‘Aristocratic’ Ways Are Getting Tired at P&G; Dividends and Buybacks Have Become Procter & Gamble Stock’s Only Source of Return

October 25, 2013 Leave a comment

‘Aristocratic’ Ways Are Getting Tired at P&G

Dividends and Buybacks Have Become Procter & Gamble Stock’s Only Source of Return

SPENCER JAKAB

Oct. 24, 2013 1:54 p.m. ET

Get ready to hear an aristocrat speak Friday when Procter & Gamble Co. PG -0.37%unveils fiscal first-quarter results. No, revered Chief Executive A.G. Lafley hasn’t been knighted and, oddly, isn’t slated to be on the earnings call. The blue blood is the company itself. Nobody will confuse Cincinnati with Versailles, even if P&G’s headquarters has more floor space than the historic palace. But, by dint of having increased its dividend annually for at least a quarter century, the company is a “dividend aristocrat.”For many investors and funds, that alone is a reason to hold P&G’s shares. The problem is that, for several years, its combined cash payouts have been their only source of return.

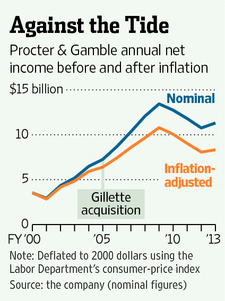

P&G had a nice run early in the last decade, capping it off by agreeing to purchase rival Gillette in 2005. Synergies from that deal helped boost earnings for another few years.

But net income for the fiscal year that ended in June was actually lower than in 2007, adjusted for inflation. Earnings per share rose, boosted by copious buybacks. But those purchases are interchangeable with dividends. This year, for example, P&G plans $6.5 billion in dividends and about $6 billion in buybacks, for a combined “yield” of 5.6%.

Based on recent guidance, fiscal 2014’s payout should be about equal to net income. Friday’s numbers will show if P&G is on track. Analysts think it earned $1.03 a share in the fiscal first quarter through September, up from 96 cents a year ago. For the full fiscal year, underlying sales growth is seen at 3% to 4%, while buybacks and cost-cutting are seen boosting per-share earnings by between 7% and 9%.

Even if those targets are met, P&G’s stock remains a bond-like investment. A long-term corporate issue of similar quality would give investors about the same yield. The difference is that the “principal,” P&G’s share price, can keep up with inflation—or tank in a recession.

Mr. Lafley, brought back in as CEO earlier this year to revitalize the consumer-goods giant, is off to an uneven start. Not only will he likely be absent from Friday’s call, but he has decided to eschew quarterly earnings guidance. Shareholders expect more from P&G’s leader—consider it noblesse oblige.