No Payoff in Coca-Cola’s Thirst for Growth; It May Be High Time to Question Where the Drinks Company Is Putting Its Emphasis

October 15, 2013 Leave a comment

October 14, 2013, 7:03 p.m. ET

No Payoff in Coca-Cola’s Thirst for Growth

It May Be High Time to Question Where the Drinks Company Is Putting Its Emphasis

Coca-Cola KO +0.37% Zero is popular with soda drinkers, but zero isn’t flavor-of-the-month with shareholders. Coca-Cola Co.’s stock is flat over the past 12 months. But don’t expect the drinks giant’s management to accentuate the negative when third-quarter results are unveiled Tuesday. In its Vision 2020 goals, Coca-Cola seeks to double unit sales to three billion servings a day from 2009 levels. But achieving this would require a growth rate of nearly twice that.As usual, executives probably will mention progress on hitting decadelong growth goals laid out in the company’s “Vision 2020.” A third of the way through that plan, though, it may be high time to question the emphasis on growth.

The quarterly results shouldn’t upset analysts, who lowered expectations of late. In fact, one would have to go back nine years to find a period in which the company lagged behind consensus forecasts by more than 1%. Analysts predict net income of 53 cents a share, up from 50 cents a year earlier.

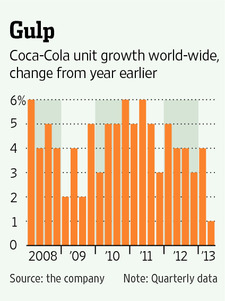

A figure that may be of more interest is world-wide unit growth, which slowed to 1% year over year in the second quarter. The company blamed bad weather, but that is a weaker pace than in the global recession in early 2009.

The company’s recent pace of unit-sales growth had been around 3% to 5% a year. In its Vision 2020 goals, Coca-Cola seeks to double unit sales to three billion servings a day from 2009 levels. But achieving this would require a growth rate of nearly twice that.

Serving more and more beverages has been the formula that turned $40 invested in a Coca-Cola share in 1919 into about $10 million today. But the market is saturated in developed countries and is getting that way elsewhere.

The company could probably meet its goals with acquisitions. But that could hamper its ability to deliver cash to shareholders—and, these days, a big chunk of returns comes from share buybacks or dividends.

Total cash paid out to shareholders was equal to more than 80% of earnings in 2012, and the company recently increased its dividend for the 51st consecutive year. At the same time, Coca-Cola’s ratio of net debt to total capital has risen sharply the past four years and is at its highest in more than a decade. Ultimately, Coca-Cola has to strike a more sustainable balance between growth and the cash it pays out.

In an income-starved investing world, fizzy growth only creates a sugar high for Coca-Cola. Enriching shareholders is the real thing.