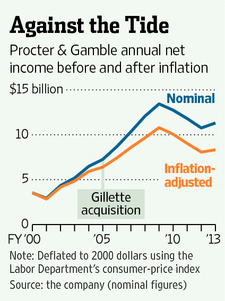

‘Aristocratic’ Ways Are Getting Tired at P&G; Dividends and Buybacks Have Become Procter & Gamble Stock’s Only Source of Return

October 25, 2013 Leave a comment

‘Aristocratic’ Ways Are Getting Tired at P&G

Dividends and Buybacks Have Become Procter & Gamble Stock’s Only Source of Return

SPENCER JAKAB

Oct. 24, 2013 1:54 p.m. ET

Get ready to hear an aristocrat speak Friday when Procter & Gamble Co. PG -0.37%unveils fiscal first-quarter results. No, revered Chief Executive A.G. Lafley hasn’t been knighted and, oddly, isn’t slated to be on the earnings call. The blue blood is the company itself. Nobody will confuse Cincinnati with Versailles, even if P&G’s headquarters has more floor space than the historic palace. But, by dint of having increased its dividend annually for at least a quarter century, the company is a “dividend aristocrat.” Read more of this post