China’s Slower Growth Puts a Drag on Western Profits

November 6, 2013 Leave a comment

China’s Slower Growth Puts a Drag on Western Profits

RUTH BENDER and KATE LINEBAUGH

Updated Nov. 5, 2013 7:10 p.m. ET

Just as European economies are showing signs of stabilizing and the U.S. economy is waking up, some companies are running into obstacles in a market long considered their brightest hope: China. U.S. and European companies invested heavily in recent years to expand in China, seeking to tap into its flourishing middle class and fast economic growth. Since the global recession, China has helped offset the free fall in sales and profits in the euro zone and stagnant revenue in the U.S.But the latest set of quarterly earnings results reveal that for many companies, China has been a drag. While some industries did well, the combination of slower economic growth, plus government crackdowns that have put fresh scrutiny on the way companies win new business, hurt sectors from technology to luxury goods to pharmaceuticals. As a result, the sluggish global sales that persisted through much of the recovery aren’t likely to pick up soon.

“Don’t kid yourself,” said Pierre Pringuet, chief executive of distiller Pernod Ricard SARI.FR -2.08% . “When a country falls from double-digit growth to 7.5%, there are repercussions.”

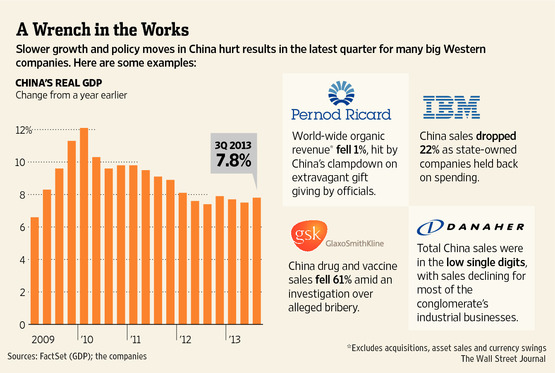

Growth in China’s gross domestic product rose to 7.8% in the third quarter from 7.5% in the second. That by far was the fastest of any major economy but still represents a substantial downshift from rates that reached as high as 14.2% in 2007. Economists are confident that annual growth will top 7.5% for this year, though Beijing has indicated it is comfortable with slightly slower growth.

The effects of China’s slower growth were aggravated for drug makers by a bribery probe, for infant-formula companies by a health scare and for the luxury-goods sector by a clampdown on government corruption that put a pinch on gift giving.

Sales at big European companies including Pernod Ricard, drug maker Sanofi SASAN.FR -0.05% and advertising company Publicis Groupe SA, PUB.FR +1.80% slowed sharply in China in the quarter through September, with some warning that slower growth could weigh on their full-year earnings.

In the U.S., Microsoft Corp. MSFT +1.95% , drug maker Eli Lilly LLY -0.08% & Co. and others also cited weakness in China.

U.S.-based Danaher Corp. DHR -0.22% , which makes water filters, printing equipment and medical devices, said its revenue growth slowed to low single digit percentages in China in the third quarter from the double-digit growth it posted in the second quarter. “Most of our industrial businesses continue to see sales declines in China,” said Danaher CEO Lawrence Culp Jr.

IBM was stung by an across-the-board drop in China demand, especially in its computer-equipment business, where sales fell 40%. China accounts for about 5% of IBM’s revenue, and the company said overall sales in the country were down 22%, as orders from state-owned companies and the public sector slowed significantly. IBM doesn’t expect demand in China to pick up until the spring.

Yum Brands Inc. YUM +0.46% said China sales at stores open at least a year fell 11% for the quarter through Sept. 7. The company forecast that sales would drop this quarter as well, following concerns over avian flu and the company’s use of antibiotics. The company began a publicity campaign to assure consumers that its chicken is safe.

“I’ve always said that our China business will have its ups and downs,” Chief ExecutiveDavid Novak said last month, “and this year is clearly proving to be one of those downs.”

