The Money Is in the Email: Square Cash Lets Users Email Funds to Friends

October 16, 2013 Leave a comment

The Money Is in the Email: Square Cash Lets Users Email Funds to Friends

WALTER S. MOSSBERG

Oct. 15, 2013 9:00 p.m. ET

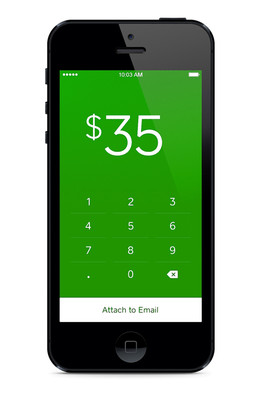

Square now has a service that makes transferring money to a friend as easy as sending them an e-mail, because it works by sending an e-mail. But, as Walt Mossberg tells us, you have to put a lot of trust into Square with your money. (Photo: Square Inc.)

While you can buy a $500 iPad at Amazon.com AMZN -1.38% with a single click, sending even small amounts of cash to a friend or relative is still often a tedious and slow task. In most cases, you wind up doing exactly what you would have in 1957—writing a check and mailing it. The recipient then has to cash it or deposit it in her bank account. But starting Tuesday, you can just email cash, free of charge, directly from your debit card to anyone else’s, regardless of what bank each party uses. There’s no login or password to remember and no special software or hardware required—you just use email. It works on both ends using any email service or program on any email-capable device, whether a computer, a smartphone or a tablet. Read more of this post