Funding Dries Up for Medical Startups; Companies Are Squeezed by Venture-Capital Drought

November 5, 2013 Leave a comment

Funding Dries Up for Medical Startups

Companies Are Squeezed by Venture-Capital Drought

JOSEPH WALKER

Nov. 4, 2013 7:58 p.m. ET

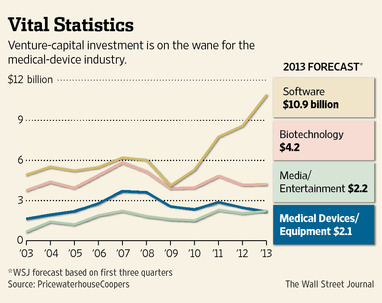

The medical-device industry, struggling to adapt to a thriftier health-care system, is getting squeezed by a venture-capital drought. Investment in the medical-device and equipment industry is on pace to fall to $2.14 billion this year, down more than 40% from 2007 and the sharpest drop among the top five industry recipients of venture funding, according to an analysis of data compiled by PricewaterhouseCoopers and the National Venture Capital Association. Venture money received by the biotechnology sector declined 28% over the same period, while software startups recorded a 75% increase.As a result, the industry responsible for making prosthetic hips and other devices is having to get creative. Entrepreneurs are taking on more debt and looking for cash in unusual places, including family investment funds overseas and high net worth individuals in the U.S., people in the industry say.

One of the biggest shifts has been entrepreneurs and their financial backers are approaching potential acquirers much earlier than in the past. Some firms are striking funding deals with larger established companies, often in exchange for board seats and future acquisition rights.

The upside is reliable financing and industry expertise. But such deals can curb the start-up’s upside potential if it finds success and becomes an acquisition target: The device firm can’t seek multiple bidders and run up its acquisition price.

Charlie Attlan, vice president of corporate business development atBoston Scientific Corp.BSX +2.04% , said his company is looking to tie up with startups much earlier than in the past. “We might have an earlier-stage collaboration, and they give up the hope of a home run if and when we acquire them,” he said.

Not long ago, the med-tech sector was seen as less risky and nearly as lucrative as the Internet and biotechnology drug sectors, the biggest recipients of venture capital. Medical technology drew $3.7 billion in investment in 2007, ranking it third among all industries; last year, the industry dropped to fourth.

The contraction of the venture industry after the 2008 financial crisis dovetailed with new pressures in the device industry, from declines in the rate of medical procedures, to increasingly tightfisted health insurers and a more stringent regulatory approval process.

The downtick is creating anxiety even for proven executives like Andrew Cleeland, chief executive of Twelve, a Redwood Shores, Calif., startup that is developing a minimally invasive mitral heart valve, which prevents blood from leaking into the lungs.

A few years ago, Mr. Cleeland helped to sell Ardian Inc., maker of an electrical device to treat high blood pressure, to Medtronic Inc. MDT +0.02% for $800 million in cash plus milestone payments—a return of more than 12 times invested capital.

“You’d think that coming off an incredible exit for our investors at Ardian that investors would be lining up,” said Mr. Cleeland, Ardian’s former chief executive. But now, he said, fundraising won’t be easy. “It’s keeping me up at night.”

Alternative funding arrangements with corporate backers have been common in the biotech industry, and are spreading now in the medical-device industry.

One such arrangement culminated this month with St. Jude Medical Inc.STJ +1.29% ‘s purchase of startup Nanostim for up to $188.5 million in cash, a price set in a 2011 agreement.

St. Jude’s investment financed the bulk of the $40 million to $50 million in costs needed to win European approval for Nanostim’s minimally invasive pacemaker, according to Allan May, former chairman at Sunnyvale, Calif.-based Nanostim and a managing director at Emergent Medical Partners. In exchange, St. Jude gained rights to purchase Nanostim within 90 days of regulatory approval.

Had venture investment not been cratering in 2011, Mr. May said, Nanostim probably would have sought a more traditional financing deal that would have kept the door open for a higher takeout price in the future.

“Is that the best deal in the world? No,” said Mr. May. “You’re trading away some potential upside for certainty.”

Amy Jo Meyer, a spokeswoman for St. Jude, said that such arrangements provide wins to both parties. “The startup is able to secure financing, in a very tight funding environment, with a strategic partner that can bring expertise and add significant value as the company develops its technology,” she said.

Still, corporate investors haven’t offset the overall funding decline. First-round financing is on pace to reach $259.73 million this year, less than half the amount in 2007 and down 21% from last year, according to an analysis of data compiled by VentureSource, which is owned by Dow Jones, publisher of The Wall Street Journal.

The total number of investment deals in med-tech is projected to fall by a third this year from 2007, the data from PwC and the National Venture Capital Association show. The industry’s share of total venture capital investment, meanwhile, is on pace to fall to roughly 8%, down from 12% the year before the financial crisis.

Medtronic, an aggressive corporate investor, is making earlier-stage bets than before but hasn’t increased its total spend, said Geoff Martha, senior vice president, strategy and business development.

“We’re putting more at risk at an earlier stage because no one else is,” said Mr. Martha.