How Charter’s Time Warner Cable bid woke up a ‘sleeping beast’; For Comcast, Daring Deals to Expand Its Reach Across Industries

February 16, 2014 Leave a comment

How Charter’s Time Warner Cable bid woke up a ‘sleeping beast’

Thu, Feb 13 2014

By Soyoung Kim and Liana B. Baker

NEW YORK (Reuters) – Talks between Comcast Corp and Charter Communications Inc over how they could together buy Time Warner Cable Inc quickly soured as the two bickered over price and the feasibility of engineering a split of the No. 2 U.S. cable operator.

Charter, backed by billionaire John Malone’s Liberty Media Corp, had been pursuing Time Warner for months, but was not making any headway as its larger rival – nearly three times its size by market value – asked for $8 billion more than what it had offered.

But Comcast actually believed Time Warner Cable’s $160 per share counter to Charter’s $132.50 per share bid was reasonable, several people familiar with the situation said on Thursday. At the same time, it worried that splitting a public company with assets in multiple markets and millions of subscribers would be tough, made even harder by the acrimony that had built up over the past eight months between Charter and Time Warner Cable.

On February 4 Comcast and Charter met in a last-ditch attempt to see if they could work out their differences, the sources said. They could not.

So later in the day, Comcast Chief Executive Brian Roberts called Time Warner Cable’s Rob Marcus to say that he was ready to make a bid for all of Time Warner Cable at a figure close to the asking price, according to the sources.

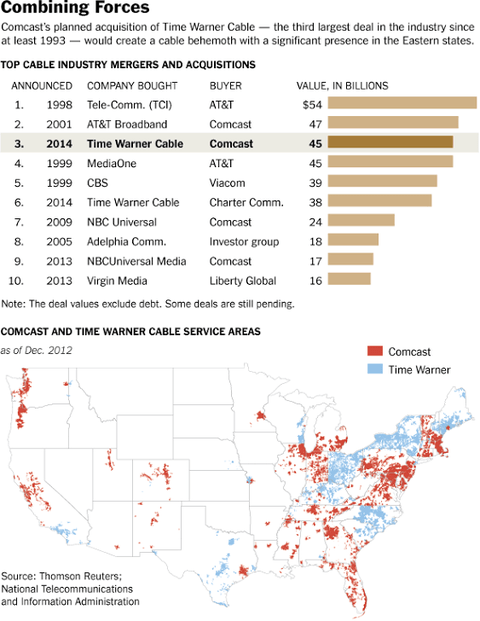

On Thursday, the two announced a $45.2 billion all-stock deal to create a cable behemoth, with an empire stretching from New York to Los Angeles. The deal is the largest M&A transaction so far this year and the third-largest in the media and entertainment sector of all time, according to Thomson Reuters data.

If the deal closes, it could give Comcast unprecedented leverage in negotiations with content providers and advertisers. For that reason it is also likely to come under keen regulatory scrutiny.

Representatives for Time Warner Cable, Comcast and Charter declined to comment on details of the negotiations. All the sources asked not to be named because the conversations were private.

Interviews with several people who were intimately involved in negotiations, however, paint a picture of what went on behind the scenes over the last few days as the deal came together and how Charter lost a prize that it had worked so hard to win.

In some ways, these sources said, the two companies have Charter to thank for the deal. Although Comcast, the top U.S. cable operator, had always been intrigued by the idea of buying Time Warner Cable, a deal was not on its list of priorities until Charter put it in play last summer. In the end, one of the sources said, all Charter did was “wake up the sleeping beast.”

John Paulson, whose Paulson & Co hedge fund is one of Time Warner Cable’s top 10 shareholders, said of Comcast in an interview with Reuters: “They’re gentlemen, old school businessmen. But they’re also aggressive.”

Charter’s next steps were not clear on Thursday. It had nominated a slate of directors to replace the entire board of Time Warner Cable on Tuesday, but was kept in the dark as its prize was slipping away to another buyer.

Time Warner Cable CEO Marcus, in the job for just 44 days, said in an interview that the deal, while good for his shareholders, is bittersweet for him.

“I was looking forward to thousands of days, not tens of days doing this job,” Marcus said.

Still, the former Paul, Weiss, Rifkind, Wharton & Garrison LLP M&A lawyer who over the past eight years had served in various roles at Time Warner Cable, including its top dealmaker and chief operating officer, just pulled off one of his largest deals ever. And thanks to his tenure at the company, he could take home some $50 million after it closes.

“Sometimes you don’t have control over how things unfold,” Marcus said.

THE FINAL DAYS

Things moved quickly over the last 10 days, the sources said.

After months of pursuing Time Warner Cable without success and speaking informally with Comcast last year, Charter approached Comcast once again in the middle of January about teaming up.

