Abe Risks Ire of Rice Farmers, Consumers With Latest Proposals; Japan Leader Intensifies Campaign to Push Through Politically Difficult Economic Change

November 7, 2013 Leave a comment

Abe Risks Ire of Rice Farmers, Consumers With Latest Proposals

Japan Leader Intensifies Campaign to Push Through Politically Difficult Economic Change

TOKO SEKIGUCHI and MITSURU OBE

Nov. 6, 2013 11:52 a.m. ET

TOKYO—As Japanese Prime Minister Shinzo Abe intensifies his campaign to push through politically difficult economic change, he took one step forward and one step back Wednesday, proposing a reduction in long-standing protections for rice farmers while watering down a pledge to liberalize online sales of medication. In a surprise move, Mr. Abe’s ruling Liberal Democratic Party approved a plan that called for ending production rationing and across-the-board cash handouts to farmers in five years, curbing support for a key bloc that has kept the party in power for most of the postwar period.The proposal is part of a broader package being crafted by the LDP and the government to ease trade barriers in agriculture and other politically influential sectors, as Mr. Abe steers Japan to join an emerging pan-Pacific trade bloc endorsed by the U.S.

“This has been long called for and long overdue—everybody knew something had to be done, but nobody dared to touch the issue,” said Tamotsu Takemoto, professor of agriculture at Meiji University. “They clearly chose to make a difficult decision while the government is stable politically,” he added, echoing a claim by Mr. Abe’s supporters that his high popularity and large majority in parliament give him more authority to push through much-needed economic overhauls than a string of weak Japanese leaders who presided over a period of slow growth.

But hours before the farm announcement, Mr. Abe’s health minister disappointed some of the prime minister’s allies by unveiling a closely watched plan for regulating online sales of over-the-counter medicines. While the market is relatively small, Mr. Abe earlier this year had made it a symbol of his push to cut red tape, vowing to set the same set of rules for e-commerce companies as brick-and-mortar drugstores. After intense pushback from pharmacies and concerns raised by safety advocates, he instead decided to put forth legislation that restricts online sales for the most potent OTC medications.

That prompted a blistering news conference from Internet mogul Hiroshi Mikitani, once a strong supporter of Mr. Abe who said he would quit one of Mr. Abe’s economic advisory panels in protest over the decision. “We were supposed to make it easier for businesses to do new things, and encourage innovation—we’re about to go in the exact opposite direction,” the chief executive ofRakuten Inc., 4755.TO +1.51% an online marketplace, told reporters.

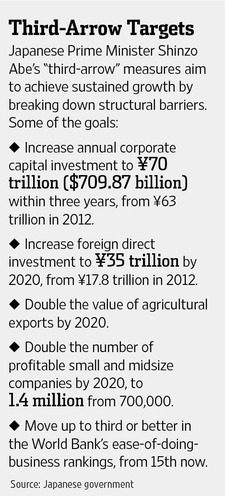

The rice and drug decisions come as Mr. Abe puts forward a long list of proposals to deregulate or restructure different sectors of Japan’s economy. The proposals encompass the third, and most difficult, phase of the ambitious economic program launched after he took office the end of last year to pull his country out of its two-decade-long slump.

Mr. Abe talks of the “three arrows” of economic policy: The first arrow came through his appointment of a new Bank of Japan governor, who quickly flooded markets with an increase in money supply. The second arrow was a new program of public-works stimulus spending. Those two relatively easy changes helped launch a stock market rally in the early months of the year, and pushed down the value of the yen, which lifted profits of Japanese exporters by making goods more competitive in global markets.

He is now firing in earnest the “third arrow” of structural overhauls to be proposed in the current session of parliament, changes that many economists say are needed to have a long-term, sustainable impact on growth. But these changes take longer to implement and have an impact, and many involve challenging powerful commercial and bureaucratic constituencies. The range of overhauls under consideration include breaking up the country’s regional electric utilities and creating free-enterprise zones where companies may face looser regulations and get more freedom to hire and fire workers.

The decision to propose a change in support for rice farmers came at a raucous meeting of ruling party lawmakers, many arguing heatedly against doing anything to change support for growers of a crop seen as central to the country’s national identity.

Mr. Abe didn’t himself address the rice proposal in public Wednesday. But in an interview with The Wall Street Journal last month, he signaled a desire to shake up a sector long seen as inefficient from heavy protection. “We must create an agriculture in Japan which is productive and competitive,” he said.

The rice-overhaul proposal is set to be incorporated into an agricultural revitalization strategy that the government is expected to compile by the end of the month. The strategy will likely include other measures, such as the establishment of a “farmland accumulation bank” that will lease or purchase plots from farmers and lease them out to large operators, such as businesses.

Ending the production rationing and cash handouts could send the rice price lower and trigger an exit of small, inefficient farmers that now dominate the industry. Meanwhile, big farming operations will be allowed to expand their output, raising productivity to better prepare them for a possible influx of cheaper imports.

Small farmer groups are loudly demanding the LDP and the government make up for the loss of protection with new subsidy programs. The government proposals, drawn up by the farm ministry, contained many plans for new subsidies to support farming communities.

The new proposal follows Japan’s participation in July in the Trans-Pacific Partnership negotiations, a U.S.-led free trade initiative.

The price-support system through production rationing has been in place since 1970 and was intended to protect domestic rice farmers to maintain the nation’s food self-sufficiency. But it has also reduced incentives for productivity improvements, experts and government officials said.

Meanwhile, high prices steadily reduced demand for domestic rice. Between 1970 and 2012, domestic rice demand fell nearly 40%, necessitating reinforcement of the quota system, creating more abandoned farmland, and doing little to improve food self-sufficiency.

While Mr. Abe won praise from economic reformers for his rice plan, he drew scorn for his proposal to impose new limits on sales of online medicines.

The prime minister “put forth the online drug sales as a symbol of deregulation, but once they got to the specifics of it, they had to become realistic, and set exceptions,” says Hisashi Yamada, chief economist at the Japan Research Institute think tank. “In that sense, they’re backpedaling on reforms.”

When Mr. Abe formally launched his “third arrow” reforms in a June 5 speech, the first example he cited of these types of commerce-liberating policies was lifting the ban on OTC-drug sales.

That was, in some ways, making a virtue of necessity. Shortly after Mr. Abe took office in late December, Japan’s Supreme Court ruled illegal a 2009 health ministry regulation that prohibited most online sales of certain OTC drugs due to safety concerns.

Mr. Abe’s administration needed to respond to the legal decision. In the wake of the court decision, some companies such as Kenko.com—one of the plaintiffs in the lawsuit—have started selling pharmaceuticals online without any regulations. Under the new rules, the government will end up forcing some e-commerce companies to pull from their websites medication currently being sold.

When the debate began over crafting the online-drug law over the summer, drugstores pushed for stringent rules against online retailers. By early October, officials had written a plan that would allow equal sales rights between online and physical drugstores for products deemed low-risk, such as laxatives and some cold medicines.

But the debate intensified over so-called switch OTCs—drugs that recently required prescriptions but are now sold over the counter—and drugs designated as having high toxicity profiles. Those are drugs for which the line between an effective dose and a toxic dose is relatively thin. These 28 items include popular drugs like Daiichi Sankyo‘s4568.TO -0.96% Loxonin S painkiller.

Mr. Abe’s chief spokesman defended the conclusion, noting that the drugs facing online-sales limits represent a tiny fraction of overall OTC medicine sales in Japan. The decision “combines both aspects of safety and convenience,” said Yoshihde Suga, the chief cabinet secretary.