Toys ‘R’ Us is heading into the holidays with a new leader who has little experience with the U.S. market, owners who don’t always see eye to eye and a debt burden that tops $5 billion

October 18, 2013 Leave a comment

No Joy in Toys ‘R’ Us Land

Management Void Is Finally Filled, but Debt and Ownership Structure Burden Retailer

SUZANNE KAPNER and JOANN S. LUBLIN

Updated Oct. 17, 2013 5:29 p.m. ET

Toys ‘R’ Us hired an insider to be its CEO after external candidates turned down the job. Above, the retailer’s Times Square store in New York. Keith Bedford for The Wall Street Journal

With the holidays approaching, this should be the happiest time of year for a toy company. But Toys “R” Us Inc. is facing a season of uncertainty. The company that helped create the “category killer” retail model is headed into the crucial shopping period with a new leader who has little experience with the hyper-competitive U.S. market. Meanwhile, the company’s longer-term strategy is in flux, and people close to the company say it is hamstrung by owners who don’t always see eye to eye and a debt burden that tops $5 billion.The drain on resources has handicapped e-commerce efforts, a crucial area as more retail sales migrate to the Web, former employees said. At $1 billion, Internet sales still account for less than 10% of Toys “R” Us revenue.

The problems have their roots in a $6.6 billion leveraged buyout in 2005 that piled on the debt and left it beholden to three investor groups—Bain Capital Partners LLC, KKRKKR +0.73% & Co. and Vornado Realty Trust VNO +1.10% —each with differing game plans.

The three had hoped to exit the investment with an IPO a few years ago, but they disagreed over exact timing, according to people familiar with the situation, and the window of opportunity has since closed because of the retailer’s steady declines in profit.

Vornado in particular is ready to get out, according to people familiar with the matter. Vornado has written down the value of its holding by $118.5 million. But because the stake had appreciated before the write-downs a year or so ago, the investment is now worth $418 million, roughly what Vornado paid for it.

Until Wednesday, Toys “R” Us had been operating without a permanent CEO since February, when Gerald Storch announced his intention to step down. Many issues were punted to an eight-person executive committee, slowing decision-making, people familiar with the matter said.

According to people close to the company, the investors had hoped to attract a retailing superstar from outside Toys “R” Us, but settled on Antonio Urcelay, a longtime company executive who had held the position on an interim basis since May.

The company went through several recruiting firms during its unsuccessful search for a new president two years ago, then tapped Korn/Ferry International for its CEO hunt, said people familiar with the situation. Toys “R” Us sounded out several potential CEO candidates, including J. Paul Raines, who runs Gamestop Corp., and J.K. Symancyk, president of mass-market retailer Meijer, but they said they weren’t interested, according to a person familiar with the situation. Marvin Ellison, Home Depot Inc.’s executive vice president of U.S. stores, also was approached, another informed individual said.

Messrs. Raines and Ellison declined to comment. Mr. Symancyk didn’t return calls seeking comment.

The elevation Wednesday of 61-year-old Mr. Urcelay, who most recently ran the European operations, was couched by people close to the company as a temporary solution to the management void. Mr. Urcelay, a Spaniard who has spent all of his 17 years with the company based in Europe, won’t be relocating to the U.S., said a person familiar with his plans. The company declined to make Mr. Urcelay available for comment.

Toys “R” Us also hired Hank Mullany as its U.S. president, filling a slot vacant since 2011. Mr. Mullany, 55, previously ran ServiceMaster Co. and held various positions with Wal-Mart Stores Inc., WMT +0.24% including executive vice president of its Wal-Mart U.S. division. He is seen by some as a possible contender to one day succeed Mr. Urcelay.

Founded in 1948, Toys “R” Us tends to lose money during the first nine months of the year, but makes enough in the fourth quarter to end the year in the black. Preparing for what is expected to be a fiercely competitive holiday season, the company is expanding into non-toy categories such as child-friendly tablets, entertainment products and party goods.

