China Seen Losing Sheen for IBM to Nike as Hurdles Mount

October 28, 2013 Leave a comment

China Seen Losing Sheen for IBM to Nike as Hurdles Mount

Companies from IBM to Starbucks are struggling with new obstacles in China as Communist Party officials tussle over the direction and depth of economic reforms. China’s state-controlled media last week accused Starbucks Corp. (SBUX) with charging too much for coffee and said Samsung Electronics Co.’s smartphones don’t work properly. International Business Machines Corp. (IBM) IBM’s China revenue slipped 22 percent in the third quarter, contributing to the first-ever sales decline in the company’s growth-markets division, as state-owned companies started delaying orders, including mainframes and servers.“The operating environment for foreign firms has deteriorated in the last year in a serious way,” said Shaun Rein, managing director of China Market Research Group in Shanghai. “In my 16 years in China, it’s some of the worst business sentiment among foreign executives. They don’t feel as welcome as they used to.”

When the U.S.-China Business Council, a Washington-based trade group, surveyed U.S. executives this month, the chief complaints included rising costs and bureaucratic red tape. Almost 70 percent of the more than 100 U.S. firms polled said profit margin would be flat or narrow this year. Only 39 percent are optimistic about the next five years in China; 58 percent felt that way in 2011.

Growth Engine

Since opening its economy to foreign investment in the 1970s, China has been a growth engine that has generated billions of dollars in revenue for multinationals. While foreign firms struggled in the early years, the business environment improved after the nation joined the World Trade Organization in 2001. More recently, rising labor costs have prompted some companies to put their factories elsewhere. Now, with economic growth slowing, policy-makers are struggling to pull off a long-awaited transition from export-fueled growth to an economy driven by domestic consumption.

China has pared economic growth projections to an average of 7 percent this decade, compared with 10.5 percent in the previous 10 years. Even maintaining that slower pace will be challenging. Leaders are battling a property bubble, while a five-year credit expansion has put the economy’s debt burden in the same vicinity that preceded crises or sharp slowdowns in Japan and other Asian nations. Wages, adjusted for inflation, have tripled in the past decade.

Consumer Cutback

“The current economic model is running out of gas,” said James McGregor, Greater China chairman of consulting firm APCO Worldwide Inc. “If they don’t reform they can’t keep growing.”

Slowing growth caught up with Coca-Cola Co. (KO) in the first half of this year, as retail sales slowed the most in 10 years, the company said in July. Low-priced water accounted for most of the beverage industry’s growth as consumers cut back on pricier juices and sodas.

Stronger domestic competition and more discerning shoppers have hurt sales at Nike Inc. (NKE) and Yum! Brands Inc. McDonald’s Corp. same-store sales fell 3.2 percent in the third quarter, the fourth decline in a row.

Chinese consumers are “very cautious” and typically revert to local chains in difficult economic times, Chief Executive Officer Don Thompson said on a call with analysts.

Chinese filmmakers are also capturing most of the country’s growth, with rules that favor local productions. The U.S. share of film receipts in China shrunk to 42 percent this year from 58 percent a year ago, according to Rentrak, a research firm.

Middle Class

U.S. companies haven’t lost their appetite for the world’s second-largest economy. China is a $300 billion market for U.S. firms that will get even larger as the middle class doubles to 600 million in the next decade, according to the U.S.-China Business Council, which counts Wal-Mart Stores Inc. and Apple Inc. among its more than 200 members.

General Electric Co. (GE) boosted sales 13 percent there in its most recent quarter owing to a surge in orders for health-care devices. Even as Coach Inc.’s U.S. business sags, the handbag maker’s sales surged more than 35 percent in China. General Motors Co. and Volkswagen each plan to sell a record 3 million vehicles in China this year.

Domestic politics are driving much of the uncertainty in the executive suite. The recent broadsides against foreign companies may have less to do with protectionism than with assuaging public concerns about prices, analysts say. While salaries are rising in China, prices for housing, education and health care are growing faster. In the past, inflationary pressures have sparked protests, which the government is keen to avoid.

Reform Clarity

There may be more clarity on what shape reforms will take next month when top leaders and heads of the biggest state firms and banks have a third full meeting of the Central Committee. It was after such a plenum in 1978 that China opened the economy to foreign investment and loosened state controls.

Opinions vary on how much change will come this time. Industries, including pharmaceuticals, health care and education, will be opened to foreign investments, according to Ken Peng, senior economist at BNP Paribas SA in Beijing.

“It might not be as profitable as it used to be, but it’s not a dead end,” Peng said. “There are new opportunities to discover.”

With the government in its first year, this meeting may also be nothing more than paying “lip service” to reforming state-owned enterprises and “breaking barriers” into industries monopolized by the state, Lu Ting, head of Greater China economics at Bank of America Corp. in Hong Kong, said in a note on Oct. 22. “It won’t be a make-or-break moment.”

Next month, companies will be watching the rhetoric emanating from Beijing. Executives are hoping the government reiterates that “foreign companies are welcome in China and they can have fair access to this market,” McGregor said.

