China’s Tesla Risks Overcharging

November 5, 2013 Leave a comment

China’s Tesla Risks Overcharging

ABHEEK BHATTACHARYA

Updated Nov. 3, 2013 11:06 p.m. ET

Tesla Motors TSLA +8.03% isn’t the only stock exciting investors about the future of electric cars. Chinese electric-car maker BYD 1211.HK -0.39% —backed by a major investment from Warren Buffett —has seen its Hong Kong-listed shares soar 153% in the past year, even as Chinese auto stocks are up 66%. This charge could be set to power down.Investors have gotten excited about BYD thanks both to Tesla’s meteoric rise, and because China’s central government said in September that it would help cities add new electric cars and subsidize new buyers over the next two years.

The problem is not only that investors are assuming the technology will commercially succeed. That’s an issue with Tesla, too, as it looks to sell ever larger numbers of cars. With BYD, investors are also assuming that this sprawling company is focused enough to sell a meaningful number of electric cars.

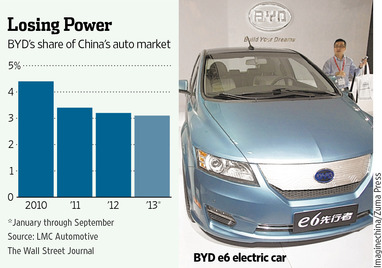

But, unlike Tesla, half the company isn’t even car-related. BYD gets 47% of its revenue from making handset components, solar cells and rechargeable batteries. And those are highly competitive businesses that are hardly profitable. BYD’s auto business doesn’t buzz either, having lost market share three years running, according to LMC Automotive.

Despite BYD’s reputation for expertise in battery technology, less than 1% of the cars it sells are electric. BYD’s electric cars trailed behind Chery and Jianghuai Auto in terms of electric vehicle sales in 2012, says Macquarie’s Janet Lewis.

This means BYD may not be the biggest beneficiary of an electric-car boom. Its gasoline-powered models, which make up the bulk of sales, are low-end, and for now aren’t selling enough to justify BYD’s lofty stock price.

That leaves much of the company’s future success reliant on continued state largess. The main buyers of electric vehicles are local governments who use them for taxi fleets and other public uses. Government subsidies for items such as research and development were 57% of pretax profit for the first nine of months of 2013. Strip out nonrecurring income such as subsidies, and net profit fell 123% year-over-year between January and September, says Ms. Lewis.

But hope seems to spring eternal for electric-car investors. BYD trades at 53 times forward earnings. Granted, that is less than the 100-times multiple Tesla fetches. But BYD’s valuation is four times the second-richest Hong Kong-listed auto maker, Brilliance China Auto, and nearly double its own five-year average, according to FactSet.

Tesla’s valuation and heady share-price rise this year raise questions about the U.S. company, but at least that’s a pure bet on a single polarizing question—will electric cars prove a commercial success? With BYD, investors are betting on too many other things also falling into place.