Japan Exchange and Nikkei to Start New Index Focusing on ROE

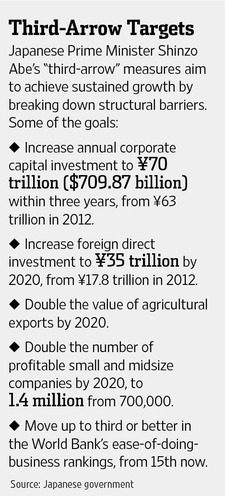

Japan Exchange Group Inc. (8697), operator of the world’s second-biggest equity market, will create an index with Nikkei Inc. that selects members based on return on equity, in a bid to highlight the nation’s best stocks. The bourse operator and Nikkei, which also runs the Nikkei 225 Stock Average, will compile the measure from Jan. 6, according to a statement on Japan Exchange’s website. The gauge will have 400 shares, with 386 Tokyo Stock Exchange first section companies, one from the second section, two from the TSE Mothers market and 11 from Jasdaq. Stocks will include Japan Tobacco Inc. (2914) and Toyota Motor Corp. (7203) as well as Rakuten Inc. (4755) and GungHo Online Entertainment Inc., the bourse said. Eligibility for the JPX-Nikkei Index 400 is based on quantitative factors such as return on equity, operating profit and market value, as well as qualitative aspects such as having at least two independent outside directors and providing earnings disclosure in English, the statement said. “The new index will be composed of companies with high appeal for investors,” according to the statement. “The new index will promote the appeal of Japanese corporations domestically and abroad, while encouraging continued improvement of corporate value.” Read more of this post