Sony Struggles to Stay In the Game; Bleak Outlook for Consumer Electronics Business Worries Analysts, Investors

November 2, 2013 Leave a comment

Sony Struggles to Stay In the Game

Bleak Outlook for Consumer Electronics Business Worries Analysts, Investors

JURO OSAWA

Updated Nov. 1, 2013 12:10 p.m. ET

In just three months, Sony Corp. 6758.TO -11.13% went from a company on the mend to one whose recovery is now in serious doubt. Hidekazu Miyahara, an analyst at Marusan Securities, 8613.TO -1.25% recalls the celebratory mood at Sony’s earnings briefing in Tokyo in late July. The Japanese electronics giant had just reported a net profit for the three months ended June 30 and analysts saw signs of a recovery in Sony’s core electronics operations following restructuring that involved 10,000 layoffs. During the question-and-answer session, another analyst told the executives how excited he was to see the television business finally turn profitable.On Thursday, Mr. Miyahara was shocked to see Sony issue a profit warning while reporting a loss for the three months ended Sept. 30.

“The outlook is particularly disappointing because Sony has already done a lot of cost cuts,” said Mr. Miyahara. “There may be little room left for more drastic cuts in fixed costs,” he said, noting that he is reviewing his “Buy” rating on the stock.

Meanwhile, Moody’s investor service said it would review Sony’s debt rating for a possible downgrade, citing “slow progress being made in improving overall profitability.”

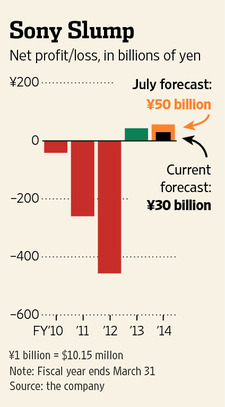

Investors sent the Japanese electronics maker’s shares tumbling in Tokyo trading Friday after the company slashed its profit outlook by 40% Thursday. The stock fell 11% to close at ¥1,668 (about $16.96) wiping more than $2 billion off Sony’s market value.

Sony’s quarterly loss was mainly due to its movie business, but what is worrying analysts and investors is the bleak outlook for its consumer electronics. TVs became unprofitable again, and Sony cut its sales forecasts for TVs, PCs and cameras. The biggest concern is that the profit warning isn’t just a temporary outcome of a harsher economic climate, but an indication that the turnaround scenario as a whole may not be working.

“Movies are in many ways a hit-and-miss, but it’s the structurally troubling electronics division that’s disappointing,” said Takuya Yamada, a senior fund manager at Astmax Asset Management, which has around $1.2 billion in assets under management.

Under Kazuo Hirai, who became chief executive last year, Sony has designed a three-year road map for a turnaround. After squeezing a group net profit in the last fiscal year thanks in part to asset sales, this year’s promise from Mr. Hirai was to turn its electronics operations profitable, including the TV business that has been unprofitable on an annual basis for nearly a decade. This isn’t the first time Sony has disappointed investors with its earnings outlook. Howard Stringer, Mr. Hirai’s predecessor, also promised a turnaround that never panned out.

Sony’s next bets are its Xperia smartphones and the PlayStation 4 videogame console, but analysts say the prospects for those businesses are far from guaranteed, given intensifying competition and changing consumer preferences.

“Sony needs to make harsh decisions about what its product portfolio is going to be,” said Steve Durose, senior director at Fitch Ratings. He said that Sony should consider moving away from consumer electronics to focus more on industrial products for corporate customers, like its Japanese peer Panasonic Corp. 6752.TO +6.19% , which raised its profit outlook Thursday.

Sony Senior Vice President Shiro Kambe said he expects sales to pick up significantly after the Nov. 15 release of PlayStation 4, the company’s first reboot of its popular console in seven years. Sony plans to sell five million PS4 units by the end of March.

One of Sony’s most competitive operations is supplying camera sensors used in smartphones, including Apple Inc. AAPL -0.53% ‘s iPhone. But strong demand for smartphone camera sensors is being canceled out by shrinking demand for traditional cameras that also use Sony sensors.

“We think Sony has a revenue problem, rather than a cost problem,” wrote Macquarie Securities analyst Damien Thong in a research note Friday. “The firm has stepped up its ability to deliver desirable premium products, but the reality is that apart from smartphones, Sony has yet to ignite top-line growth,” Mr. Thong said.

Sony has so far focused on the European market for its smartphones and its presence is small in the U.S. and China, two of the world’s largest mobile markets. If Sony were to ramp up its marketing in those markets, the increase in costs may pressure the earnings from the mobile business, analysts say.

A Sony spokeswoman said that the company will focus on cost efficiency and make sure that its smartphone business stays profitable, even though it won’t compromise on necessary marketing. Sony is now expanding its mobile business in China and other emerging markets, in addition to Europe and Japan, she said.

“Organizational integration and streamlining at Sony, with its broad-ranging product divisions, hasn’t kept up with the tide of hardware concentration on smartphones and tablets, and we see a risk of the firm being forced into restructuring involving major outlays,” Deutsche Securities analyst Yasuo Nakane wrote in a research note.

Sony already faces shareholders calling for further restructuring of its sprawling operations. Hedge-fund investor Daniel Loeb, whose firm holds Sony shares, has proposed a spin-off of the company’s entertainment division through an initial public offering, saying that movie and music businesses are being poorly managed.

Mr. Loeb’s Third Point LLC declined to comment.