Return of Cash Sparks Big Stock Rallies; Investors Judged on Annual Performance Are Eager to Act Before Year-End

November 7, 2013 Leave a comment

Return of Cash Sparks Big Stock Rallies

Investors Judged on Annual Performance Are Eager to Act Before Year-End

ANJANI TRIVEDI, BEN EDWARDS and JAKE LEE

Nov. 6, 2013 1:06 a.m. ET

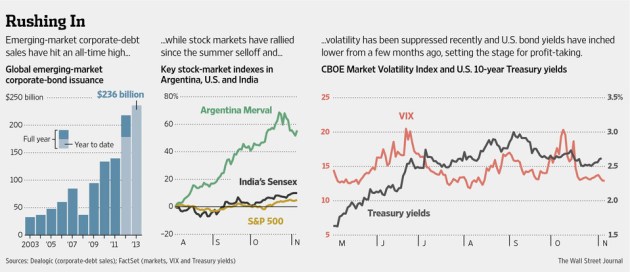

Cash is returning to emerging markets, sparking big stock rallies and a surge in fundraising, as calm in the U.S., combined with low interest rates, spurs global investors to try to juice up returns before the end of the year. Yield-hungry investors are venturing far into risky territory. Investors snapped up $1.8 billion worth of stock sold by Chinese banks in Hong Kong over the past two weeks, while India’s stock market has climbed to record highs. Brazil sold $3.25 billion of debt, its biggest dollar-denominated offering on record, and Pakistan said Monday it plans to sell debt overseas for the first time in six years.The calendar is a big driver of the enthusiasm. Many investors who are judged on annual performance are eager to make up ground before books close for 2013 in under a couple of months after emerging markets disappointed for much of the year. Still, the inflows aren’t on the scale at the start of the year and not all markets are benefiting.

The enthusiasm stems from the Federal Reserve signaling it will maintain the pace of its bond-buying program, pumping $85 billion into markets each month, an effort that has kept interest rates on safer securities low and drawn large institutional investors back in hopes of better returns.

That is providing a last window of opportunity for companies and governments trying to raise cash with borrowing costs low, before interest rates are expected to rise next year. It is also a reversal from the summer, when concern that the Fed might scale back, or taper, its stimulus this year sparked a selloff as investors anticipated higher yields on low-risk securities in the developed world.

“The concern and the panic over tapering was probably overplayed,” said Pierre-Yves Bareau, chief investment officer for emerging-market debt at J.P. Morgan Asset Management, which manages $1.5 trillion of assets globally. “Markets have come back to a more rational stance.”

Mr. Bareau said his firm has invested in a wide range of emerging-market assets in the wake of the summer’s selloff, including longer-dated sovereign debt and currencies. The latter strategy, he said, has now run its course, and his firm is increasing its exposure to corporate bonds instead.

Some of the biggest moves are in markets that had been most unloved. India suffered badly during the summer exodus because investors worried that if foreign cash dried up, the country could have trouble funding its trade deficit, but the rupee has jumped more than 6% since hitting a record low on Aug. 28. Over the past three months, Indian stocks have been Asia’s top performer, surging more than 10% to record highs.

The availability of foreign cash is also sparking a flurry of sales of corporate debt. Emerging-market companies have sold $71 billion of bonds since June, taking this year’s total to $236 billion, almost a third more than was sold at this stage in 2012, according to Dealogic, a data provider.

Companies are rushing to complete deals now before mid-December, when bankers typically start taking vacations and the market for new issues winds down. The flurry of deal activity mirrors events in the U.S. where investors are jumping into initial public offerings at the fastest clip since the financial crisis.

Latin America, in particular, has provided rich pickings for investors seeking bargains, after average corporate bond yields in that region surged to almost 7% during the selloff. Argentina’s stock market is a standout, rallying 80% since July.

“When the market started bouncing back, most of the value has been in Latin America,” said Zara Kazaryan, a bond fund manager at Threadneedle Investments in London, which manages £84.9 billion ($136.2 billion) of assets.

Ms. Kazaryan said her fund will seek to increase its positions in Latin American corporate debt this year, and will also consider adding high-yield bonds from across all emerging markets. As long as U.S. Treasury yields don’t move higher, she said, emerging-market bonds will continue to recover.

Investors say Chinese stocks are cheap, so they are rushing to buy into the market.

Much of the wave of bond and stocks offerings comes because ample amounts of cash are available. J.P. Morgan Chase JPM -0.17% & Co. estimates that $66 trillion is sloshing around the financial system, a record high for the money supply and up 4.6% since the start of the year.

Volatility, another key barometer of how investors feel about risk, has slumped across currencies and stocks, a shift that has encouraged investors to buy without fear of wild swings.

Yields on emerging-market sovereign debt, which rose until September, have also fallen sharply, signaling the return of foreign investors to the market. Average yields on five-year emerging-market government debt have dropped by 0.57 percentage point. In Indonesia, where the decline has been among the most dramatic, yields fell to 7.2% from 8.1%.

To be sure, some observers warn this revival in emerging markets might be teeing up further pain when the Fed finally starts easing back on its bond-buying program.

“There is a danger that the selloff we saw in the summer was just stage one of a much wider asset-price deflation in the emerging markets,” said Brendan Brown, head of economic research at Mitsubishi UFJ Securities International. Dr. Brown reckons Chinese monetary tightening or the cooling of real estate bubbles in emerging markets such as Brazil or India could trigger a fall in global asset prices.

In China, the world’s biggest emerging market, the economy has rebounded from a first-half slowdown, boosting a host of commodities that are closely linked to the country’s buying. But borrowing costs have also been creeping higher in the country’s closed bond markets on fears rising bad loans may cause pain later down the road.

“The attractiveness of the emerging markets was twofold: liquidity and fundamentals. I think what we are going to find out is, it was more about liquidity than improving fundamentals,” said Marc Chandler, global head of currency strategy at Brown Brothers Harriman. “We’re close to peak liquidity.”

Money managers, though, say they’ll be better prepared next time round for when the Federal Reserve does start to ease off its bond buying program.

“The fact that there isn’t a minefield in front of you in terms of policy or some deadline, from here to the end of the year, you have a clear runway to at least think about your allocation in emerging markets,” said Robert Abad, an emerging-markets fixed-income portfolio manager at Western Asset, which has $440 billion of assets under management.

He said a lot of short-term investors left emerging markets in the summer and it is mostly those with longer-term outlooks that are staying put.

“Right now people want to understand where the U.S. story is going, so until the price-maker [the U.S.] gets its act together, we’re going to move with the ebb and flow of the herd mentality,” said Mr. Abad.