Demand Media’s eHow Learns Hard Lessons; Strategy Began to Fall Apart as Google Changed Search Algorithms

October 21, 2013 Leave a comment

Demand Media’s eHow Learns Hard Lessons

Strategy Began to Fall Apart as Google Changed Search Algorithms

WILLIAM LAUNDER

Oct. 20, 2013 8:13 p.m. ET

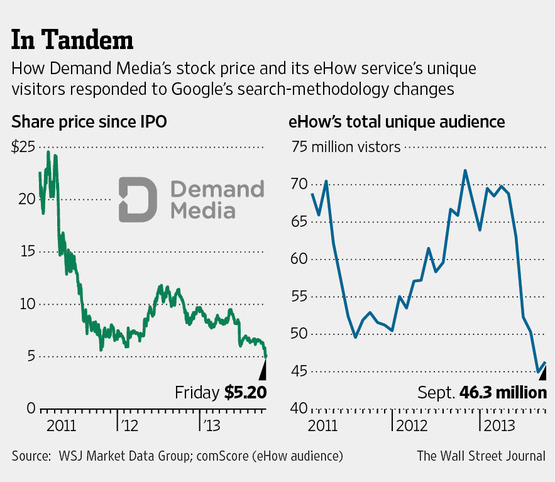

When Demand Media Inc. DMD +2.97% went public in early 2011, rising to an early valuation of over $2 billion, traffic to its “how-to” website eHow was soaring. Demand’s business model of creating content to answer search queries posed by Web surfers seemed to have legs. But the strategy began to fall apart within months of the IPO as Google introduced changes to its search algorithms to weed out content its computers showed wasn’t what searchers sought. EHow, a major source of ad revenue, saw its traffic plunge from a high of 70.5 million unique U.S. visitors in March 2011 to 46.3 million last month, according to comScore. Along the way, Demand’s stock price dropped 79% from an early peak, cutting its market capitalization below $500 million.The challenges facing Demand were highlighted last week when Chairman and Chief Executive Richard Rosenblatt, a co-founder of the company, resigned abruptly. He’ll be succeeded as CEO on an interim basis by Shawn Colo, another co-founder, as the company searches for a permanent successor.

Demand gave no explanation for Mr. Rosenblatt’s departure. People familiar with the situation said the executive isn’t considered a corporate turnaround expert. Rather, they described him as an executive best known for launching digital companies. His departure, ahead of a planned spinoff of Demand’s Internet-name registry business, will give Demand time to find new senior executives for the separated companies while freeing up Mr. Rosenblatt to consider new business ventures, one of the people said.

As for Demand, while the company has diversified its business, it remains exposed to changes in Google’s search methodology. During its second-quarter call with analysts in August, it warned that changes to Google’s search algorithms during the spring and summer months will likely reduce the company’s full-year revenue by up to $25 million. While that is only 7% of 2012 revenue, it is significant because such ad revenue represents almost pure profit for the company, Chief Financial Officer Mel Tang said in an interview.

Evercore Partners analyst Doug Arthur, for instance, cut his 2013 per-share earnings estimate six cents to 34 cents a share as a result of the guidance change. Demand Media is expected to report earnings for the third quarter early next month.

Demand’s experiences highlight the flaws in what has been called the “content farm” business model, observers say. “The idea that content can be created to exploit the inefficiencies of search algorithms has been shown not to be a viable business,” said Michael J. Wolf, managing director of Activate, a strategy-consulting firm that works with digital-media companies. “This is a company that really hasn’t been able to take advantage of major growth areas” of the Web such as video and high-quality editorial content.

Demand pointed to steps taken to adapt its content and become less dependent on Google, which last year accounted for around 38% of total company revenue. EHow, which relied on Google for 60% of its traffic a year ago, has reduced its reliance to 30% to 40%, Mr. Tang told analysts in September.

EHow accounts for about one-third of overall company revenue, Demand has said. In addition, Demand owns sites such as Livestrong.com, an online health and fitness destination, and Cracked.com, a humor site, which have been less vulnerable to the algorithm changes. Demand also creates content on behalf of other media companies in its content division.

In the interview, Mr. Tang acknowledged that Demand had probably “overstocked the shelves” in its rush to create a giant library of content, previously producing upward of 200,000 articles and other content during its peak months.

Demand has tried to improve the quality of its content, adding graphics and photos to articles, increasing their length and introducing quality-control steps to its editorial process. It has also become more selective about the freelancers it relies on to churn out much of the content. The goal, in part, is to pass muster with algorithm changes that try to weed out articles that appear uninteresting, such as ones that generate lots of back clicks by Google users or appear to duplicate text on other Web pages.

Still, the company faces challenges. Mr. Rosenblatt’s resignation follows several other high-profile departures from the company over the past two years. Early last year, three top executives, Larry Fitzgibbon, Joe Perez and Steven Kydd, –left Demand, subsequently launching Tastemade, a digital video production firm. The former executives weren’t available for comment.

In May, Chief Revenue Officer Joanne Bradford quit to join Hearst Corp.’s San Francisco Chronicle. Ms. Bradford, a well-known digital advertising executive, had been recruited by Demand prior to its IPO to help lift its profile with Madison Avenue.

Ms. Bradford said that she “loved” working with Demand and Mr. Rosenblatt and that her decision to leave was motivated in part by a desire to stay closer to her home in San Francisco. Demand’s headquarters is located in Santa Monica.

With advertisers, “they aren’t on the radar anymore like they used to be,” said Carl Fremont, chief digital officer at media-buying firm MEC, a division of WPP PLC.

Ms. Bradford was replaced by Jeff Dossett, who joined Ms. Bradford’s team prior to the IPO and has previously worked at tech companies including Yahoo Inc. and MicrosoftCorp.

Demand is trying to become less dependent on ad revenue, which accounts for around 80% of its content business’s revenue. In June, it acquired Society6, an e-commerce site that sells items like customizable iPhone cases, for about $94 million. At eHow, meanwhile, Demand has introduced a consulting service, eHow Now, that lets consumers connect in real time with experts like lawyers and mechanics.

‘”If I were talking in five years about a 50-50 split between advertising and digital products and subscriptions, I would be a happy man,” Mr. Tang said.

Meanwhile, some analysts are optimistic about the business that Demand plans to spin off: its domain business. Demand has invested heavily in new domain-name extensions that will likely be introduced to the market next year when they are released by the Internet Corporation for Assigned Names and Numbers, or Icann, an organization that governs Internet standards.

“As this new business rolls out, it’s a very large opportunity for them,” said Andre Sequin, an analyst at RBC Capital Markets.

Demand said it remains committed to the split but warned that the separation could take longer than expected in light of Mr. Rosenblatt’s departure.