Mattel Gives Barbie a Makeover for China; U.S. Toy Maker Launches Fresh Effort to Endear All-American Doll to Chinese Consumers

November 8, 2013 Leave a comment

Mattel Gives Barbie a Makeover for China

U.S. Toy Maker Launches Fresh Effort to Endear All-American Doll to Chinese Consumers

U.S. toy manufacturer Mattel is aiming to fill Chinese toy chests by outfitting its Barbie dolls and other products to better suit Chinese tastes. Laurie Burkitt speaks with Mattel’s Asia-Pacific Senior Vice President Peter Broegger about the company’s new strategy in China.

LAURIE BURKITT

Updated Nov. 7, 2013 8:16 p.m. ET

BEIJING—Barbie closed her swank Shanghai mansion two years ago, after China’s parents turned up their noses at her pink ball gowns and Ken’s polo shirt-and-sweater ensembles. Now Mattel Inc. MAT -1.56% is making a new effort to sell Chinese on the impossibly proportioned all-American doll, with an appeal to Tiger moms who would rather have their children reading books than plugging body parts into Mr. Potato Head. New, low-price offerings include “Violin Soloist” Barbie, complete with bow and sheet music.Mattel is targeting education-minded parents such as Luo Chongzong, who watched her 9-year-old daughter, Yang Siqi, gaze at a 369 yuan (about $61) “Fashion Design” Barbie playset during a recent visit to a Beijing Wal-Mart. “She loves those dolls, but I had to stop buying them because they distract her from her studies,” said Ms. Luo, 33 years old. “She’ll spend hours braiding her hair, dressing and undressing her,” she said.

The world’s largest toy maker by sales has even gone to the government. This week it paired leaders of China’s Ministry of Education and Ministry of Culture with educational experts who presented research on the benefits of play in effort to boost play time in schools.

“If they allow for more play, half of our marketing is done,” said Peter Broegger, Mattel’s Asia Pacific senior vice president, in an interview.

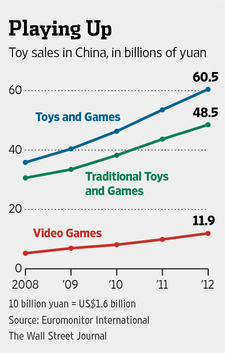

The El Segundo, Calif., company is one of many toy sellers adjusting tactics for China. Sales in China’s toy market, excluding videogames, rose 18% to nearly 48 billion yuan ($7.84 billion) in 2012 from a year earlier, according to market research firm Euromonitor International.

Still, many Chinese consider toys a waste of time in a country that prizes educational success, said Hong Kong-based consultant Torsten Stocker. “Joy and learning are like oil and water in China,” said Mr. Broegger, adding that the company is trying to change that image.

Mattel increasingly emphasizes brainy, using the tagline “Play IQ” for its Fisher Price toys in China rather than the “Joy of Learning” one it uses in the West.

Toys “R” Us Inc. announced last year plans to expand operations online and with physical stores to sell more toy microscopes, building blocks and other educational toys.

Companies like Danish block maker Lego A/S are making China-specific toys and are positioning themselves as educational bridges between school and the sandbox.

Mattel has China ambitions for its other brands too. This year it opened a Shanghai playland for its Thomas the Tank Engine train toys as well as a traveling Hot Wheels racing track in shopping malls for its mini cars. In recent years it has also pared back its offerings, pulling products such as Little People toddler-friendly toys from shop shelves in China to focus on building demand and creating China-specific products, said Mr. Broegger. One switch: In some toy sets it replaces puppies with pandas.

“We went back to basics and we’ve learned to be patient,” he said.

Mattel’s China business took a hit in March 2011, when it closed its six-story Shanghai flagship store aimed at hyping Barbie in China. The lavish outlet featured a spa, a cosmetics counter and a cocktail bar.

“Without establishing Barbie as a new cultural icon in China, Mattel set itself up for failure,” said Helen Wang, a consultant and author of “The Chinese Dream,” a book about China’s rising middle class.

Mr. Broegger said that the lessons learned from the Shanghai store’s closure have helped, with sales tripling since 2010. He declined to offer specific financial details but said 2013 sales are on track to match the previous two years combined.

One lesson is pricing. “Violin Soloist” Barbie costs 79 yuan, or roughly $13, compared with the $30 international version.

Mattel is increasing its distribution beyond the current 30 cities in China, Mr. Broegger said, declining to offer specifics. He said the company also is revving up a digital identity by jumping into social networking and broadcasting Barbie and Thomas the Tank cartoons on Chinese video streaming sites.

Mr. Broegger said Mattel intends to have a bigger footprint in China, but he isn’t prepared to make big promises. “We will expand as we learn,” he said.

Mattel is still reviewing labor conditions at its factories here, a spokeswoman said. In October, China Labor Watch, a New York-based advocacy group, alleged that Mattel’s factory workers are being underpaid and overworked at six Chinese factories that make Mattel toys with a combined workforce of 20,000.