To contact Bloomberg News staff for this story: Matt Townsend in New York at mtownsend9@bloomberg.net; Liza Lin in Shanghai at llin15@bloomberg.net

China Is Back in Vogue With Investors

Positive Economic Signs Have Lifted Shares and Global Commodity Prices, Despite Concerns

SHEN HONG and DANIEL INMAN

Oct. 27, 2013 2:57 p.m. ET

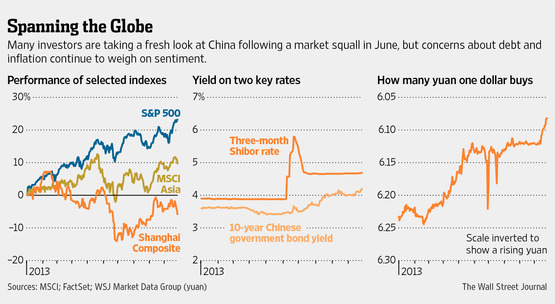

SHANGHAI—Investors are turning their focus back to China, after months in which global markets were driven by relentless speculation about the U.S. Federal Reserve’s next move. Shares are climbing across Asia, and prices for industrial commodities such as copper and iron ore have bounced back amid signs that China’s economy is revving up. The yuan regularly sets record highs against the dollar as cash floods into the country.

It hasn’t been an entirely smooth ride. Emerging-market stocks and bonds shuddered and gold prices jumped last week as borrowing costs soared in China’s money market, raising fears of a cash crunch for banks. Some investors worry that official efforts to avoid a debt bubble and keep a lid on inflation could stifle growth—fears that sent Shanghai’s stock market and global commodity prices tumbling earlier this year.

The willingness to take another chance on Chinese stocks and on other markets tightly linked to the country’s economy underscores the paucity of attractive options available. Global growth continues to be soft, while hefty central-bank support for Western economies has resulted in near record prices in many stock and bond markets. Though China’s economic rise drove global markets for much of the last decade, the recent rough patch presents a fresh opportunity to get in, some investors say.

“China comes along with a story—a real bombed-out market, with low valuations—and a lot of people jumped on that,” said Gary Dugan, chief investment officer, Asia and Middle East at private bank Coutts & Co. Ltd., who raised his allocations to Chinese stocks in September.

The benchmark Shanghai Composite index has rallied 15% off of this year’s low in late June to end Friday at 2132.96, although it is still down 6% on the year. In Indonesia, which counts China as a major customer for its commodities, the Jakarta Stock Exchange Composite Index is up 12.7% this month. Prices of copper, for which China makes up 40% of global demand, are up nearly 9% since hitting a three-year low in June, ending last week at $7,180 a metric ton on the London Metal Exchange.

Those markets have gotten a boost from encouraging Chinese economic data recently. A private-sector gauge of China’s manufacturing activity jumped to a seven-month high this month, while the economy expanded 7.8% in the third quarter from a year earlier, faster than growth in the first two quarters of 2013. Adding fuel to the fire are the recent launch of a free-trade zone in Shanghai and expectations for economic overhauls at a Communist Party meeting next month. The changes are expected to include greater access to the economy for private and foreign investors, further economic deregulation and moves to allow increased mobility of the population.

The indicators have eased concerns that China will see its growth rate slow dramatically this year. China’s booming economy in recent years fueled demand for commodities ranging from oil to soybeans and lifted the prospects of emerging markets. As the world’s second-biggest economy has cooled, it has left global markets increasingly dependent on the easy-money policies of rich countries’ central banks, which may begin to remove that support as early as next year.

“You began to see data that told you things weren’t as bad as everyone thought,” said Catherine Raw, portfolio manager at BlackRock Inc.’s Commodities Strategies Fund, which oversees $420 million. “The fears that China was going to have a hard landing…have disappeared.”

Ms. Raw purchased copper-mining stocks early in the year, in a bet that a downturn in Chinese demand for the metal would turn out to be temporary. She called the position “painful” until the market rebounded over the summer.

Still, jitters abound, mostly centered on China’s lending market. The Shanghai Composite fell 2.8% last week, and global commodities prices dropped as well after Chinese banks’ funding costs shot up.

The average rate on seven-day repurchase agreements, or repos, a benchmark that tracks the cost of lending between banks, hit 5.05% on Friday, up from 3.49% a week earlier. The selloff has spread to government bonds, too, with the 10-year government-bond yield climbing to 4.2% Friday, the highest level in nearly six years.

Traders said the rapid rise in borrowing costs echoed June’s crippling cash crunch, which left banks scrambling for funds and spooked global markets.

It also brought to the forefront lingering worries about an explosion of debt, especially of lending to local governments. These loans could reach 30 trillion yuan ($4.9 trillion), equal to 60% of gross domestic product, according to some estimates.

Economists say that level of borrowing isn’t sustainable, but many fear that China’s economy can’t grow without it. That is why hints that China’s government is preparing to restrict lending, seen in the central bank’s apparent tolerance of higher interbank lending costs, are spilling over into global financial markets.

Jorge Mariscal, chief investment officer of emerging markets at UBS Wealth Management, which has $1.7 trillion in assets, is holding back on investments in China on concerns about the potential for tighter liquidity measures.

He is buying stocks in South Korea, where companies would benefit from a pickup in Chinese demand while having some distance from problems in the lending market.

Plenty of investors are willing to put up with the occasional setback.

“China’s market is very cheap,” said Tony Edwards, chief executive for Asia-Pacific at asset manager Robeco, which manages $250 billion. “In the short-term you might not look very smart, but in the long term you will.”