South Korea Markets Enjoy a Renaissance

November 6, 2013 Leave a comment

South Korea Markets Enjoy a Renaissance

ANJANI TRIVEDI

Nov. 5, 2013 7:11 p.m. ET

Investors are piling into South Korean stocks and bonds, lured by a trade surplus and a brightening growth outlook that makes the country a standout among emerging markets. South Korea’s Kospi Composite Index is near two-year highs, and in the year to date, the only Asian currency performing better than South Korea’s won against the U.S. dollar is the Chinese yuan. Furthermore, yields on the South Korea latest dollar bond, sold on Sept. 4, have dropped to 3.38% from 4.02% as of Tuesday, according to data provider Markit. Bond yields move in the opposite direction of prices.South Korea’s economy is benefiting from an uptick in economic growth in its big export markets: the U.S., Europe and China. Asia’s fourth-largest economy saw exports jump sharply in October to a record $50.5 billion. The rising exports have bolstered South Korea’s trade surplus and foreign-exchange reserves, a factor that investors view as supportive of asset prices.

“It’s a twin surplus,” said Audrey Kaplan, head of international equity at Federated Investors Inc., referring to both the country’s trade and its budget surpluses. Ms. Kaplan expects faster growth in China in the year’s second half will prove to be a boon for South Korea.

The $650 million Federated InterContinental Fund, which Ms. Kaplan co-manages, has relatively big exposure to South Korean stocks, including Samsung Electronics Co.005930.SE -0.20% and auto makers Hyundai Motor Co. 005380.SE +1.84% and Kia Motors Corp. 000270.SE +3.31%

The drivers behind growth in South Korea—which accelerated to 3.3% in the third quarter—are absent in countries such as India and Indonesia, which export much less and are struggling with underinvestment in key industries.

Global investors and sovereign-wealth funds have piled into South Korea, indicating belief this period of financial and political calm could last. That is a welcome change after military tensions in the Korean peninsula earlier this year escalated when North Korea tested a nuclear weapon. It also marks a reversal from past decades, when investors were wary of South Korea following several financial crises.

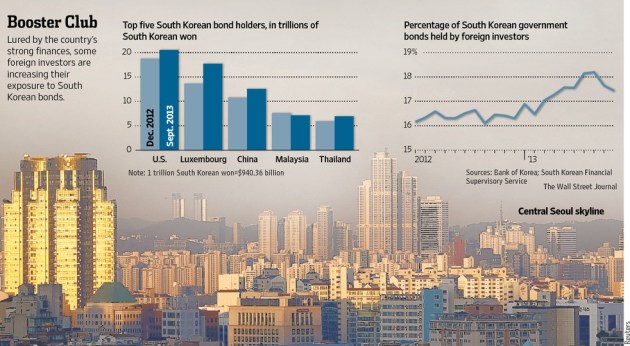

That confidence has pushed foreign holdings of South Korean government debt up 8% this year to 98 trillion won ($92 billion). The U.S., Luxembourg and China rank as the top three holders.

“We expect interest in Korean bonds will grow,” said Min Am Cho, a portfolio manager at Mirae Asset Global Investments, which oversees $54.3 billion of assets.

The value of South Korean government bonds held by Norway’s sovereign-wealth fund, the world’s largest, has risen 31% this year to 27 billion Norwegian kroner ($4.5 billion). South Korea now ranks among the top 10 bond investments in the fund, called Norges Bank Investment Management.

South Korea still faces hazards. The country’s dependence on exports for growth makes it vulnerable to a downturn in the global economy.

Any disappointment in the U.S. economy is likely to filter through to South Korean stocks, said Derrick Irwin, a portfolio manager at Wells Capital Management, a unit of Wells Fargo & Co. that has $349 billion of assets under management. Mr. Irwin’s emerging-market fund has relatively small exposure to South Korean stocks.

Furthermore, like many emerging markets, South Korea has benefited from the U.S. Federal Reserve’s extraordinary stimulus measures put in place after the financial crisis. When the Fed begins to pare back its bond purchases—expected in the coming months—it could spark a broad selloff in emerging markets similar to the one experienced this past summer, some analysts say.

Yet another risk for South Korea is its strengthening won, which could make the country’s exports less competitive.

Still, some experts say that South Korean markets have shown their resilience. In the past, investors believed that South Korea would “be the first to go down” in any global crisis, analysts at Morgan Stanley said. South Korea gained this reputation because its financial markets performed poorly in the financial crises that struck Asia in 1997 and the world-wide markets in 2008.

Now, South Korea has relatively low levels of sovereign debt and a high credit rating. Moody’s Investor Service upgraded South Korea to Aa3 last year, putting it on the same footing as Japan and China. In the region, only Singapore, Australia, New Zealand and Hong Kong are rated higher than South Korea.

“People have accepted that [South Korea] will have this crazy neighbor doing something every now and then, but it won’t affect the fundamentals,” said Sharon Lam, an economist at Morgan Stanley.