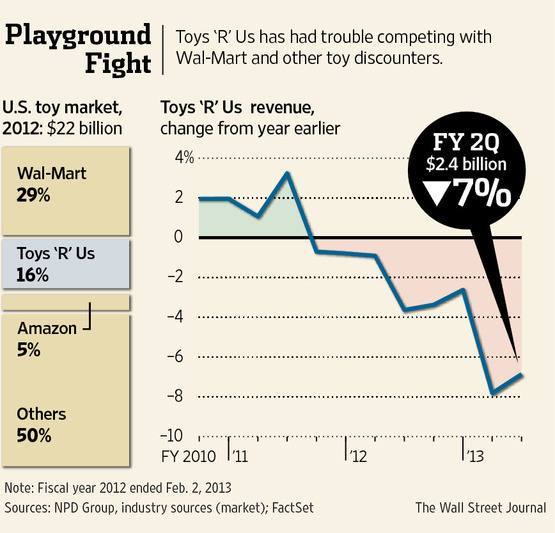

But, on top of its company-specific problems, it is struggling to overcome sluggishness in the $22 billion U.S. toy industry, which grew just 2% last year, in part due to a birthrate that has declined in each of the past five years.

“Toys “R” Us has a lot of challenges, and I’m not sure they have the resources to overcome them,” said Isaac Larian, the chief executive of MGA Entertainment, a large toy manufacturer that sells to the company.

In a prepared statement, Bain, KKR and Vornado said: “Toys ‘R’ Us has made significant progress since the buyout, and we believe the company has a bright future under the leadership of Antonio Urcelay and the talented management team. We will continue to invest substantial time, energy and resources to position the company for growth, both during this holiday season and over the long term.”

The company finished its most recent fiscal year with sales and profits at their lowest level in six years. Its share of the toy market has remained static since 2006, at 16%, lagging behind Wal-Mart’s 29% share, though ahead of Amazon.com Inc. AMZN +0.09% which has a 5% share, according to market research firm NPD Group and industry sources.

Meanwhile, Toys “R” Us has paid $3.7 billion to service its debt since the buyout. For every dollar in operating earnings the company took in last year, it paid out 86 cents in interest.

The company spent $286 million on capital expenditures in 2012, about a third of what retailers of a similar size tend to spend.

Some former employees said one misstep was deciding not to invest in building an e-commerce website from scratch. Instead, the company has stuck with a seven-year-old agreement to outsource management of its website to eBay EBAY -4.00% Enterprises, a unit of eBay Inc., a situation that gives Toys “R” Us less flexibility and control.

The investors, in regulatory filings, said capital expenditures have totaled $2.6 billion since the acquisition and they haven’t taken out any money in the form of special dividends.

To turn the company around they brought in Mr. Storch, a former Target Corp.TGT +1.50% executive who became CEO in 2006. He moved quickly to end the price wars by stocking more exclusive merchandise that couldn’t be found at the discounters. He snapped up competitors FAO Schwarz and KB Toys, which had filed for bankruptcy, leaving Toys “R” Us as the last remaining dedicated toy retailer, and made a big, successful bet on the hot toy Zhu Zhu Pets.

Profit climbed to $312 million on sales of $13.6 billion for the year ended January 2010, up from $252 million on $11.1 billion in sales in the 12 months ended January 2005, the last full year before the company was taken private. But the retailer’s long-running problems soon cropped up again. Sales flattened over the next three years. Toys “R” Us filed for an initial public offering in May 2010 with a plan to go public that fall, but the private-equity owners disagreed on the timing, people familiar with the matter said. Vornado argued the company should wait until after the holiday season in hopes of fetching a higher price, the people said. Bain sided with Vornado, but KKR wanted to strike while it could, the people said.

KKR lost that battle and the IPO was delayed. But then profits sank nearly 50% in the 12 months ended January 2011 to $168 million as the European and Japanese units suffered from the softening economies in those regions, and they continued to slide for the next two years, to $149 million in fiscal 2012 and $38 million in fiscal 2013. The chance to go public slipped away, and Toys “R” Us asked to withdraw its IPO papers in March.

The people familiar with the investors’ thinking said there was some deliberation on different structuring options for the proposed offering, for instance whether the real estate would be part of the entity that went public, but all agreed that the timing was ultimately not right for a deal to proceed.

“Having three owners has complicated life for them quite a bit,” said Sean McGowan, a toy analyst with Needham & Co.

Corrections & Amplifications

Internet sales account for less than 10% of Toys “R” Us revenue. An earlier version of this article incorrectly said Internet sales account for less than 1%.