The idea was for Charter to buy all of Time Warner Cable and later sell off select systems to Comcast.

Comcast, with a $138 billion market value, dwarfs Charter’s $13.43 billion, as well as Time Warner Cable’s $40 billion market capitalization as of Thursday.

But as the two discussed options, Comcast became increasingly uncomfortable with Charter’s hostile approach and more skeptical that Charter would be able to win Time Warner Cable’s blessing with its offer, the sources said.

Comcast also became increasingly excited about the prospect of buying Time Warner Cable on its own.

Comcast felt that it could pay between $150 and $160 per share for Time Warner Cable, the sources said.

Initially it was also willing to put cash along with stock into the deal. But one of the sources said Time Warner Cable wanted an all-stock deal and for Comcast to use the cash instead to initiate a large share buyback program after the transaction closed to boost the share price of the combined company.

That meant Time Warner Cable shareholders would end up owning 23 percent of the combined company and also not have to pay taxes as a result of the transaction.

In return for paying the price, however, Roberts had one demand: Comcast would not pay a reverse break-up fee, or the penalty that a buyer pays to the seller if it fails to close a deal, typically because of regulatory reasons, the sources said.

The request was unusual for a deal that was sure to face regulatory scrutiny. A few years ago, for example, AT&T Inc agreed to pay as much as $6 billion as reverse breakup fee, paid in cash and spectrum, as part of its deal to buy T-Mobile USA from Deutsche Telekom for $39 billion. The deal was shot down by regulators, and AT&T had to pay the fees.

Some lawyers said such fees are rare in the cable industry, however.

“These businesses operate fairly independent enough and if this deal does not get approved, there is not going to be that much damage to Time Warner Cable,” said Robert Townsend, co-chair of Morrison & Foerster’s global M&A practice.

Comcast CEO Roberts said he did not recall ever agreeing to a reverse termination fee, not even in its $30 billion buyout of majority of NBC Universal in 2009.

Time Warner Cable’s board determined that the proposed transaction should get regulatory approval because the companies do not operate in the same markets, the sources said. They agreed to Comcast’s condition.

Talks were further aided by the fact that executives from the two companies knew each other and were friendly, the sources said. They also had worked together on a deal previously.

In 2006, the two split up bankrupt cable operator Adelphia Communications in a complicated $17.6 billion transaction. Marcus was Time Warner’s lead negotiator on the deal at that time.

This time around, the two chief executives, along with Comcast Chief Financial Officer Michael Angelakis and Time Warner Cable’s Arthur Minson, negotiated key points of the deal by phone as well as in-person meetings in New York, without relying much on advisers.

The two sides agreed a final deal price of $158.82 per share on Monday morning, and the board of each company approved the transaction on Wednesday evening.

“Throughout the whole process with Charter, I consistently said one thing – insufficient value. They didn’t value the unique asset that was Time Warner Cable,” Marcus said. “On the simplest level, the TWC-Comcast merger was superior.”

Comcast takeover of Time Warner Cable to reshape U.S. pay TV

Thu, Feb 13 2014

(Reuters) – Comcast Corp’s proposed $45.2 billion takeover of Time Warner Cable Inc could face close scrutiny from U.S. antitrust regulators because of the deal’s potential to reshape the country’s pay TV and broadband markets.

The company resulting from the merger of the top two U.S. cable service providers would boast a footprint spanning from New York to Los Angeles, with a near 30 percent share of the pay TV market as well as a strong position in providing broadband Internet services.

The all-stock deal, announced on Thursday, would put Comcast in 19 of the 20 largest U.S. TV markets, and could give it unprecedented leverage in negotiations with content providers and advertisers.

The friendly takeover came as a surprise after months of public pursuit of Time Warner Cable by smaller rival Charter Communications Inc, and immediately raised questions as to whether it would be blocked by the Department of Justice or the Federal Communications Commission.

Time Warner Cable shares jumped 6.8 percent to $144.50, still substantially short of the $158.82 per share value that Comcast put on its offer, indicating investors’ worries about regulatory clearance. Comcast shares fell 3.5 percent, cutting the per-share offer value to $154.

“I don’t know if the deal is too big to fail to be approved but it is definitely too big to sail through either the Department of Justice or the FCC without serious, serious examination,” said former FCC Chairman Reed Hundt.

“Only Comcast could have paid this price and the combined company, if approved, would tilt the balance of power at every negotiating table in media and content and broadband and equipment industries.”

Comcast Chief Executive Brian Roberts said he was confident about getting the green light from regulators as the two companies plan to divest 3 million subscribers, so that their combined customer base of 30 million would represent just under 30 percent of the U.S. pay television video market. He said no decisions have been made on which markets to sell.

The new cable giant would still tower over U.S. satellite competitor DirecTV, which has about 20 million video customers.

