SoftBank’s Run Not on Firm Ground; given that SoftBank’s stake in Alibaba is 36.7%, the implied value of Alibaba as a whole comes to roughly $109 billion

October 17, 2013 Leave a comment

SoftBank’s Run Not on Firm Ground

AARON BACK

Updated Oct. 16, 2013 11:49 a.m. ET

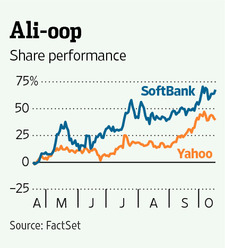

Shares in Japanese conglomerate SoftBank 9984.TO +1.22% have been on a tear, more than doubling this year even as the company has been on a global acquisition spree. Speculation over the value of its stake in Chinese e-commerce giant Alibaba Group is a major factor behind the rise. But there is little upside left to this trade. SoftBank shares rose 2.2% on Wednesday after it acquired a controlling stake in Finnish mobile game developer Supercell, though it hardly appears to have gotten a bargain. It is likely that investors were also cheered by Alibaba’s robust earnings, revealed the night before by fellow shareholder Yahoo. YHOO -0.87% Alibaba’s net profit in the three months to June surged to $707 million from $273 million a year earlier, Yahoo’s disclosure showed.

Alibaba’s listing, likely to take place early next year in the U.S., could value it anywhere from $70 billion to $120 billion, according to analyst estimates. Stockbrokers are pitching SoftBank as a way for ordinary investors to play the Alibaba listing, because it owns more than a third of the Chinese company.

But a sum-of-the-parts valuation for SoftBank, whose market capitalization is $88.3 billion, suggests that an aggressive valuation for Alibaba is already baked in.

Start with SoftBank’s domestic telecom business. Taking its earnings before interest, taxes, depreciation and amortization for the year to June and applying a multiple of 4.5 times based on the valuation of its two main Japanese competitors yields a value of $46.4 billion.

Next, add in SoftBank’s stakes in Yahoo Japan, 4689.TO +0.99% U.S. mobile operatorSprint, S +4.48% and Japanese mobile game company GungHo Online Entertainment,3765.TO +1.10% all publicly traded. The holdings are jointly worth $34.2 billion at current market prices.

Then subtract SoftBank’s net debt, which stood at $22.3 billion at the end of June, according to S&P Capital IQ. This means there is around $30 billion left over in SoftBank’s market cap representing the value the market assigns to its stake in Alibaba.

Investors will also have taken into account any potential tax bill from divesting the shares. Applying a conservative 25% tax discount, and given that SoftBank’s stake in Alibaba is 36.7%, the implied value of Alibaba as a whole comes to roughly $109 billion.

That is near the top end of analyst estimates for the Chinese firm. And it doesn’t take into account any “conglomerate discount” that may be embedded in SoftBank’s market cap, which would suggest an even higher value for Alibaba alone.

Of course, for a sprawling business like SoftBank, there are many variables to track. Much depends, for instance, on how Chief Executive Masayoshi Son executes his grand vision for synergies with Sprint.

But any way one slices it, a successful listing for Alibaba looks to be priced into SoftBank shares. As hype builds around Alibaba, investors should think twice before piling into its highflying Japanese shareholder.