Buyers Eye Hong Kong Banks for China Links

November 5, 2013 Leave a comment

Buyers Eye Hong Kong Banks for China Links

Companies That Want to Enter China’s Banking Sector Look to Hong Kong Lenders With Chinese Licenses

ISABELLA STEGER and YVONNE LEE

Updated Nov. 4, 2013 10:04 a.m. ET

Chinese financial companies eager to break into banking in their country may have better luck looking outside the mainland, as a recent offer by brokerage owner Yue Xiu Enterprises (Holdings) Ltd. for Hong Kong’s Chong Hing Bank Ltd. 1111.HK -0.29%shows. Yue Xiu said Oct. 25 it has made an offer for a 75% stake in Chong Hing Bank for 11.64 billion Hong Kong dollars (US$1.50 billion), in what could be the first sale of a Hong Kong bank since 2010. The attraction, an official at Yue Xiu said, is less Chong Hing’s exposure to Hong Kong, a city of eight million, than its Chinese banking license, through which the family-owned bank has one branch in Guangdong.“While China’s economy has grown significantly over the past 10 years, the Chinese government hasn’t issued new commercial banking licenses since 2006,” the Yue Xiu official said. “Banks in Hong Kong with licenses to operate in China are attractive acquisition targets for mainland Chinese companies seeking to enter the country’s banking sector.”

Chinese regulators haven’t issued new joint-stock commercial banking licenses in almost a decade. The last bank that secured a license was China Bohai Bank Co., and that was at the end of 2005, according to the lender’s website. A joint-stock commercial bank is a bank owned by several different investors, which could include the Chinese government, individuals, foreign or domestic companies.

The China Banking Regulatory Commission wasn’t immediately available for comment.

Guangdong-headquartered Yue Xiu, which focuses on real estate and infrastructure, has no banking experience but has signaled its ambitions to diversify into financial services since 2012, when it set up Yue Xiu Financial Group, which controls businesses including Guangzhou Securities.

Having a majority stake in Chong Hing would allow it to become an integrated financial services company in the province through Chong Hing’s financial services licenses.

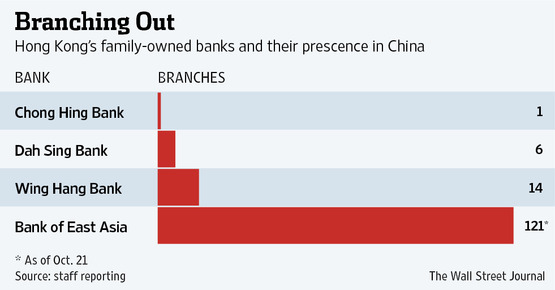

Other nonbank companies from China have shown interest in banks in Hong Kong’s four remaining family-owned banks. All four have branches in China.

In 2008, China Life Insurance Co. 601628.SH -0.70% , China’s largest insurer by premiums, proposed buying a 10% stake in family-owned Wing Hang Bank Ltd.0302.HK +1.36% from the Bank of New York Mellon Corp. BK +0.46% , but the deal fell through. China Life later said it aims to acquire a controlling stake in a bank, a move that would allow it to catch up with rival Ping An Insurance (Group) Co. of China Ltd., which has a bank.

“We have been approached by several Chinese nonfinancial companies about how they can own a Hong Kong bank,” said a Hong Kong-based financial-institutions banker who isn’t involved in the Chong Hing deal.

Under the Closer Economic Partnership Arrangement, a free-trade pact that gives Hong Kong companies preferential access to China, Hong Kong banks with subsidiaries in Guangdong are allowed to expand within the province.

The official from Yue Xiu said the company hopes to use Chong Hing’s license to open more branches in Guangdong to serve existing clients in the province. Chong Hing has one branch in the province’s Shantou city.

Beyond the fact that it represents a foray into banking by Yue Xiu, the company’s interest in the Hong Kong lender, founded by the Liu family in 1948, raised eyebrows for a number of reasons. Chong Hing is the smallest of Hong Kong’s family-owned banks by market capitalization, and it posted one of the lowest returns in the city’s banking sector last year.

Its return on equity in 2012 was 7.63%, sharply lower than the 9.89% for Wing Hang Bank Ltd., another family-owned bank that is in sale talks with potential suitors.

While Hong Kong is a small city, its banks are attractive for buyers, because loan growth is robust. Liquidity in China is still tight after curbs on lending were imposed three years ago, so many Chinese companies have been forced to go to Hong Kong banks for loans instead.

Analysts said Yue Xiu’s plan to buy Chong Hing, which is subject to regulatory approval in Hong Kong, could hurt the Hong Kong lender’s credit rating if it expands aggressively on the mainland.

“Chong Hing is currently the most conservatively run Hong Kong family bank with low loan-to-deposit ratio [of 61%] and limited China exposure,” Morgan Stanley MS +0.48% said in a research note late last month.

“Under Yue Xiu, we think Chong Hing Bank would embark on a more aggressive growth strategy, given the increased business referrals and linkages to China.” The Yue Xiu official said the firm hopes to open more branches in Guangdong, but declined to speak in detail about its expansion plans.