceiling tiles.

He said fully loaded truck trailers traveling to or from its Marietta, Pa., ceiling tile plant will have to use a 25-mile detour, mostly to avoid a two-lane state highway bridge over a tributary of the Susquehanna River that will no longer be rated to accommodate fully loaded heavy-duty trucks.

Armstrong projects the additional miles will add about $200,000 to $300,000 a year to the Marietta plant’s transportation costs.

“These costs will get passed on to our distributors and it’s a cost that will get passed on to the consumers too,” Mr. Maier said.

The burden is greatest in industries and regions where heavy loads are the norm, such as steel, energy, construction and automotive. But the impact percolates through the broader economy as well. Inadequate surface transportation is projected to cost U.S. businesses $430 billion more in operating expenses by 2020 and cause $1.7 trillion in lost sales opportunities, according to the ASCE.

“Having a transportation system that becomes less efficient hurts our ability to compete,” said David Ellis. , a research scientist for the Texas A&M University’s Transportation Institute. The institute’s primary funding comes from contracts with state agencies and private companies.

Federal funding for highways and bridges isn’t affected by the federal government’s shutdown. But additional repair monies after next year aren’t assured: Supporters of an increase in the federal motor fuel tax face opponents who view higher fuel taxes as an unnecessary burden.

The U.S. hasn’t raised the federal fuel tax for 20 years and many states also have been reluctant to raise taxes on fuel or vehicle registration fees, prompting drastic tactics to manage stretched funds.

“One thing we don’t factor in our investments is a decline in state-owned transportation infrastructure, but it could become a huge issue,” said Dave Strobel , senior vice president of global operations for Carpenter Technology Corp., a Wyomissing, Pa., maker of alloys and metals for aerospace, energy and medical industries.

The company has six plants spread across Pennsylvania, where one in four bridges is structurally deficient—the highest in the nation. The state Department of Transportation recently lowered weight limits on more than 1,000 bridges dotting the state to reduce wear and extend their service. As a result those bridges could be off-limits to big trucks and trailers.

Mr. Strobel is concerned the restrictions will result in circuitous routes and make it more difficult and expensive to directly transport ingots from a plant in Reading and another recently acquired near Latrobe, Pa., to a new mill in Alabama.

Bob Wilson , the owner of Bob Wilson Trucking, 20-truck fleet based in Smithton, Pa., figures the restricted bridges will add 100 miles to a 600-mile trip from Pittsburgh to Boston, increasing the cost of that trip by 10% to $1,100 from $1,000. About 80 cents of each extra dollar is for fuel with the remainder going for tolls, the driver and truck maintenance. Mr. Wilson anticipates he will be able to recover some, but not all, of the additional cost from his customers.

Not every company can pass on the costs. Safety-Kleen Inc. has a motor oil recycling plant in an industrial corridor in East Chicago, Ind., that includes a refinery for oil companyBP BP.LN +0.54% PLC and a mill for steelmaker ArcelorMittal SA MT +1.43% . Last year, the state demolished a 1.25-mile long bridge that twisted through the corridor, saying it was too expensive to replace and too deteriorated to remain open.

Safety-Kleen said since the bridge’s removal traffic has flooded onto surface streets, creating bottlenecks that add 15 minutes to each tank truck coming to or leaving the East Chicago plant.

Safety-Kleen estimates the extra time is costing the company $250,000 a year.

“These are costs that we can’t pass along in our finished product prices. It just means lower margins,” said Mike Ebert, vice president of re-refining operations, noting that Safety-Kleen’s prices are derived from the price of crude oil and can’t easily be raised to cover higher transportation expenses. Local officials want a private company to build, own and operate a new bridge that would be a toll road.