Foreign investors are stampeding into South Korea, snapping up stocks in the longest buying spree on record

October 19, 2013 Leave a comment

Foreign Investors Pile Into South Korea

Foreign investors are stampeding into South Korea, snapping up stocks in the longest buying spree on record.

KANGA KONG and DANIEL INMAN

Updated Oct. 18, 2013 7:06 a.m. ET

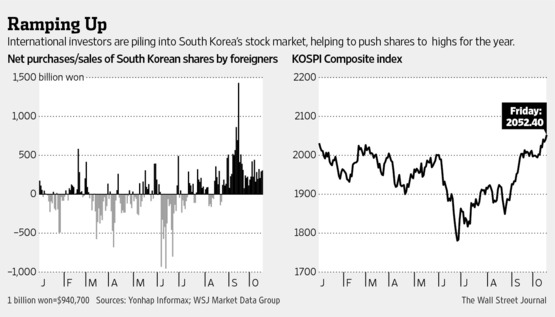

Foreign investors are stampeding into South Korea, buying up stocks for 36 straight trading days to mark the longest buying spree on record as cheap equities and the nation’sstrong finances attract buyers. Since the start of the second half there’s been $13.1 billion of inflows, more than reversing the $9.4 billion that was yanked out in the first six months of the year. The cash has fuelled a 16% rally in stocks since the end of June to touch this year’s high on Friday, while the currency has also advanced. Much of the allure lies with the country’s solid economy, recording trade surpluses for 19 months that both analysts and investors say bodes well for future economic growth. Unlike previous buying from overseas that has usually centered just on a handful of Korea’s largest companies like Samsung Electronics005930.SE +0.62% and Hyundai Motor,005380.SE -3.02% this time investors are also venturing into smaller and lesser known firms.“It’s much more than the big names,” said Mark Konyn, chief executive officer of Cathay Conning Asset Management, which managed $960 million in Asian equities as of June 30.

Brokers say they’ve been inundated by clients from overseas wanting to visit companies, large and small, to help them make investment decisions. Local dealer Macquarie Securities says the number of requests for visits has risen 50% in the second half of the year from the first, while other local brokers have also experienced a similar increase.

“One good barometer to gauge the strength of foreign interest in Korean equities would be foreign requests to visit Korean companies,” says Harry Park, head of Korean equities atSamsung Securities. 016360.SE +0.74% “We’re seeing a flurry of such requests, particularly for companies in the tech, retail and auto sectors.”

Samsung Securities helped arrange visits for 117 foreign investors last year and Mr. Park says it is on track for more this year, with many of the requests coming in the second half of the year. He says foreign investors are mostly large global mutual and pension funds from the U.S., the U.K., and Asia.

Even with the buying starting on Aug. 23 and including Friday, the benchmark Kospi index has only gained 2.8% so far this year, dwarfing Japan’s 40.1% surge and the Philippines’ 13.7% advance. The Kosdaq index, which holds Korea’s smaller companies, has climbed 5.9%, with foreign holdings at almost 10% in September—the highest in two years.

Stocks remain cheap, trading at just 11.5 times forward earnings. That compares to Japan’s Nikkei, which is trading at 20 times and the Philippines, where stocks are trading at 18.6 times. Macquarie Securities’ head of Korean equity Terence T. Lim says foreigners have further room to increase their exposure, given that those tracking emerging market indices are still slightly underweight on Korea.

Plus, growing indications that the Federal Reserve may keep up its aggressive stimulus measures are also a boost for emerging markets, which benefit from a flood of cheap money looking for high returns.

“With the Fed’s tapering seeming to be delayed and foreigners have to find allocation in emerging markets, Korea is likely to continue to attract” said Mr. Lim.

Korea’s healthy trade numbers stem from shipping a quarter its exports to China, and 10% to the U.S., two countries that are both showing signs of growth. Countries in Southeast Asia, a region that’s also growing fast, also make up a large component of export destinations. A further positive is the country has run a current account surplus for 19 straight months.

“I think it has been unloved because it is probably the most developed of all the economies in Asia,” said Sam Le Cornu, senior portfolio manager at Macquarie Investment Management in Hong Kong, who manages around $1 billion in assets and is currently underweight South Korea. “But having said that, it doesn’t run massive current account deficits like Indonesia and India do, so at least it still has strong balance of payments.”