Kelley Blue Book, Price Bible for Used Cars, Heads to China

November 8, 2013 Leave a comment

Kelley Blue Book, Price Bible for Used Cars, Heads to China

Joint Venture Aims to Tap Chinese Secondhand Auto Sales

COLUM MURPHY

Nov. 7, 2013 3:02 a.m. ET

SHANGHAI—U.S.-based auto researcher Kelley Blue Book and Chinese online automotive-marketing company Bitauto Holdings Ltd. BITA -0.83% are combining forces to give Chinese consumers used-car pricing data, plugging a hole in the development of the world’s largest car market. Kelley Blue Book, operator of the widely used KBB.com website, and Bitauto each will hold a 40% stake in the joint-venture company. China Automobile Dealers Association, an industry group, will hold the remaining 20%. Financial terms weren’t disclosed.

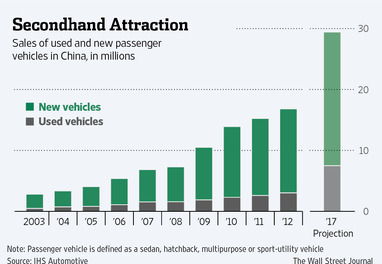

China’s market for used cars remains small because the country’s auto-sales boom is so new and there is a relative lack of newer-model used cars. Last year, around three million used passenger vehicles were sold in China, compared with around 14 million new cars, according to advisory firm IHS Automotive.

New-car dealers in China haven’t developed as robust a used business as elsewhere. Used-car sales accounted for around 2% of the value of dealer car sales in China in 2012, compared with more than 30% in the U.S. in 2011, according to J.D. Power & Associates dealer studies.

That is changing. Auto makers are expanding their certified used-car sales efforts, hoping customers who trade in cars will buy a new car from the same dealer. Offering data on a car’s resale value can be a strong selling point, particularly for luxury car brands.

Andy Zhang, chief financial officer of Bitauto, a Beijing-based company that has an existing car-pricing and listing website, said demand in China for such information was “quite significant.” Offering price data from a trustworthy source would encourage more Chinese to sell their cars, he said.

The joint venture will create a new website that uses price data supplied by the dealers’ association and earns revenue from advertising by auto makers and dealers.

Shen Jinjun, general secretary of the auto dealers association, said the venture’s products would help provide greater transparency and boost confidence for consumers.

Zhao Ling, a 34-year-old retail-banking worker, bought a used Lexus ES300 for less than two-thirds the 450,000 yuan ($73,000) a new model would have cost. The seller was a friend, which gave Ms. Zhao confidence in the vehicle. “Most people are concerned about the quality of the car when they buy second hand,” said Ms. Zhao. “I didn’t have such concerns as I knew the car very well.”

While there are many Chinese websites listing new-car prices, the used market is more fragmented and pricing is more opaque.

“Asymmetric information is a big issue for any used-car buyer, but it’s a particular issue in China because of the lack of independent used-car appraisal,” said IHS analyst Lin Huaibin. “That’s why the market is not as strong as it should be.”

China’s top auto makers, including Volkswagen AG VOW3.XE +0.05% and Daimler AGDAI.XE +0.40% ‘s Mercedes-Benz, are ramping up used-car sales efforts, pursuing strategies they have used elsewhere to promote repeat buying from loyal customers.

Volkswagen is expanding its used-car program here and plans to have 200 authorized dealerships by the end of 2013 and 450 by 2015, according to a company spokesman.

Mercedes-Benz has 55 dealers in China authorized to sell used vehicles and has plans to expand in the secondhand market, the company said.

“The China market is growing rapidly from a used-car perspective,” said Jared Rowe, president of Irvine, Calif.-based Kelley Blue Book. “China is ready to start adopting some of the practices that you see in other markets.

“We don’t claim to understand all the nuances of the Chinese market,” he said. “This is a really good way to enter.”

Kelley Blue Book was open to entering other international markets, “but for now we are focused on two very large used-car markets—that is the U.S. and China,” he said.