Big consulting and accounting firms are making a risky move into strategy work; “operations consultants sit at the front of the classroom. Strategy consultants stay in the back, not paying attention, throwing paper airplanes. But they still get the girls and get rich.”

November 9, 2013 Leave a comment

Big consulting and accounting firms are making a risky move into strategy work

Nov 9th 2013 | NEW YORK |From the print edition

“OPERATIONS consultants sit at the front of the classroom,” says a partner at a strategy consultancy. “Strategy consultants stay in the back, not paying attention, throwing paper airplanes. But they still get the girls and get rich.” Like so many caricatures, this one is cruel but contains a grain of truth. Operations consultants—the fine-detail guys who tinker with businesses’ internal processes to make them run better—generally do not enjoy the same glamour or financial rewards as strategy specialists, whose job is to advise firms on make-or-break deals, adopting new business models and other big stuff.Although in practice their work overlaps, the two have until now remained distinct businesses. Strategy firms like McKinsey, Bain and the Boston Consulting Group hire from the top universities, are packed with highly paid partners and whisper their counsel in CEOs’ ears. In contrast, operations specialists such as IBM, Accenture and the Big Four accounting firms (Deloitte, EY, KPMG and PwC) employ armies of lower-paid grunts; and tend to answer to the client firm’s finance or tech chiefs.

This year, however, that line has begun to blur. In January Deloitte became the largest of the Big Four by scooping up the assets of Monitor, a strategy firm that had gone bust. And on October 30th its closest rival, PwC, said it would buy another strategy firm, Booz & Company, for a reported $1 billion. If Booz’s partners approve the deal, it will vault PwC back into first place.

The accountancies’ push into strategy has been a decade in the making. During the late-1990s technology bubble they beefed up their IT-consulting arms. But in 2001 Enron, an energy-trading firm, went bust and took its auditor, Arthur Andersen, down with it. In response, America’s Congress passed the Sarbanes-Oxley corporate-governance reform, which banned firms from doing systems consulting for companies they audited. As a consolation prize, the Big Four made a fortune helping clients comply with the new law. Their advisory businesses, full of potential for conflicts of interest with their auditing side, by now seemed dispensable. All but Deloitte had sold off those divisions by 2003.

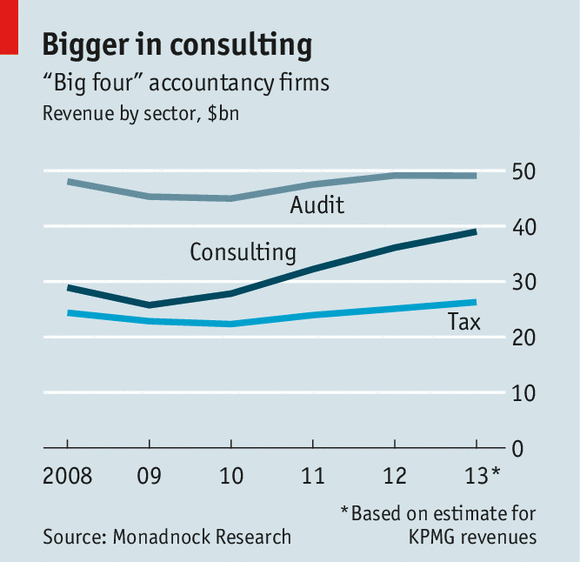

Just as the workload from Sarbanes-Oxley began to dwindle, the 2008-09 financial crisis hit, causing consulting revenues to dip (see chart). But once the economy recovered, the climate for the Big Four started to resemble the 1990s. They began to rush back into consultancy, encouraged by its high margins and double-digit annual growth rates at a time when revenue growth from auditing and tax work had slowed. In particular, Deloitte and PwC began gobbling up operations consultancies as they sparred for the top spot.

For years the strategy firms remained beyond the Big Four’s grasp. During the 2000s they had mostly prospered on their own, and their partners shuddered at the thought of being subsumed into giant bureaucracies. After the financial crisis, however, midsized strategy consultants hit hard times. Cost-conscious companies with globalising businesses wanted either to hire boutiques with deep knowledge of their industries, or to benefit from the scale of generalist firms with offices everywhere. Too big for some clients and too small for others, Monitor went under, and Booz—a spin-off from Booz Allen Hamilton, which now focuses on operations work for governments—went on the block.

Both Booz and PwC say that the two sides of consulting are converging, and that more clients want a one-stop shop that can both devise a strategy and execute it. Deloitte and Monitor claim their integration is already bearing fruit. “There’s been a very healthy two-way cross-selling opportunity,” says Mike Canning of Deloitte.

Nonetheless, Booz’s leadership still faces a hard sell to get the deal passed. In 2010 the company’s partners voted down a proposed merger with AT Kearney, another midsized strategy firm. This marriage involves far more risks. A significant number of Booz’s clients would immediately be in doubt because PwC audits them—strategy consulting for audit clients is banned in many countries, and even where it is legal it is frowned upon (not least in America). Since the Big Four are structured as associations of national partnerships, Booz’s staff would probably end up being divided by country, hindering the global co-operation that many big clients seek.

Most important, each of Booz’s 300 partners would have to trade meaningful sway over the direction of a highly profitable firm for a minuscule stake in a diversified, lower-margin empire. If the sale is approved, the test of its success will come in a few years, after Booz’s partners receive their full payout and can head off. An exodus would leave PwC empty-handed.

The Big Four are also running a risk far greater than the cost of their purchases. A decade ago they placated regulators by retreating from advisory work. High-profile deals like the Booz-PwC tie-up put the conflict of interest between auditing and consulting back in the spotlight: after it was announced, Arthur Levitt, a former head of America’s Securities and Exchange Commission, warned that the firms were “slipping back” towards old, bad habits. Any gains from pushing into strategy work might end up being outweighed by the cost of another regulatory crackdown.