India’s IT Firms Face Midlife Crisis

October 22, 2013 Leave a comment

India’s IT Firms Face Midlife Crisis

ABHEEK BHATTACHARYA

Updated Oct. 21, 2013 9:34 a.m. ET

A good year for India’s information-technology companies doesn’t change the fact that they are battling a midlife crisis. A combination of factors has pushed IT stocks up 50% this year, even as India’s benchmark Sensex index is up only 8%. These outsourcing firms’ biggest markets in the U.S. and Europe are rebounding, which has boosted sales in the September quarter. Plus the Indian rupee has weakened 10% against the dollar this year, helping margins in the short term. Yet these companies are still suffering from a lack of strategic direction, which shows up in their growing cash hoards.

Take Infosys, India’s second-largest IT firm by sales. A decade ago, it was growing at 30% to 40% levels by selling cheap software services. It delivered an impressive 40% return on equity to its shareholders, who in turn valued the company highly. It traded at 24 times forward earnings, almost twice the valuation for the Sensex.

Now Infosys is all grown up. Sales are expanding in the midteens. Like Microsoft in recent years, investors have stopped valuing Infosys as a high-growth play. It now trades at 16.7 times forward earnings, compared with 14.5 times for the Sensex.

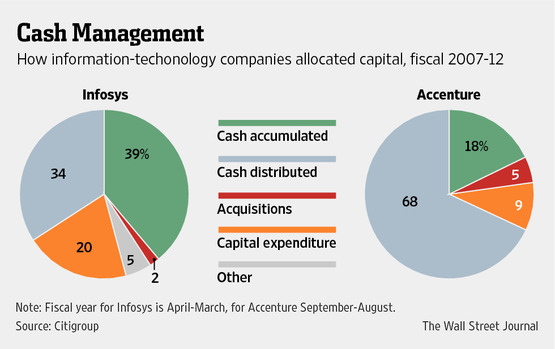

Infosys still generates ample cash, but can’t decide what to do with it. Between April 2007 and March 2012, two-fifths of its operating cash flow—the single largest component—was stashed away, says Citigroup’s Surendra Goyal. As of September this year, the company’s cash and equivalents stood at 210 billion rupees ($3.4 billion), almost half of total assets. On current trends, cash might roughly double by March 2016, forecasts Nomura. And with the firm retaining so much of the profit it makes, return on equity was down to 25% in the last 12 months and may keep falling.

Infosys could boost returns and valuations by deploying its cash. One option would be to invest in moving up the value chain, either organically or through acquisitions. But previous efforts here have been halfhearted. For example, Infosys announced in 2011 that it would expand into consulting, and bought European consulting firm Lodestone for $350 million. This summer, however, it said it would refocus on traditional outsourcing for now.

Infosys’ alternative is returning capital, which would mean admitting it is a mature company—not necessarily a bad thing but sometimes a psychological hurdle for previously highflying companies. Infosys’ global peer Accenture, ACN +0.89% for instance, distributed 68% of its operating cash flow to shareholders between September 2007 and August 2012, notes Mr. Goyal. Accenture’s return on equity has stayed in the 60% to 70% neighborhood for the last decade.

India’s IT firms are enjoying some luck, but they can’t keep coasting. They should either recapture their youth with a bold expansion, or make preparations to age gracefully.