Analysts estimate that third-quarter revenue at companies in the S&P 500 index increased just 3.2%, according to Thomson Reuters, following several periods of flat or no growth. Profits are expected to fare better, rising 5.3%, as companies cut costs and buy back stock, which boosts earnings per share.

The picture in Europe is bleaker. Earnings for companies in the Stoxx Europe 600 are expected to decline 14.6% as revenue falls 1.9%. While many European companies have reported improved performance at home, the euro-zone recovery remains shallow. Emerging markets are a particular weak spot, in part because many currencies have weakened against the euro.

“If the surprises continued at this rate, this would be the worst reporting season for revenues since 2009,” UBS strategist Nick Nelson wrote to investors.

The slowdown in China isn’t affecting all sectors equally. Goods related to car sales—from tires to turbochargers—are clocking robust returns. Spending on health care and environmental upgrades remains strong.

General Electric Co. GE -0.04% reported strong third-quarter order growth of 17% in China, with demand for health-care equipment up 33%. China sales at industrial and aerospace manufacturer United Technologies Corp. UTX -0.28% rose 11%, helped by strong sales of elevators. And Textron Inc. TXT -1.22% cited healthy demand in China, selling 14 helicopters in the quarter.

French cosmetics maker L’Oréal SA maintained a double-digit sales gain in China. “The fact that China’s growth is losing one point, or less or more, is not significant, and should not change the rhythm of growth that we are achieving,” said CEO Jean-Paul Agon.

But other executives said excess capacity and weak pricing raised concerns that industrial growth is slowing. China’s manufacturing sector is just barely expanding, according to purchasing-managers data released Friday.

“We are not hearing the vast opportunistic optimism that existed, let’s say, a year or two ago,” said Jim Russell, senior equity strategist at U.S. Bank Wealth Management.

China results for technology companies highlight how the macroeconomic environment has gotten cloudy, he said. Microsoft said its revenue across its businesses in China was down from a year earlier as economic conditions “have been challenging.” Cisco SystemsInc. CSCO +2.15% and Hewlett-Packard Co. HPQ -1.16% also cited softness in China.

The luxury industry, meanwhile, said it has suffered as a government crackdown on extravagance among public officials slowed purchases of gifts and status symbols.

Kering SA KER.FR -1.81% ‘s Gucci brand in the latest quarter posted its first decline in sales since 2009, hit by China.

Pernod Ricard started promoting less-expensive beverages targeted at younger Chinese consumers as sales fell for pricey cognacs such as Martell. Rivals DiageoDGE.LN +0.13% PLC and Rémy Cointreau SA RCO.FR -0.68% also felt the chill.

“We don’t know when this will stop,” said Rémy Cointreau CEO Frédéric Pflanz.

Drug makers face their own obstacles amid Chinese government scrutiny after a bribery investigation into GlaxoSmithKline GSK.LN +0.48% PLC. The company has said some of its managers in China may have broken the law and that Glaxo is cooperating with investigators. Glaxo said the probe sent its pharmaceutical and vaccine sales in China down 61%.

Sanofi lowered its 2013 earnings forecast for the second time this year as China sales rose just 5% in the latest quarter, down from double-digit growth in recent years.

Eli Lilly said its sales growth in China slowed to 11% from as high as 41% early last year. Chief Financial Officer Derica Rice called the compliance issues a short-term problem but said China’s economic slowdown is a “constant matter to deal with.”

Danone SA, BN.FR -0.82% meanwhile, cut its full-year financial targets after an unfounded warning from a milk supplier about bacteria levels slammed sales of the French company’s infant products across Asia. Danone had already cut prices in China for baby formula after authorities fined the company for price fixing.

Abbott Laboratories ABT +1.03% was hit by the same scare, and CEO Miles White said it is difficult to get consumers to switch back to its brands. Still, that isn’t changing the drug maker’s strategy.

“Our prospects and our expectations of China haven’t changed. Our investment profile hasn’t changed,” he said. “We have built a large plant in China. We intend to build more.”