Domestic films set to dominate box office; This year, Chinese films accounted for 58% of box-office revenue, compared with 48.5% in 2012

November 8, 2013 Leave a comment

Domestic films set to dominate box office

Updated: 2013-11-05 10:50

By Huang Ying ( China Daily)

Domestic movies are expected to conquer the Chinese market this year, after being beaten by importedproductions for the first time in four years in 2012, industry observers said.In the first three quarters of the year, China’s movie market had total ticket sales of 16.42 billionyuan ($2.7 billion), up 35 percent year-on-year, according to official data released by the filmbureau under a new administration formed in March, which falls under the auspices of the StateAdministration of Radio, Film and Television and the State Press and PublicationAdministration.

The growth this year was mainly attributed to the solid performance of domestic films.

During the period, domestic productions had ticket sales of 9.56 billion yuan, up 94 percentcompared with a year earlier, while imported movies’ box-office takings fell 5 percent year-on-year to 6.86 billion yuan.

So far this year, Chinese films have grabbed a marketshare of 58 percent in terms of box office receipts, whilethe figure for 2012 was just 48.5 percent.

“The improvement in the quality of the productions is oneof the main factors driving this momentum,” said ShaoGang, deputy director of consulting for the culture andentertainment industry at Horizon Research ConsultancyGroup.

Hollywood movies did poorly in the first half and then hada better performance during the summer withblockbusters such as Superman: Man of Steel and PacificRim, said Shao.

Pacific Rim ranked fourth in the top-10 list of the highest-grossing movies shown in China in the first threequarters, with total ticket sales of 694.3 million yuan, whileSuperman: Man of Steel was at the bottom of that list withbox-office revenue of 394.6 million yuan.

“I think that for the whole year, domestic movies willdominate the market, because many high-quality Chinesemovies have been released, while the number ofcompetitive foreign rivals is far from sufficient this year,”said Huang Qunfei, general manager of Beijing New FilmAssociation Co Ltd, one of China’s leading theaterchains.

Topping the list is the comedy Journey to the West:Conquering the Demons, directed by Stephen Chow,which grossed 1.25 billion yuan at the box office, followedby Hollywood’s Iron Man 3 with revenue of 755 millionyuan.

The fast expansion of movie theaters in China alsocontributed to the positive figures.

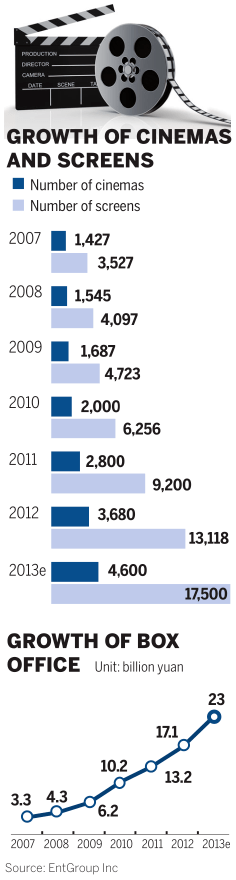

The country’s total number of theaters has risen to 4,305,with 625 theaters added in the first nine months,according to data from EntGroup Consulting, a Beijing-based entertainment consultancy.

“Theater chains are expanding very quickly in second-and third-tier cities these years,” said Huang, adding thatpeople in the areas surrounding those cities prefer towatch domestic films.

At the end of 2012, county-level cities nationwide boastedabout 1,000 digital cinemas, with more than 3,000screens, according to the film bureau.

“The Chinese film studios’ increasing efforts in themovies’ marketing campaigns also boosted the significantbox-office growth of domestic productions, which showcases the benefits brought by industrialsegmentation,” said Shao.

“However, the shift of market dominance between domestic and imported productions is justnormal, as it’s quite common for domestic movie industries to have their on-years and off-years,” said Huang.

Last year, China’s box-office revenue totaled 17.1 billion yuan, up 30.18 percent year-on-year,with imported films accounting for more than half of the market share with ticket takings of 8.8billion yuan.