Comcast argued that the acquisition would be beneficial to consumers in that it would roll out its more advanced cloud-based set-top boxes to Time Warner Cable customers. It also said the deal would eventually result in higher broadband speeds.

“Significantly, it will not reduce competition in any relevant market be because our companies do not overlap or compete with each other,” Roberts said. “In fact, we do not operate in any of the same zip code.”

The new partners are concentrated in different cities. Comcast would fill in its New Jersey and Connecticut portfolio with Time Warner Cable’s New York City customers, for instance, and add major markets such as Los Angeles and Dallas.

Hedge fund manager John Paulson, whose Paulson & Co is one of Time Warner Cable’s top 10 shareholders, called the merger “a dream combination.”

ADVERTISING SYNERGIES

If successful, the deal will be the second time in little more than a year that Comcast has helped reshape the U.S. media landscape after its $17 billion acquisition of NBC Universal was completed in 2013.

“The negative is that NBC Universal ownership further complicates regulatory approval with implications even for usage-based pricing,” Wunderlich Securities Matthew Harrigan said in a research note.

Representatives for the U.S. Federal Communications Commission and the Justice Department could not be reached for comment.

Comcast’s offer price is roughly what Time Warner Cable demanded from Charter and a 17 percent premium from the No. 2 cable provider’s closing price on Wednesday. Charter shares slid 6.2 percent.

Comcast and Time Warner Cable expect to create $1.5 billion in operating savings, with 50 percent of those savings expected in the first year. The proposed deal will be accretive to Comcast, which plans to expand its stock buyback program to $10 billion at the close of the transaction.

Comcast is interested in advertising synergies it would gain by owning the New York City market as well as the opportunity to expand its business services unit, its fastest-growing cable division, to a larger footprint.

“For Comcast, adding New York and Los Angeles has advertising potential, along with Time Warner Cable’s sports assets, which provides an acquisition target that is simply too compelling to ignore, especially with an (under-leveraged) balance sheet,” said BTIG analyst Rich Greenfield.

The two companies expect to close the deal, which would give roughly 23 percent of the merged company to Time Warner Cable shareholders, by the end of the year. Unusually for a transaction of this size, there is no break-up fee.

Analysts noted that smaller cable operator Charter, which went hostile this week by nominating a slate of directors to replace the entire board of Time Warner Cable, could still be a candidate to acquire some of the assets to be divested.

Charter offered $132.50 per share in a cash and stock deal last month that was rejected as too low. Officials at the company did not respond to a request for comment.

SPORTS NETWORKS

Talks between Comcast and Time Warner Cable started about a year ago, but negotiations gathered pace in recent weeks, people familiar with the matter said. Time Warner Cable had told Comcast it considered Comcast to be its preferred buyer once Charter had approached them, the sources said.

Comcast had also been in talks with Charter about the possibility of carving up Time Warner Cable markets, but opted not to participate in a hostile situation, the people said.

Comcast also likely was attracted to Time Warner Cable’s two regional sports networks in Los Angeles, where it has spent billions on local TV rights for LA Lakers basketball and LA Dodgers baseball.

The deal would be a coup for Time Warner Cable Chief Executive Rob Marcus, who just ascended to the top job on Jan 1. Filings show that the former mergers and acquisitions attorney is set to pocket $50 million if Time Warner Cable is sold and he is replaced while he is CEO.

J.P. Morgan, Paul J. Taubman, and Barclays Plc acted as financial advisors to Comcast. Morgan Stanley, Allen & Company, Citigroup and Centerview Partners are financial advisors to Time Warner Cable on the deal.

FEBRUARY 13, 2014, 8:56 PM 4 Comments

For Comcast, Daring Deals to Expand Its Reach Across Industries

By MICHAEL J. DE LA MERCED and BILL CARTER

Three weeks ago, Comcast unveiled plans to build an addition to its headquarters, a gleaming steel-and-glass tower designed by the renowned architect Norman Foster that will cast a shadow over downtown Philadelphia.

With its proposed $45 billion takeover of Time Warner Cable, the company could do much the same over the media and telecommunications landscape.

The deal, announced on Thursday, solidifies Comcast’s reputation as an enterprise with grand, even audacious, ambitions. Begun 51 years ago with just 1,200 subscribers in northern Mississippi, Comcast has grown into a giant conglomerate that now has one foot in the broadband and cable businesses and another in content, thanks to its ownership of NBCUniversal.

Its competitors now include companies as varied as Verizon in broadband and theWalt

Disney Company

“I didn’t know what he was talking about then, but he was right,” Mr. Roberts said.

“I don’t think of it as a cable company anymore,” Mr. Doerr said.

FEBRUARY 13, 2014, 8:48 PM 3 Comments

Industry Shifts May Aid Comcast in Takeover Bid