Sony Struggles to Stay In the Game; Bleak Outlook for Consumer Electronics Business Worries Analysts, Investors

November 2, 2013 Leave a comment

Sony Struggles to Stay In the Game

Bleak Outlook for Consumer Electronics Business Worries Analysts, Investors

JURO OSAWA

Updated Nov. 1, 2013 12:10 p.m. ET

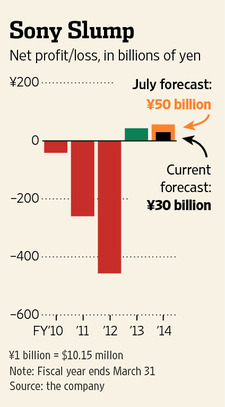

In just three months, Sony Corp. 6758.TO -11.13% went from a company on the mend to one whose recovery is now in serious doubt. Hidekazu Miyahara, an analyst at Marusan Securities, 8613.TO -1.25% recalls the celebratory mood at Sony’s earnings briefing in Tokyo in late July. The Japanese electronics giant had just reported a net profit for the three months ended June 30 and analysts saw signs of a recovery in Sony’s core electronics operations following restructuring that involved 10,000 layoffs. During the question-and-answer session, another analyst told the executives how excited he was to see the television business finally turn profitable. Read more of this post