Return-Hungry Investors Tap ‘Frontier’ Markets; As Growth Elsewhere Becomes Elusive, Riskier Economies Get Noticed

October 25, 2013 Leave a comment

Return-Hungry Investors Tap ‘Frontier’ Markets

As Growth Elsewhere Becomes Elusive, Riskier Economies Get Noticed

ERIN MCCARTHY

Oct. 24, 2013 7:23 p.m. ET

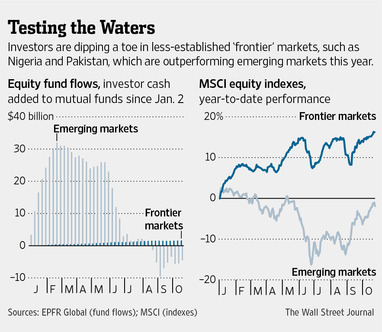

Stock investors are looking for new frontiers. Faced with sluggish growth in developed markets and a recent bout of volatility in emerging markets, fund managers are heading toward riskier countries like Pakistan and Nigeria in the hope of bigger returns. So-called frontier markets—the developing economies considered among the riskiest places to invest—are up 16% this year, according to MSCI Inc. MSCI +0.95% That compares with a 2% drop for stocks in more mainstream developing economies.Funds focused on frontier-market equities have pulled in $3.38 billion from investors so far this year, according to fund tracker EPFR Global. By comparison, emerging-market equity funds have posted a net $13.21 billion in outflows over the same period.

Fund managers drawn to frontier stocks are hoping to get in early on the next emerging-markets success story.

They say young populations and plans for new roads and ports in places such as Kenya and Bangladesh remind them of Brazil or India in the early 2000s, when those countries were on the cusp of a decade of rapid growth.

Frontier economies also have a reputation for being unstable and

too small to handle large amounts of foreign investment. Their performance has trailed their more established peers for years as investors poured billions of dollars into emerging markets, spurred by ultralow interest rates in the developed world.

But some investors say the places that sat out the boom now are likely to sit out the bust as well.

Emerging markets sold off this summer, as investors believed the Federal Reserve was close to beginning a tapering of its bond purchases. Many economists now expect that process to start in 2014. But when it happens, frontier markets will be much less exposed to it than more developed emerging markets.

“The unwind of that hot money isn’t impacting frontier [markets] as much because it never really benefitted from it that much,” said Tim Drinkall, lead portfolio manager for frontier markets at Morgan Stanley Investment Management, which has $360 billion in assets under management or supervision. Mr. Drinkall has been adding to holdings of Pakistani stocks since May.

Among the top performers this year: Saudi Arabia’s stock market has soared 20%, Nigeria’s has jumped 18% and Romania’s has climbed 17.5%, according to MSCI. Meanwhile, Brazilian shares are down 8.4% and Mexico’s stocks have fallen more than 5%.

Alan Conway, head of emerging market equities at Schroders SDR.LN +1.17% PLC, with $388 billion under management, said his firm owns stocks in Saudi Arabia, Kazakhstan and Ukraine among others in its frontier-market fund.

He said frontier economies’ cheap labor costs, “massive” young populations and natural resources will help these stocks outperform those of emerging markets.

“This is where tomorrow’s growth story is,” Mr. Conway said.

To be sure, frontier markets still have their risks. Corruption remains a major problem in some countries, and some economies are dependent on high commodity prices.

Another hazard is that frontier stock markets are small and trading volumes often are low. The combined value of the companies in 33 frontier markets tracked by MSCI amount to less than 0.4% of the value of all stocks they track globally.

Markets this small have the potential to turn on a dime, said Tom Leventhorpe, client portfolio manager and managing director on the global emerging markets team at J.P. Morgan Asset Management, which has $1.5 trillion under management. The larger emerging-market portfolios in Mr. Leventhorpe’s firm have had “little” money invested in frontier-market holdings this year, he said.

“The entire frontier market cap…is about one-third the market cap of Apple, AAPL +1.32%” he said. “If consensus changes on it quite quickly, there’s a very narrow door for the exit.”

But the potential returns make the risks worthwhile, particularly as investor confidence in the growth outlook of larger emerging markets has diminished, said Matthias Paul Kuhlmey, head of global investment solutions at advisory firm HighTower.

Mr. Kuhlmey said he is recommending clients invest in some African stock markets as well as Vietnam. He said dividend yields above 4%, compared with 2.5% in larger emerging markets, make frontier markets worth a look.

“We’re getting paid for the risk we’re taking” in frontier markets, he said. “Emerging markets have been … spoiled by capital flows into their economies.”

Oct 24, 2013

OK To Like Emerging Markets Again?

Have emerging market assets finally embarked on a rally which can stick?

Quite a few analysts seem to think so, including those who have been cautious or outright bearish in the past.

One of these is Societe Generale’s Benoit Anne.

He thinks that Tuesday’ssoft U.S. payrolls data have provided “some reconfirmation” that the stars are aligned for global emerging markets to perform strongly until the end of the year, according to a note published Wednesday.

Obviously there will be bouts of profit taking to set the global emerging markets back, but Mr. Anne points to three main pillars of support.

First comes overall investor positions in emerging markets, which SocGen thinks is still “fairly light.”

Then come the fundamentals, which suggest that many emerging markets are recovering at least gradually and in some cases rather faster.

Lastly comes value. The bank reckons there is still plenty of value to be had following the summer’s ‘brutal moves’ lower. Emerging markets faced the brunt of IMF growth forecast cuts back in July, on fears that the unwinding of stimulus by the Fed would hit them disproportionately hard.

Sure enough former emerging darlings have languished, while old stagers in the developed world, like the S&P 500 and the DAX, forged on to record highs.

However, Washington’s fiscal gridlock, along with some weaker numbers out of the U.S. economy have lengthened the odds on any early tapering of stimulus from the Fed.

And SocGen isn’t alone in thinking this will mean more cash for emerging markets.

Credit Agricole reckons those lackluster U.S. payrolls numbers will buoy risk appetite, with emerging market currencies, especially, set to benefit.

And while Steve Barrow at Standard Bank doesn’t bang the drum for emerging markets specifically, he does say that, with the twin roadblocks of the debt-ceiling impasse and the payrolls numbers out of the way, the market might be inclined to “come out of its shell and put more cash to work in riskier assets.”

Assuming the Fed doesn’t spoil the party with some pro-tapering rhetoric, or the pesky U.S. economy doesn’t start firing again and force the markets to contemplate stimulus withdrawal anew, emerging markets seem set for a little more support as 2013 fades out.