Legend Capital eyes wearable device market with tech investment

November 5, 2013 Leave a comment

Legend Capital eyes wearable device market with tech investment

Staff Reporter

2013-11-05

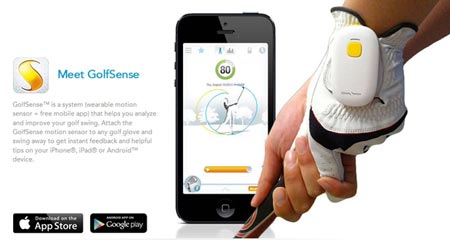

An ad for the GolfSense sensor and app developed by Zepp Labs. (Internet Photo)

Many investors are now eyeing wearable devices as the next potential field in consumer electronics, with companies looking to invest in related start-up firms, reports the Chinese Entrepreneur magazine. The concept of wearable devices emerged last year, with the introduction of Google Glass — an eyeglass-shaped mobile computing device, the magazine said. Da Mi, vice president of Legend Capital, a subsidiary of Chinese investment holdings company Legend Holdings, said the most applicable hardware remains the smartphone at this time, but the future lays in sensor hardware. Earlier this year, Legend Capital decided to invest in Zepp Labs — which combines 3D motion technology and sports — and entered its board, after seeing the latter’s hot sales in North America.The investor said he was disappointed, however, after paying a visit to the US headquarters of Zepp Labs, as the tech company has only one employee in the US, its CEO Jason Fass.

Zepp Labs has successfully developed a number of motion-sensing products in the past couple of years and is registered in both China and the US, with the China operations running the company’s research and development with more than 20 engineers.

As a venture capital firm, Legend invests a lot in early-stage start-up companies, and faced with limited financial data of the investment targets, focuses on companies’ management teams, paying close attention to the capability and quality of the core management, Da said.

Zepp was initially founded by Han Zheng, a former PhD student researcher at Microsoft Research Asia. In Oct. 2010, Han and his team developed the first prototype for the GolfSense sensor and app, which immediately won attention from Apple, whose executives urged Han to sell the product via the Apple. In April last year, GolfSense began sales in Apple stores for US$129.99.

After the introduction of GolfSense, Zepp then needed a product manager to handle the US sales — its most important target market. Han employed Fass to take over the CEO position, while Han became chief technology officer.

Insiders said that wearable devices will be a popular investment in the near future. Figures showed that wearable devices in China had a combined sales scale of 420 million yuan (US$68.9 million) last year, which is expected to exceed one billion yuan (US$164 million) in 2015, and nearly five billion yuan (US$819.8 million) in 2017, with an annual compound growth of 60%, the magazine said.