Amazon Puts Groceries in Its Shopping Cart

October 28, 2013 Leave a comment

Amazon Puts Groceries in Its Shopping Cart

Online Retailer Pushes Into Produce Aisle

MIRIAM GOTTFRIED

Oct. 27, 2013 3:32 p.m. ET

Even if it is huge already, Amazon.com AMZN +9.39% can’t help but try to find ways to get even bigger. The e-retailer, selling everything from auto parts to videogames, may eventually become known for pushing kale and cucumbers. AmazonFresh, its grocery-delivery effort, is still in its infancy: After testing it in Seattle since 2007, Amazon brought the service to parts of Los Angeles in June.That’s not exactly jumping in. But Amazon has good reason to be cautious.

The grocery business is known for razor-thin margins. And previous attempts at online-grocery delivery have had mixed results. Webvan, an early entrant, went bankrupt in 2001. Neither FreshDirect, serving the New York area, nor OcadoOCDO.LN -1.45% Group, which operates in the U.K., made an operating profit in 2012, according to Sanford C. Bernstein.

Still, the law of large numbers makes grocery difficult for Amazon to resist. The bigger it gets, the bigger its markets need to be to have an impact on revenue growth. And Amazon can afford to experiment thanks to Wall Street’s obsession with its top line, while ignoring microscopic profits. Third-quarter results out last Thursday showed revenue rose 24% to $17.1 billion, even as the retailer reported an operating loss of $25 million. Shares rose 9.4% Friday.

In theory, there is no reason groceries can’t be profitable for Amazon, according to RBC Capital Markets. The average gross margin of Whole Foods Market, WFM +1.01%Safeway, SWY +1.33% Kroger KR +0.95% and Fresh Market was 29% in 2012. Amazon’s 2012 gross margin: 25%. And it would likely have less loss of products due to factors like shoplifting or in-store damage. But matching those established players will be tough without local scale.

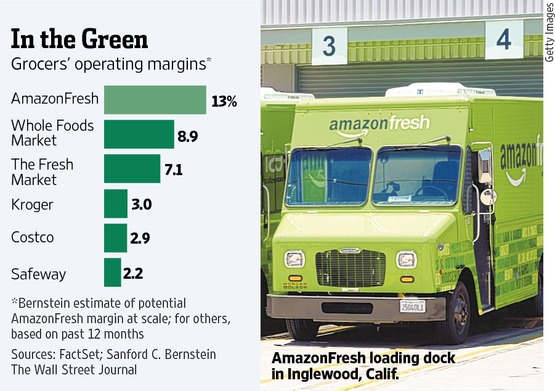

If AmazonFresh can get to 4% share in markets where it launches the service within 10 years, it will be profitable on a stand-alone basis, Bernstein believes. And once it gets to scale, the research firm estimates AmazonFresh could have an operating margin of 13%. Getting there assumes an estimated average basket size of $140 and an average of two orders a month. FreshDirect’s average order size is $120 in New York City and $150 in the suburbs. Peapod, another service with wider geographic reach, has an average order size of $157, Bernstein says.

Bernstein also assumes Amazon will only offer the service in areas dense enough to keep the cost per delivery at or below $9. Indeed, delivery charges will prove a vital variable for Amazon.

Perhaps that is why it is testing different models. In Seattle, it has no minimum order but charges delivery fees based on a sliding scale. In Los Angeles, customers have to pay an annual fee of $300, which includes the $79 fee for Amazon’s Prime membership, which gives customers free two-day shipping on many items. With the fee, all grocery orders above $35 are delivered free.

Amazon apparently wants to drive more frequent orders with the Los Angeles model. If they become too frequent, the higher cost could potentially be offset by higher sales: AmazonFresh customers can order more than 500,000 nonfood items to be delivered with groceries. The challenge is to get higher customer density in a given area, cutting delivery costs. Beyond that, Amazon will need to source high-quality food, manage more delicate inventory and develop expertise in delivering products from warehouse to consumer. Still, if any company can get big in a retail business, it’s Amazon.

It also has a history of undercutting rivals in commodity businesses by finding ways to be more efficient. Amazon said last week it has added robots to three of its fulfillment centers, suggesting it could find a way to automate grocery picking and packing as well, Cantor Fitzgerald says.

Online grocery delivery may be a lemon of a business. And Amazon won’t be able to improve it overnight. But the burden of being the biggest may mean finding a way to make it into lemonade.