Why Real-Time Bidding Is Going To Completely Change The Equation For Mobile Advertising

October 28, 2013 Leave a comment

Why Real-Time Bidding Is Going To Completely Change The Equation For Mobile Advertising

MARCELO BALLVE OCT. 26, 2013, 2:27 PM 3,785 4

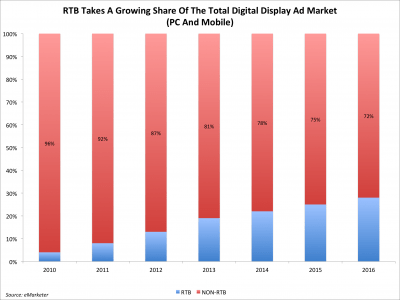

Real-time bidding is to digital advertising what high-frequency trading is to Wall Street. Computerized, algorithm-driven trading allows for the quick buying of ad impressions according to pre-set parameters. Desktop programmatic buying of display is already hugely popular. The coming impact on mobile stands to be even more significant. RTB should allow ad buyers to take full advantage of mobile’s virtues — its ability to reach users in real-time, and target potential customers according to demographics, location, and context. RTB should help sellers effectively monetize the huge, and growing, mobile audience. In a recent report from BI Intelligence, we explain what has kept mobile advertising prices depressed and how targeted RTB buying may in the long run help solve the mobile advertising CPM problem, detail RTB’s recent impact and successes on ad buyers and sellers, examine the potential obstacles to its widespread adoption, and look at how the holy grail of mobile advertising — simultaneous control, scale and efficiencies — may be reached through its use. Here’s an overview of why RTB or real-time bidding could make the difference in mobile, digital advertising’s new frontier:

It could help solve the CPM problem: The glut of ad inventory as global audiences rush into mobile has dragged on mobile display ad CPMs (CPMs refers to the cost per thousand impressions). That means publishers can’t monetize their mobile audiences effectively via ads. Advocates of programmatic — or automated buying and selling — say it can deliver the scale and efficiency needed to effectively match buyers and sellers and boost CPMs.

Leveraging location data via real-time bidding (RTB): RTB is a style of programmatic buying in which digital advertising opportunities are auctioned off in real-time. The auctions take place in milliseconds as advertisers bid on the right to show you an ad immediately after you open an app or click to a new web page, with granular control over demographics, context, location, etc. On mobile, RTB could be extremely powerful because consumers take their devices everywhere — to the mall, the car dealership, Starbucks, etc.

Helping to reach the holy grail of mobile advertising — controls and efficiencies: Believers in RTB and programmatic for mobile say they are making giant strides in perfecting their technologies, so they’ll have the ability to leverage consumer data on mobile and track users as they do on PCs (while still being sensitive to privacy concerns). That will include location, contextual, and demographic data layered on top of real-time ad requests.

Some publishers already achieve higher CPMs with RTB than they do with blind buying of impressions on traditional ad networks: As a result, RTB is seeing wider adoption across the mobile ad ecosystem, and positive momentum on both sides of the equation. The sell-side is providing more premium inventory, and larger publishers. And the buy-side is seeing more demand for RTB from advertisers and agencies. Of course, RTB and programmatic are contributing to hyper-efficient markets where ad prices tend to be low. The key is for RTB to bring scale to premium mobile ad marketplaces, bring in scale-focused brands, and lift all boats that way.

In full, the report:

Explains what programmatic buying and real-time bidding (RTB) are, and how they work

Details its recent impact and successes