Real-Estate Pioneer Loses Its Touch: Vornado Loses $250 Million on Investment in J.C. Penney; Vornado grew from a small, New Jersey strip-center owner to a giant in real estate partly through its strategy of buying big stakes in retailers to get a piece of their valuable holdings of malls, stores and parking lots

October 16, 2013 Leave a comment

Real-Estate Pioneer Loses Its Touch

Vornado Loses $250 Million on Investment in J.C. Penney

ROBBIE WHELAN

Updated Oct. 15, 2013 7:38 p.m. ET

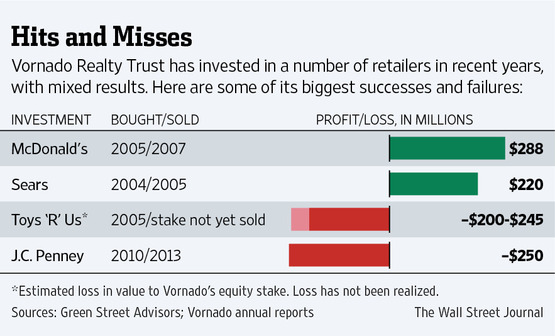

Vornado Realty Trust VNO -0.72% grew from a small, New Jersey strip-center owner to a giant in real estate partly through its strategy of buying big stakes in retailers to get a piece of their valuable holdings of malls, stores and parking lots. But you would never know it from how the company fared in its latest retail deal, a failed investment in J.C. Penney Co. JCP -8.89% Late last month, Vornado sold its remaining 6% stake in Penney for $13 a share, slightly more than half what it paid for the shares three years ago. The company’s total loss on the deal was $250 million, or 40% of its initial investment, according to Green Street Advisors Inc.Some analysts predict that another large Vornado investment in a retailer—its purchase of a big stake in Toys ‘R’ Us Inc.—also isn’t going to end well. “The J.C. Penney investment and the Toys investment could be construed as two of the worst REIT investments we’ve ever seen,” says Green Street managing director Michael Knott.

Vornado executives declined to comment. But the company’s chairman and chief executive, Steven Roth, said in an April letter to shareholders that Penney “obviously has been a difficult and very disappointing investment.”

As for Toys, Mr. Roth said in the letter that exiting that investment was “proving to be more difficult” because it is a private company also owned by KKR & Co. and Bain Capital.

Vornado’s problems with its Penney and Toys investments are a sign that the retail strategy the company pioneered has become harder to execute.

Vornado’s losses are partly due to the companies’ weak performance as retailers. But analysts say Vornado also became a victim of its own success: Other investors emulated the strategy, pushing up prices of struggling retailers such as Penney.

Also, values of retail real estate have been slow to rebound from the downturn in part because of competition from online shopping. National retail real-estate values in the second quarter were 24% below the peak of the market in late 2007, according to Moody’s/RCA Commercial Property Price Index.

The company that became Vornado Realty Trust was founded in 1980 when Mr. Roth engineered the takeover of a struggling New Jersey hardware store chain that owned ample parking lots that he wanted for building sites.

In 1995, Mr. Roth purchased Alexander’s Inc., a department-store chain with prime real estate in New York City. On the site of Alexander’s Manhattan flagship store, Vornado developed the headquarters of Bloomberg LP, a building that Alexander Goldfarb, an analyst with Sandler O’Neill + Partners, estimates is worth $1.8 billion, and sold condominiums in the same building for a profit of $137 million.

In other deals, such as a 2005 investment in McDonald’s Corp. and a 2004 investment in Sears Holdings Corp. and Sears Canada Inc., Vornado made profits by simply selling its stakes after their stocks rose.

Analysts say those bets were backstopped by strong real-estate portfolios. “Clearly in the past, Vornado got the real estate right,” says Jonathan Litt, founder of LANDandBUILDINGS, a Greenwich, Conn.-based fund that invests in REITs. “In the first generation of these trades, the companies were worth more dead than alive. In the most recent deals, the retailers had to be alive for the investments to work.”

Starting in late 2010, Vornado amassed a roughly 10% stake in the company, betting alongside activist investor William Ackman that it was due for a turnaround. Instead, starting in 2012, it posted six consecutive quarters of double-digit percentage sales declines. Both Mssrs. Ackman and Roth stepped down from J.C. Penney’s board earlier this year, and both declined to comment.

Analysts say Penney’s real estate also hasn’t been a strong backstop. They say it may be hard to extract value from the company’s 1,000 stores and other properties, which were appraised for $4.1 billion earlier this year, because if they were vacated it isn’t clear they would be able to attract another tenant.

Since Vornado’s $428 million investment in Toys ‘R’ Us in 2005, the store’s earnings have been steadily declining. Green Street estimates Vornado’s share of the company’s equity is worth between $175 and $200 million.