Malaysia Airlines (MAS) may consider bankruptcy as troubled airlines that did it have re-emerged stronger

February 26, 2014 2 Comments

Weathering the storm

Published: 2014/02/22

NOWHERE CLOSE TO PROFITS: MAS may consider bankruptcy as troubled airlines that did it have re-emerged stronger, say analysts

When a company goes bankrupt, it implies that it has no choice. But in recent cases involving troubled airlines, they did so deliberately and have re-emerged leaner and stronger.

Some analysts feel that Malaysia Airlines (MAS), which reported a net loss of more than a RM1 billion last year, may consider such a route.

They feel that MAS, with a cost disadvantage problem, is nowhere close to making profits, at least not in the next four years.

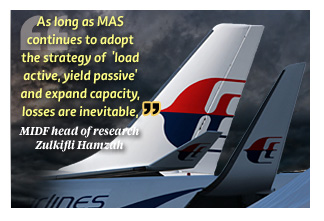

MIDF head of research Zulkifli Hamzah said MAS will not be profitable in the next two fiscal years as market conditions are against its turnaround plan.

“There is a system-wide degradation of yield base among regional airlines, such as Singapore Airlines, Thai Airways and Garuda Indonesia. On the local front, MAS has to compete with other domestic carriers, which further compresses its domestic yield.

“There is a system-wide degradation of yield base among regional airlines, such as Singapore Airlines, Thai Airways and Garuda Indonesia. On the local front, MAS has to compete with other domestic carriers, which further compresses its domestic yield.

“As long as MAS continues to adopt the strategy of ‘load active, yield passive’ and expand capacity, losses are inevitable,” he told Business Times.

MAS posted a record net loss of RM2.52 billion in 2011. It managed to narrow its losses to RM433 million in 2012.

For fiscal year 2013, it reported losses of RM1.17 billion despite cutting expenses, such as axing some routes and introducing lower fares to improve load.

Its expenditure was up 10 per cent year-on-year to RM14.9 billion due to high fuel prices.

A senior law lecturer and consultant of a legal firm suggested that MAS follows the footsteps of Japan Airlines (JAL) and American Airlines and file for bankruptcy.

He said after filing for bankruptcy, MAS can still operate under a new company and with the same name, if the registrar of companies approves.

American Airlines and its parent company filed for Chapter 11 court protection in the United States Bankruptcy Court in November 2011 to cut costs and unload massive debt built up by years of high fuel prices and labour struggles.

Two years later, they merged with US Airways Group, creating the largest airline in the world.

JAL filed Japan’s largest-ever bankruptcy petition by a non-financial company in 2010, kicking off a three-year restructuring that affected more than 15,000 employees.

Under the restructuring, JAL replaced older, less fuel-efficient planes and cut routes. It also received a 600 billion yen (RM19.3 billion) credit line and 730 billion yen in debt waivers.

“MAS will have to start all over, such as re-hiring staff, awarding contracts, as well as leasing and buying planes. MAS has contracts and agreements that expire in a long time. Those are expensive and dragging down its earnings,” he said.

Mercury Securities head of research Edmund Tham said MAS will have to find a solution, such as raising more funds, or it will become too dependable on government bailouts.

One company insider said it is possible for MAS to go the JAL and American Airlines way but “there will be a lot of noise from the unions”.

He said the airline is unfortunate to inherit costs that it could not change.

“For example, on long-haul flights, MAS has to reserve two seats for the pilots to rest, which may cost the airline up to RM20,000 per flight.

“And while the Department of Civil Aviation allows a cabin crew of four to serve on a B737, MAS has to provide a crew of six as stipulated by the union.

“There are other inherited costs that MAS could not do anything about unless the terms are renegotiated,” he adde

d

Seems like Malaysia Airlines (MAS) is going to take the bankruptcy route, similar to American Airlines and Japan Airlines (JAL). I just hope they come out leaner and meaner than before, and won’t have to go through bankruputcy again. They may want to look into how Virgin and Southwest run their operations. Only time will tell if it will work out. Hope it does.

Seems like Malaysia Airlines (MAS) is going to take the bankruptcy option, similar to American Airlines and Japan Airlines (JAL). I just hope they come out leaner and meaner than before, and won’t have to go through bankruputcy again. They may want to look into how Virgin and Southwest run their operations. Only time will tell if it will work out. Hope it does.